Accounting Q.2 A company entered into two different leases on Ist January 2012: Machine 1 A total of 24 monthly instalments of £1,500 payable in advance and terminable at any time by either party. The cash price of this machine is £50,000 and its estimated useful life is 7 years. Machine 2 The cash price of the machine is £31,700 and is expected to last 5 year with no terminal value. Primary period of lease is 4 years, with rentals payable annually in arrears at £10,000. Implicit interest rate at 10%. Company's policy is to depreciate the machine on a straight-line basis. (a) Using information provided above, explain what the differences are between finance and operating leases. (b) For the lease of machine 1, identify the amount of interest charge for the financial year 2012 using straight-line method. (c) For machine 2, show the effect of this lease, on the statements of comprehensive income and statements of financial position for the four years to 31 December 2015, under the following headings: (i) lease creditor (ii) finance charge, allocated using actuarial method (iii) depreciation charge, and (iv) net book value of assets

Accounting Q.2 A company entered into two different leases on Ist January 2012: Machine 1 A total of 24 monthly instalments of £1,500 payable in advance and terminable at any time by either party. The cash price of this machine is £50,000 and its estimated useful life is 7 years. Machine 2 The cash price of the machine is £31,700 and is expected to last 5 year with no terminal value. Primary period of lease is 4 years, with rentals payable annually in arrears at £10,000. Implicit interest rate at 10%. Company's policy is to depreciate the machine on a straight-line basis. (a) Using information provided above, explain what the differences are between finance and operating leases. (b) For the lease of machine 1, identify the amount of interest charge for the financial year 2012 using straight-line method. (c) For machine 2, show the effect of this lease, on the statements of comprehensive income and statements of financial position for the four years to 31 December 2015, under the following headings: (i) lease creditor (ii) finance charge, allocated using actuarial method (iii) depreciation charge, and (iv) net book value of assets

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 1P: Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases...

Related questions

Question

100%

Transcribed Image Text:Accounting

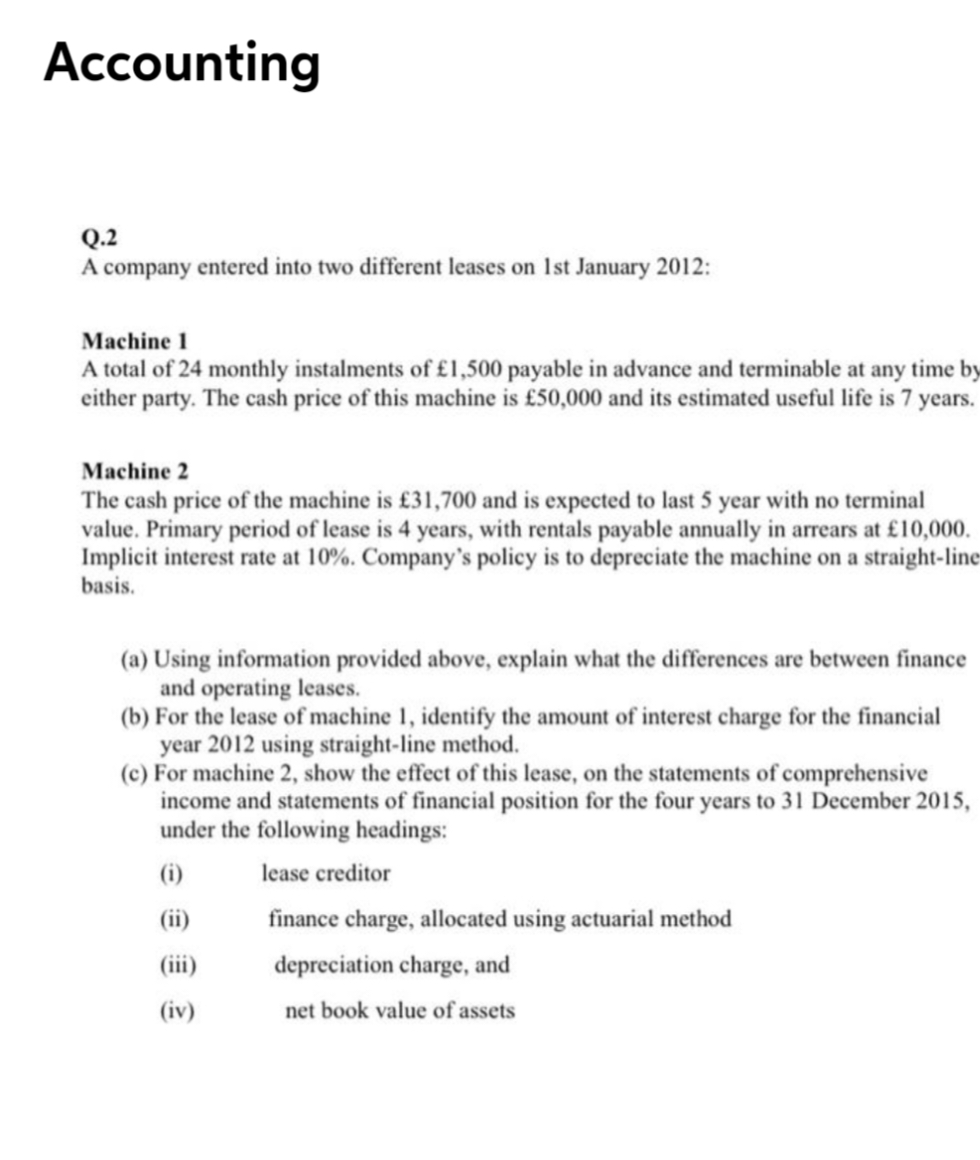

Q.2

A company entered into two different leases on Ist January 2012:

Machine 1

A total of 24 monthly instalments of £1,500 payable in advance and terminable at any time by

either party. The cash price of this machine is £50,000 and its estimated useful life is 7 years.

Machine 2

The cash price of the machine is £31,700 and is expected to last 5 year with no terminal

value. Primary period of lease is 4 years, with rentals payable annually in arrears at £10,000.

Implicit interest rate at 10%. Company's policy is to depreciate the machine on a straight-line

basis.

(a) Using information provided above, explain what the differences are between finance

and operating leases.

(b) For the lease of machine 1, identify the amount of interest charge for the financial

year 2012 using straight-line method.

(c) For machine 2, show the effect of this lease, on the statements of comprehensive

income and statements of financial position for the four years to 31 December 2015,

under the following headings:

(i)

lease creditor

(ii)

finance charge, allocated using actuarial method

(iii)

depreciation charge, and

(iv)

net book value of assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning