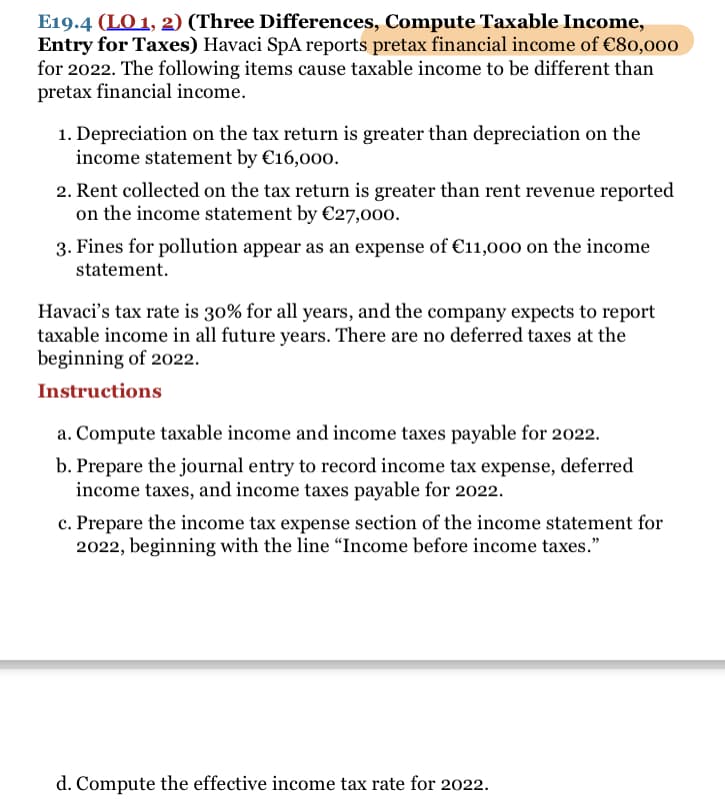

E19.4 (LO 1, 2) (Three Differences, Compute Taxable Income, Entry for Taxes) Havaci SpA reports pretax financial income of €80,000 for 2022. The following items cause taxable income to be different than pretax financial income. 1. Depreciation on the tax return is greater than depreciation on the income statement by €16,000. 2. Rent collected on the tax return is greater than rent revenue reported on the income statement by €27,000. 3. Fines for pollution appear as an expense of €11,000 on the income statement. Havaci's tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2022. Instructions a. Compute taxable income and income taxes payable for 2022. b. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2022. c. Prepare the income tax expense section of the income statement for 2022, beginning with the line "Income before income taxes." d. Compute the effective income tax rate for 2022.

E19.4 (LO 1, 2) (Three Differences, Compute Taxable Income, Entry for Taxes) Havaci SpA reports pretax financial income of €80,000 for 2022. The following items cause taxable income to be different than pretax financial income. 1. Depreciation on the tax return is greater than depreciation on the income statement by €16,000. 2. Rent collected on the tax return is greater than rent revenue reported on the income statement by €27,000. 3. Fines for pollution appear as an expense of €11,000 on the income statement. Havaci's tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2022. Instructions a. Compute taxable income and income taxes payable for 2022. b. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2022. c. Prepare the income tax expense section of the income statement for 2022, beginning with the line "Income before income taxes." d. Compute the effective income tax rate for 2022.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 14P

Related questions

Question

Please answer part (d)

Transcribed Image Text:E19.4 (LO 1, 2) (Three Differences, Compute Taxable Income,

Entry for Taxes) Havaci SpA reports pretax financial income of €80,000

for 2022. The following items cause taxable income to be different than

pretax financial income.

1. Depreciation on the tax return is greater than depreciation on the

income statement by €16,000.

2. Rent collected on the tax return is greater than rent revenue reported

on the income statement by €27,000.

3. Fines for pollution appear as an expense of €11,000 on the income

statement.

Havaci's tax rate is 30% for all years, and the company expects to report

taxable income in all future years. There are no deferred taxes at the

beginning of 2022.

Instructions

a. Compute taxable income and income taxes payable for 2022.

b. Prepare the journal entry to record income tax expense, deferred

income taxes, and income taxes payable for 2022.

c. Prepare the income tax expense section of the income statement for

2022, beginning with the line "Income before income taxes."

d. Compute the effective income tax rate for 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT