2012 Kembara Sdn Bhd. bought two trucks, first truck for Rm8000 and second truck for RM6000 and a machine for RM 8000 on 2nd January. Bought at machine costing RM3000 on 1st October 2013 Bought another truck on 2nd June for RM7600. Bought a machine costing RM2100 on 8th November 2015 Sold the first truck for RM3600 on 30th September for the sum of RM810 Bought another machine for RM2000 on 4th May The business depreciate it's machine of the rate of 15% per annum using reducing balance method and 20% per annum for it's truck with straight line basis. From the following details: The financial year end of the business is 31st October. You are required to; a) Record the above transaction; i)the truck account i)the machine account

2012 Kembara Sdn Bhd. bought two trucks, first truck for Rm8000 and second truck for RM6000 and a machine for RM 8000 on 2nd January. Bought at machine costing RM3000 on 1st October 2013 Bought another truck on 2nd June for RM7600. Bought a machine costing RM2100 on 8th November 2015 Sold the first truck for RM3600 on 30th September for the sum of RM810 Bought another machine for RM2000 on 4th May The business depreciate it's machine of the rate of 15% per annum using reducing balance method and 20% per annum for it's truck with straight line basis. From the following details: The financial year end of the business is 31st October. You are required to; a) Record the above transaction; i)the truck account i)the machine account

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 9EB: Ronson recently purchased a new boat to help ship product overseas. The following information is...

Related questions

Question

Calculate the

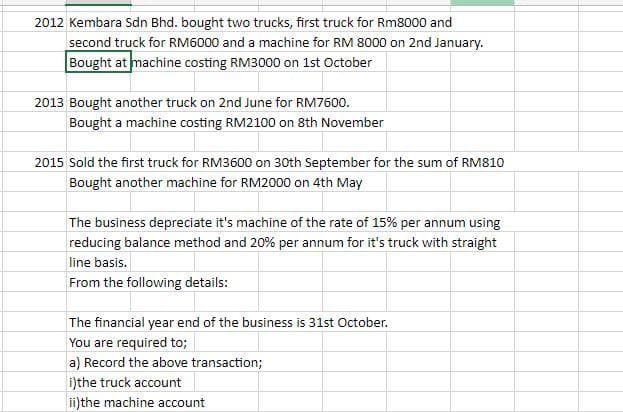

Transcribed Image Text:2012 Kembara Sdn Bhd. bought two trucks, first truck for Rm8000 and

second truck for RM6000 and a machine for RM 8000 on 2nd January.

Bought at machine costing RM3000 on 1st October

2013 Bought another truck on 2nd June for RM7600.

Bought a machine costing RM2100 on 8th November

2015 Sold the first truck for RM3600 on 30th September for the sum of RM810

Bought another machine for RM2000 on 4th May

The business depreciate it's machine of the rate of 15% per annum using

reducing balance method and 20% per annum for it's truck with straight

line basis.

From the following details:

The financial year end of the business is 31st October.

You are required to;

a) Record the above transaction;

i)the truck account

i)the machine account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College