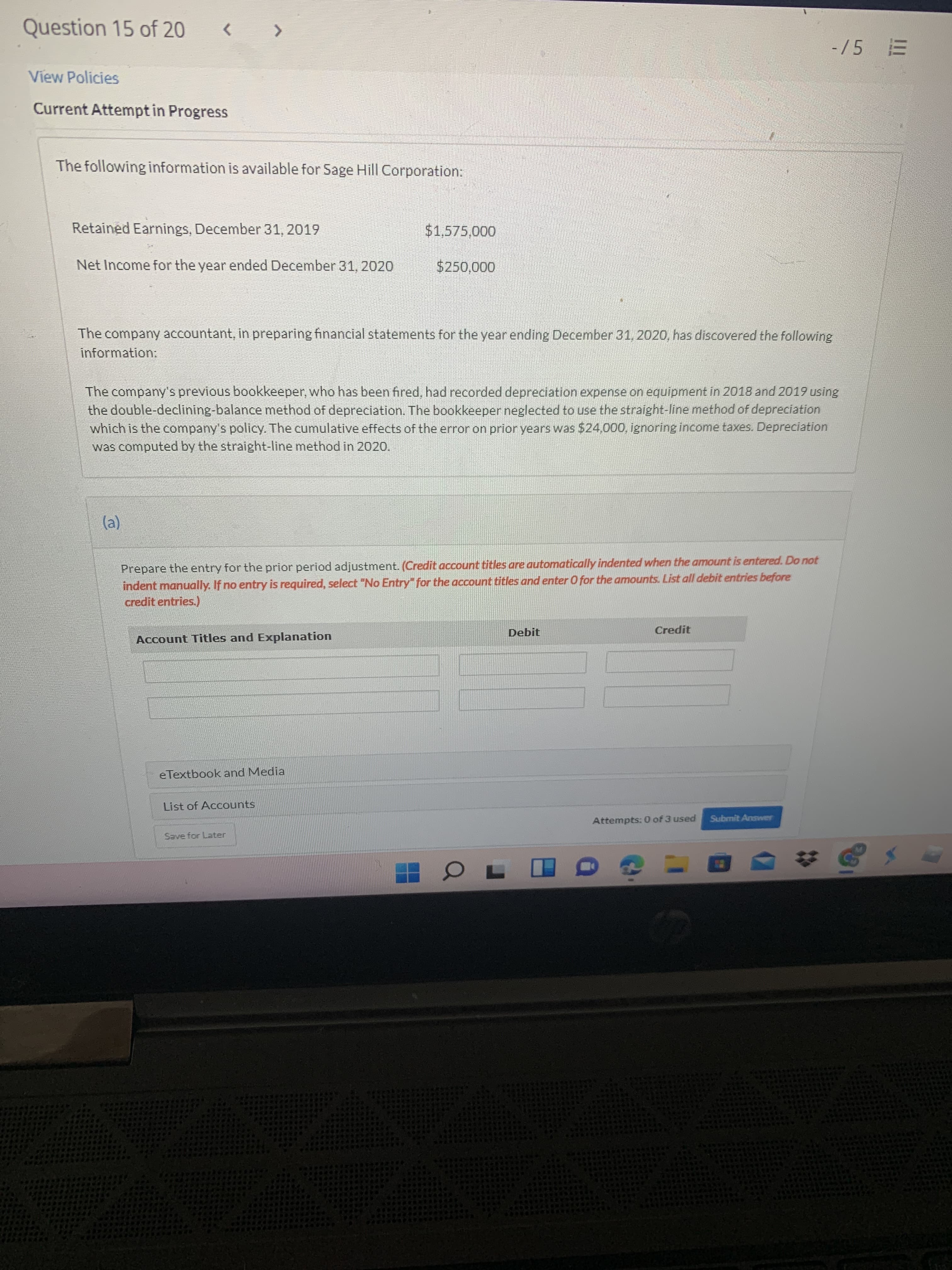

Question 15 of 20 <. -/5 View Policies Current Attempt in Progress The following information is available for Sage Hill Corporation: Retained Earnings, December 31, 2019 $1,575,000 Net Income for the year ended December 31, 2020 $250,000 The company accountant, in preparing financial statements for the year ending December 31, 2020, has discovered the following information: The company's previous bookkeeper, who has been fired, had recorded depreciation expense on equipment in 2018 and 2019 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was $24,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2020. Prepare the entry for the prior period adjustment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Debit Credit Account Titles and Explanation eTextbook and Media List of Accounts Attempts: 0 of 3 used Submit Answer Save for Later

Question 15 of 20 <. -/5 View Policies Current Attempt in Progress The following information is available for Sage Hill Corporation: Retained Earnings, December 31, 2019 $1,575,000 Net Income for the year ended December 31, 2020 $250,000 The company accountant, in preparing financial statements for the year ending December 31, 2020, has discovered the following information: The company's previous bookkeeper, who has been fired, had recorded depreciation expense on equipment in 2018 and 2019 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was $24,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2020. Prepare the entry for the prior period adjustment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Debit Credit Account Titles and Explanation eTextbook and Media List of Accounts Attempts: 0 of 3 used Submit Answer Save for Later

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Current Liabilities And Payroll

Section: Chapter Questions

Problem 10.2CP

Related questions

Question

Transcribed Image Text:Question 15 of 20

<.

-/5

View Policies

Current Attempt in Progress

The following information is available for Sage Hill Corporation:

Retained Earnings, December 31, 2019

$1,575,000

Net Income for the year ended December 31, 2020

$250,000

The company accountant, in preparing financial statements for the year ending December 31, 2020, has discovered the following

information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on equipment in 2018 and 2019 using

the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation

which is the company's policy. The cumulative effects of the error on prior years was $24,000, ignoring income taxes. Depreciation

was computed by the straight-line method in 2020.

Prepare the entry for the prior period adjustment. (Credit account titles are automatically indented when the amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before

credit entries.)

Debit

Credit

Account Titles and Explanation

eTextbook and Media

List of Accounts

Attempts: 0 of 3 used

Submit Answer

Save for Later

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning