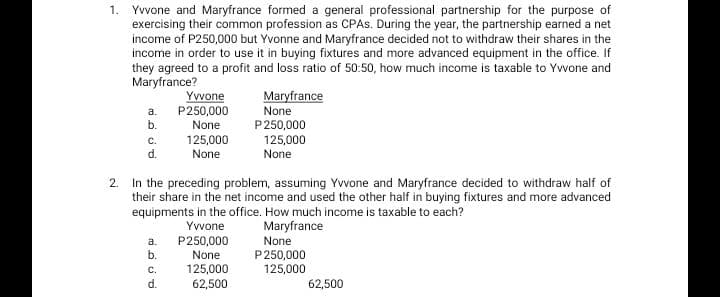

1. Yvvone and Maryfrance formed a general professional partnership for the purpose of exercising their common profession as CPAS. During the year, the partnership earned a net income of P250,000 but Yvonne and Maryfrance decided not to withdraw their shares in the income in order to use it in buying fixtures and more advanced equipment in the office. If they agreed to a profit and loss ratio of 50:50, how much income is taxable to Yvvone and Maryfrance? a. b. C. d. a. b. Yvvone P250,000 None 125,000 None 2. In the preceding problem, assuming Yvvone and Maryfrance decided to withdraw half of their share in the net income and used the other half in buying fixtures and more advanced equipments in the office. How much income is taxable to each? Yvvone Maryfrance C. d. Maryfrance None P250,000 125,000 None P250,000 None 125,000 62,500 None P250,000 125,000 62,500

1. Yvvone and Maryfrance formed a general professional partnership for the purpose of exercising their common profession as CPAS. During the year, the partnership earned a net income of P250,000 but Yvonne and Maryfrance decided not to withdraw their shares in the income in order to use it in buying fixtures and more advanced equipment in the office. If they agreed to a profit and loss ratio of 50:50, how much income is taxable to Yvvone and Maryfrance? a. b. C. d. a. b. Yvvone P250,000 None 125,000 None 2. In the preceding problem, assuming Yvvone and Maryfrance decided to withdraw half of their share in the net income and used the other half in buying fixtures and more advanced equipments in the office. How much income is taxable to each? Yvvone Maryfrance C. d. Maryfrance None P250,000 125,000 None P250,000 None 125,000 62,500 None P250,000 125,000 62,500

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:1. Yvvone and Maryfrance formed a general professional partnership for the purpose of

exercising their common profession as CPAS. During the year, the partnership earned a net

income of P250,000 but Yvonne and Maryfrance decided not to withdraw their shares in the

income in order to use it in buying fixtures and more advanced equipment in the office. If

they agreed to a profit and loss ratio of 50:50, how much income is taxable to Yvvone and

Maryfrance?

a.

b.

C.

d.

a.

b.

Yvvone

P250,000

None

125,000

None

2. In the preceding problem, assuming Yvvone and Maryfrance decided to withdraw half of

their share in the net income and used the other half in buying fixtures and more advanced

equipments in the office. How much income is taxable to each?

Yvvone

Maryfrance

C.

d.

Maryfrance

None

P250,000

125,000

None

P250,000

None

125,000

62,500

None

P250,000

125,000

62,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning