Noreen is a self-employed consultant who uses 10% of her residence as an office. The office is used exclusively for business and is frequented by customers on a regular basis. Noreen also uses her den as an office (7% of the total floor space of her home) to prepare bills and keep records. However, the den is also used by her children as a TV room. In 2021, Noreen's net income from the consulting business (other than her home office expenses) amounts to $100,000 in 2021. She also incurs $900 of expenses directly related to the office (e.g., painting of the office, window blinds). Noreen incurs the following expenses in 2021 related to her residence: (Click the icon to view the expenses.) Read the requirements. Requirement a. Which of the expenditures above (if any) are deductible for 2021? Are they for AGI or from AGI deductions? Complete the table below to show the amount and classification of each of expense in. (Noreen is electing to use the "actual expenses" rather than the "safe harbor" method. Complete all input fields. Enter a "0" if an amount is not deductible.) Direct home office expenses Indirect home office expenses: Real estate taxes Mortgage interest Insurance Depreciation. $ $ Repairs and utilities Total indirect home office expenses Total expense for office in home 900 3,400 9,000 700 8,500 2,500 ... Amount of Deduction Type of Deduction Data table Real estate taxes Mortgage interest Insurance Depreciation Repairs and utilities Total $ $ 3,400 9,000 700 8,500 2,500 24,100 X Requirements a. Which of the expenditures above (if any) are deductible for 2021? Are they for AGI or from AGI deductions? b. Would your answer to Part a change if Noreen's net income from consulting were only $3,040 for the year? Print Done X etho

Noreen is a self-employed consultant who uses 10% of her residence as an office. The office is used exclusively for business and is frequented by customers on a regular basis. Noreen also uses her den as an office (7% of the total floor space of her home) to prepare bills and keep records. However, the den is also used by her children as a TV room. In 2021, Noreen's net income from the consulting business (other than her home office expenses) amounts to $100,000 in 2021. She also incurs $900 of expenses directly related to the office (e.g., painting of the office, window blinds). Noreen incurs the following expenses in 2021 related to her residence: (Click the icon to view the expenses.) Read the requirements. Requirement a. Which of the expenditures above (if any) are deductible for 2021? Are they for AGI or from AGI deductions? Complete the table below to show the amount and classification of each of expense in. (Noreen is electing to use the "actual expenses" rather than the "safe harbor" method. Complete all input fields. Enter a "0" if an amount is not deductible.) Direct home office expenses Indirect home office expenses: Real estate taxes Mortgage interest Insurance Depreciation. $ $ Repairs and utilities Total indirect home office expenses Total expense for office in home 900 3,400 9,000 700 8,500 2,500 ... Amount of Deduction Type of Deduction Data table Real estate taxes Mortgage interest Insurance Depreciation Repairs and utilities Total $ $ 3,400 9,000 700 8,500 2,500 24,100 X Requirements a. Which of the expenditures above (if any) are deductible for 2021? Are they for AGI or from AGI deductions? b. Would your answer to Part a change if Noreen's net income from consulting were only $3,040 for the year? Print Done X etho

Chapter6: Business Expenses

Section: Chapter Questions

Problem 33P

Related questions

Question

Please do not give image format

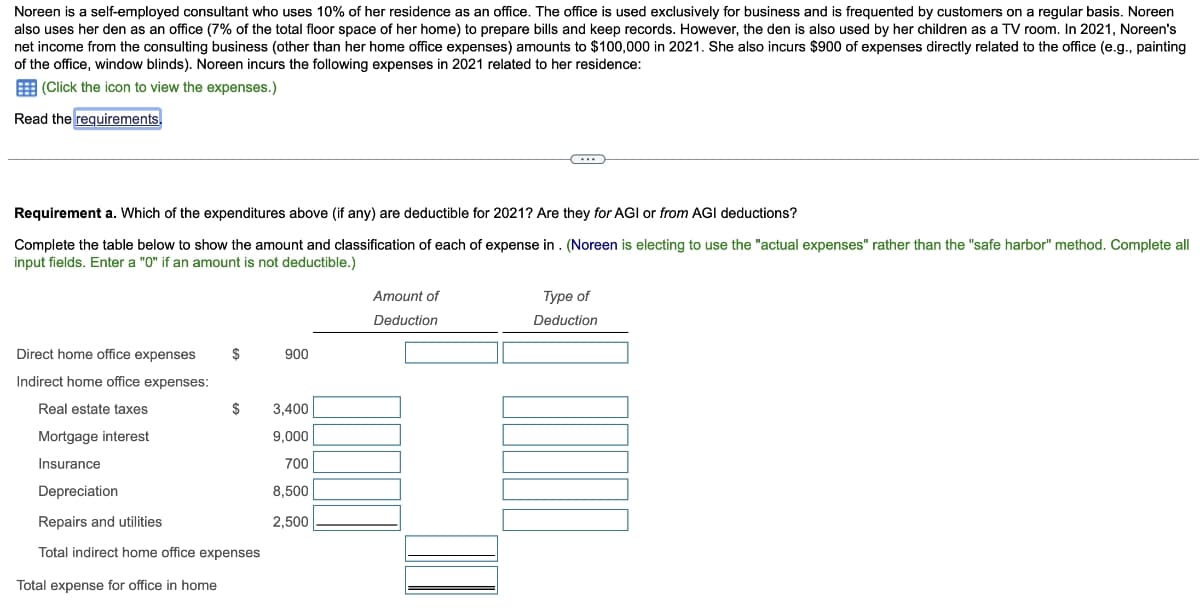

Transcribed Image Text:Noreen is a self-employed consultant who uses 10% of her residence as an office. The office is used exclusively for business and is frequented by customers on a regular basis. Noreen

also uses her den as an office (7% of the total floor space of her home) to prepare bills and keep records. However, the den is also used by her children as a TV room. In 2021, Noreen's

net income from the consulting business (other than her home office expenses) amounts to $100,000 in 2021. She also incurs $900 of expenses directly related to the office (e.g., painting

of the office, window blinds). Noreen incurs the following expenses in 2021 related to her residence:

(Click the icon to view the expenses.)

Read the requirements.

Requirement a. Which of the expenditures above (if any) are deductible for 2021? Are they for AGI or from AGI deductions?

Complete the table below to show the amount and classification of each of expense in. (Noreen is electing to use the "actual expenses" rather than the "safe harbor" method. Complete all

input fields. Enter a "0" if an amount is not deductible.)

Direct home office expenses

Indirect home office expenses:

Real estate taxes

Mortgage interest

Insurance

Depreciation.

$

$

Repairs and utilities

Total indirect home office expenses

Total expense for office in home

900

3,400

9,000

700

8,500

2,500

...

Amount of

Deduction

Type of

Deduction

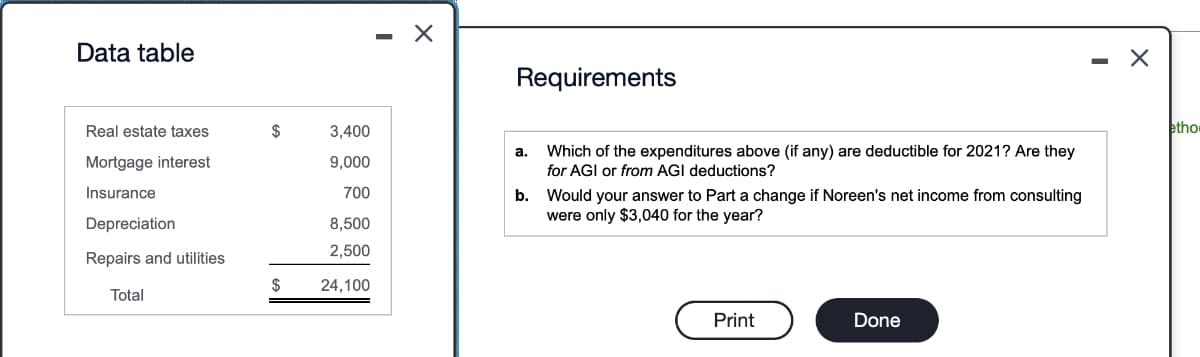

Transcribed Image Text:Data table

Real estate taxes

Mortgage interest

Insurance

Depreciation

Repairs and utilities

Total

$

$

3,400

9,000

700

8,500

2,500

24,100

X

Requirements

a. Which of the expenditures above (if any) are deductible for 2021? Are they

for AGI or from AGI deductions?

b. Would your answer to Part a change if Noreen's net income from consulting

were only $3,040 for the year?

Print

Done

X

etho

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT