00 %24 1 Problem Set: Module Eight CengageNOWv2 | Online teachi x Cengage Learning + x leAssnment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=D&inprogress%-false .com eBook Show Me How Adjustments to Net Income-Indirect Method Ripley Corporation's accumulated depreciation-equipment account increased by $15,325 while $3,800 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $22,420 from the sale of investments. Reconcile a net income of $286,900 to net cash flow from operating activities. Check My Work (Previous 6:04 PM 4/19/2022 dy 91 f12 Su prt sc I14 144 $4 4. 5. 6. 7. R. 13

00 %24 1 Problem Set: Module Eight CengageNOWv2 | Online teachi x Cengage Learning + x leAssnment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=D&inprogress%-false .com eBook Show Me How Adjustments to Net Income-Indirect Method Ripley Corporation's accumulated depreciation-equipment account increased by $15,325 while $3,800 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $22,420 from the sale of investments. Reconcile a net income of $286,900 to net cash flow from operating activities. Check My Work (Previous 6:04 PM 4/19/2022 dy 91 f12 Su prt sc I14 144 $4 4. 5. 6. 7. R. 13

Chapter2: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 14SP

Related questions

Question

Transcribed Image Text:00

%24

1 Problem Set: Module Eight

CengageNOWv2 | Online teachi x

Cengage Learning

+ x

leAssnment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=D&inprogress%-false

.com

eBook

Show Me How

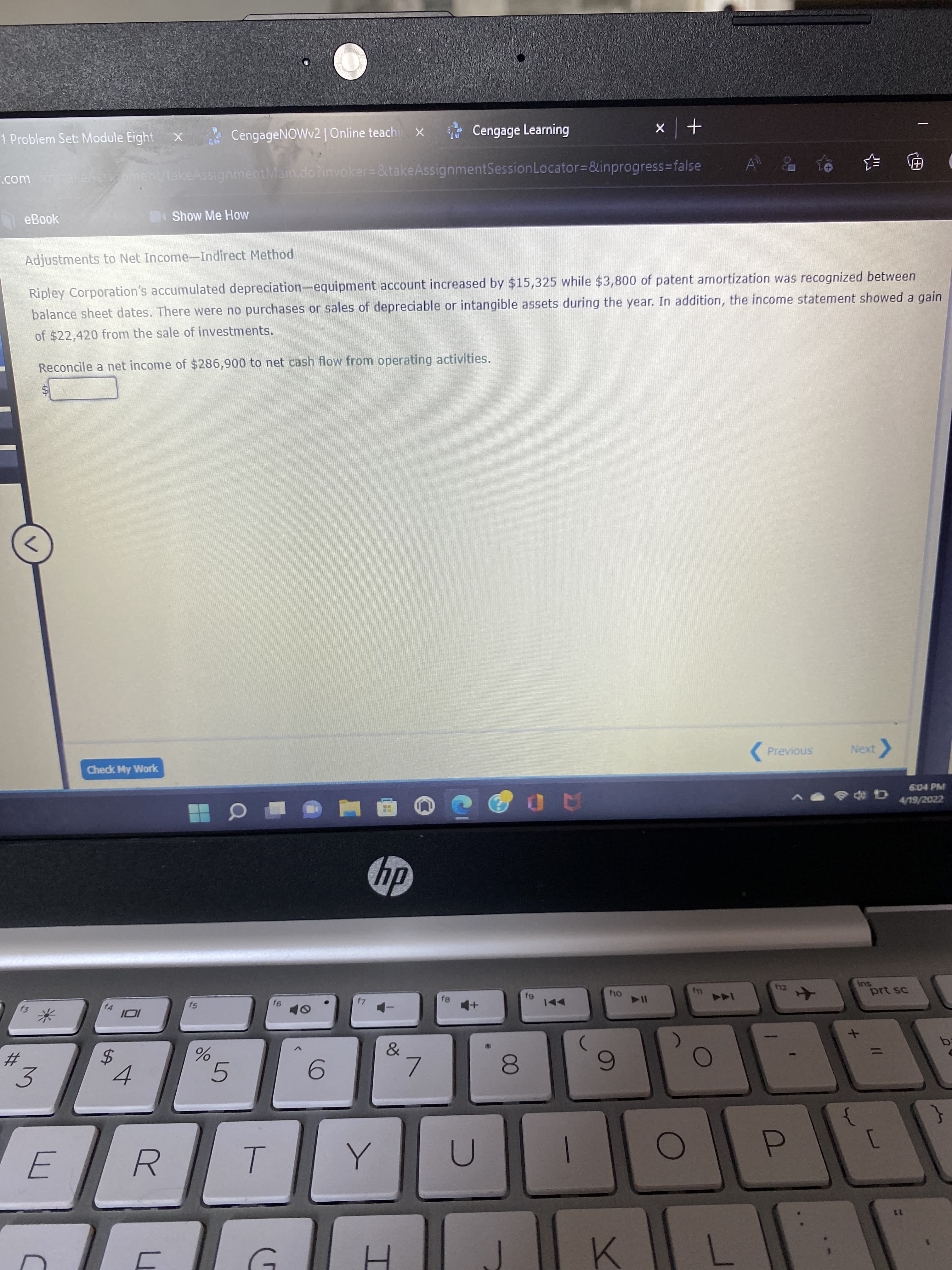

Adjustments to Net Income-Indirect Method

Ripley Corporation's accumulated depreciation-equipment account increased by $15,325 while $3,800 of patent amortization was recognized between

balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain

of $22,420 from the sale of investments.

Reconcile a net income of $286,900 to net cash flow from operating activities.

Check My Work

(Previous

6:04 PM

4/19/2022

dy

91

f12

Su

prt sc

I14

144

$4

4.

5.

6.

7.

R.

13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning