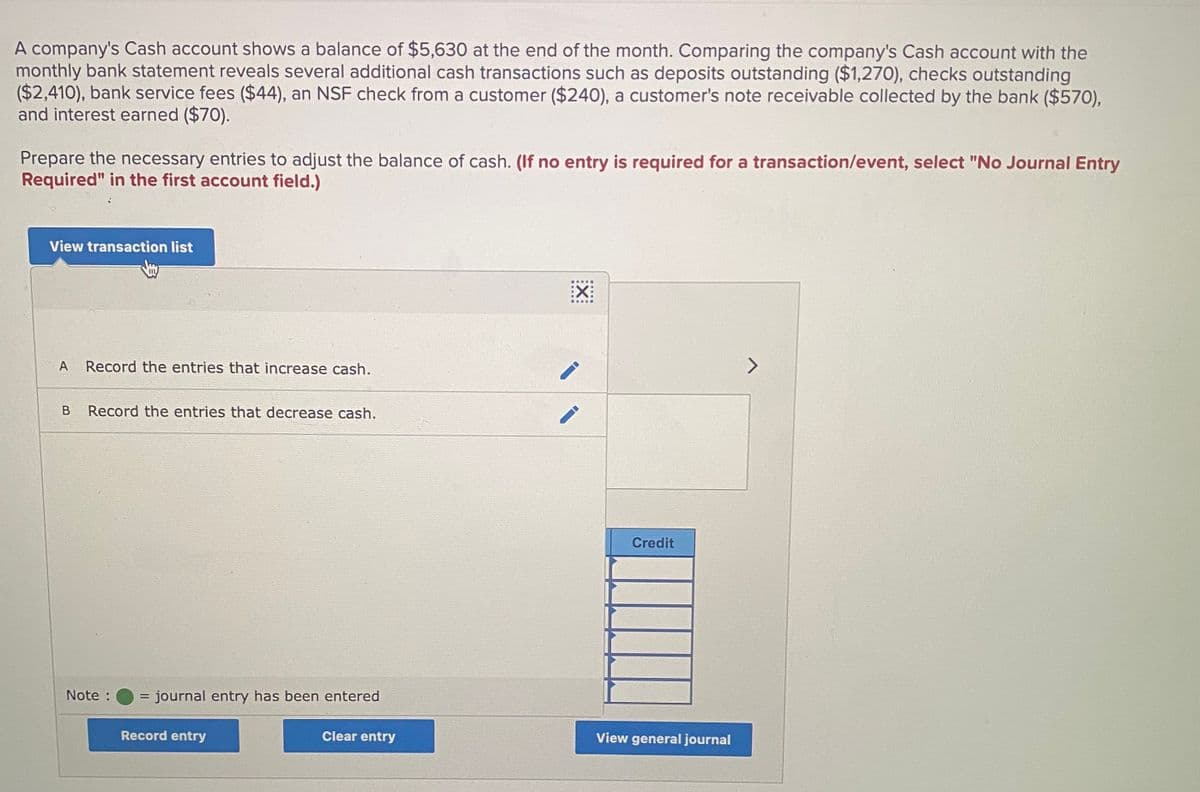

A company's Cash account shows a balance of $5,630 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as deposits outstanding ($1,270), checks outstanding ($2,410), bank service fees ($44), an NSF check from a customer ($240), a customer's note receivable collected by the bank ($570), and interest earned ($70). Prepare the necessary entries to adjust the balance of cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list :X: A Record the entries that increase cash. Record the entries that decrease cash. Credit Note : = journal entry has been entered %D Record entry Clear entry View general journal :X:

A company's Cash account shows a balance of $5,630 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as deposits outstanding ($1,270), checks outstanding ($2,410), bank service fees ($44), an NSF check from a customer ($240), a customer's note receivable collected by the bank ($570), and interest earned ($70). Prepare the necessary entries to adjust the balance of cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list :X: A Record the entries that increase cash. Record the entries that decrease cash. Credit Note : = journal entry has been entered %D Record entry Clear entry View general journal :X:

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5E

Related questions

Question

Transcribed Image Text:A company's Cash account shows a balance of $5,630 at the end of the month. Comparing the company's Cash account with the

monthly bank statement reveals several additional cash transactions such as deposits outstanding ($1,270), checks outstanding

($2,410), bank service fees ($44), an NSF check from a customer ($240), a customer's note receivable collected by the bank ($570),

and interest earned ($70).

Prepare the necessary entries to adjust the balance of cash. (If no entry is required for a transaction/event, select "No Journal Entry

Required" in the first account field.)

View transaction list

:X:

A

Record the entries that increase cash.

Record the entries that decrease cash.

Credit

Note :

= journal entry has been entered

%D

Record entry

Clear entry

View general journal

:X:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College