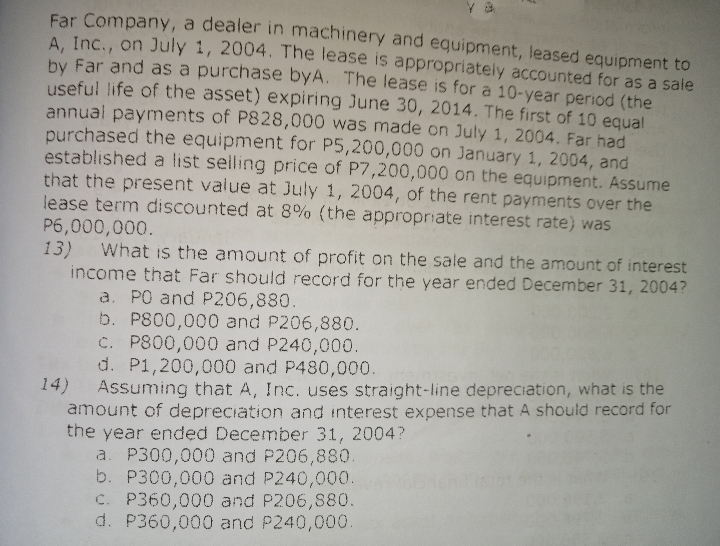

Far Company, a dealer in machinery and equipment, leased equipment to A. Inc., on July 1, 2004. The lease is appropriately accounted for as a sale by Far and as a purchase byA. The lease is for a 10-year period (the useful life of the asset) expiring June 30, 2014. The first of 10 equal annual payments of P828,000 was made on July 1, 2004. Far had purchased the equipment for P5,200,000 on January 1, 2004, and established a list selling price of P7,200,000 on the equipment. Assume that the present value at July 1, 2004, of the rent payments over the lease term discounted at 8% (the appropriate interest rate) was P6,000,000. 13) What is the amount of profit on the sale and the amount of interest income that Far should record for the year ended December 31, 2004? a. PO and P206,880. b. P800,000 and P206,880. C. P800,000 and P240,000. d. P1,200,000 and P480,000. 14) Assuming that A, Inc. uses straight-line depreciation, what is the amount of depreciation and interest expense that A should record for the year ended December 31, 2004? a. P300,000 and P206,880 b. P300,000 and P240,000. C. P360,000 and P206,880. d. P360,000 and P240,000.

Far Company, a dealer in machinery and equipment, leased equipment to A. Inc., on July 1, 2004. The lease is appropriately accounted for as a sale by Far and as a purchase byA. The lease is for a 10-year period (the useful life of the asset) expiring June 30, 2014. The first of 10 equal annual payments of P828,000 was made on July 1, 2004. Far had purchased the equipment for P5,200,000 on January 1, 2004, and established a list selling price of P7,200,000 on the equipment. Assume that the present value at July 1, 2004, of the rent payments over the lease term discounted at 8% (the appropriate interest rate) was P6,000,000. 13) What is the amount of profit on the sale and the amount of interest income that Far should record for the year ended December 31, 2004? a. PO and P206,880. b. P800,000 and P206,880. C. P800,000 and P240,000. d. P1,200,000 and P480,000. 14) Assuming that A, Inc. uses straight-line depreciation, what is the amount of depreciation and interest expense that A should record for the year ended December 31, 2004? a. P300,000 and P206,880 b. P300,000 and P240,000. C. P360,000 and P206,880. d. P360,000 and P240,000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:Far Company, a dealer in machinery and equipment, leased equipment to

A. Inc., on July 1, 2004. The lease is appropriately accounted for as a sale

by Far and as a purchase byA. The lease is for a 10-year period (the

useful life of the asset) expiring June 30, 2014. The first of 10 equal

annual payments of P828,000 was made on July 1, 2004. Far had

purchased the equipment for P5,200,000 on January 1, 2004, and

established a list selling price of P7,200,000 on the equipment. Assume

that the present value at July 1, 2004, of the rent payments over the

lease term discounted at 8% (the appropriate interest rate) was

P6,000,000.

13) What is the amount of profit on the sale and the amount of interest

income that Far should record for the year ended December 31, 2004?

a. PO and P206,880.

b. P800,000 and P206,880.

C. P800,000 and P240,000.

d. P1,200,000 and P480,000.

14) Assuming that A, Inc. uses straight-line depreciation, what is the

amount of depreciation and interest expense that A should record for

the year ended December 31, 2004?

a. P300,000 and P206,880

b. P300,000 and P240,000.

C. P360,000 and P206,880.

d. P360,000 and P240,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning