10. State what would happen to the equity of Kicking Horse Oil Ltd. after each of the following independent transactions: (a) The founders of the company made an initial investment of $100,000, receiving 100,000 common shares in exchange. (b) The company borrowed $250,000 from a bank. (c) The company listed its shares on the Calgary Stock Exchange and sold 1,000 common shares to the general public for $1,000,000. (d) The company sold 100,000 10% cumulative preference shares to the general public for $100,000. (e) The company invested $1,250,000 in oil exploration rights. (f) The company paid $2,000 interest on the bank loan. (g) The oil exploration rights were revalued at $5,000,000. (h) In year 1, the company reported a loss of $50,000. In (i) G) At the end of year 2, the company paid a dividend of $10,000 to the preference shareholders and $25,000 to the common shareholders. year 2, the company reported a net income of $200,000.

10. State what would happen to the equity of Kicking Horse Oil Ltd. after each of the following independent transactions: (a) The founders of the company made an initial investment of $100,000, receiving 100,000 common shares in exchange. (b) The company borrowed $250,000 from a bank. (c) The company listed its shares on the Calgary Stock Exchange and sold 1,000 common shares to the general public for $1,000,000. (d) The company sold 100,000 10% cumulative preference shares to the general public for $100,000. (e) The company invested $1,250,000 in oil exploration rights. (f) The company paid $2,000 interest on the bank loan. (g) The oil exploration rights were revalued at $5,000,000. (h) In year 1, the company reported a loss of $50,000. In (i) G) At the end of year 2, the company paid a dividend of $10,000 to the preference shareholders and $25,000 to the common shareholders. year 2, the company reported a net income of $200,000.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter13: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 3PA: The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the...

Related questions

Question

Solve part e, f, g, h, i, and part j

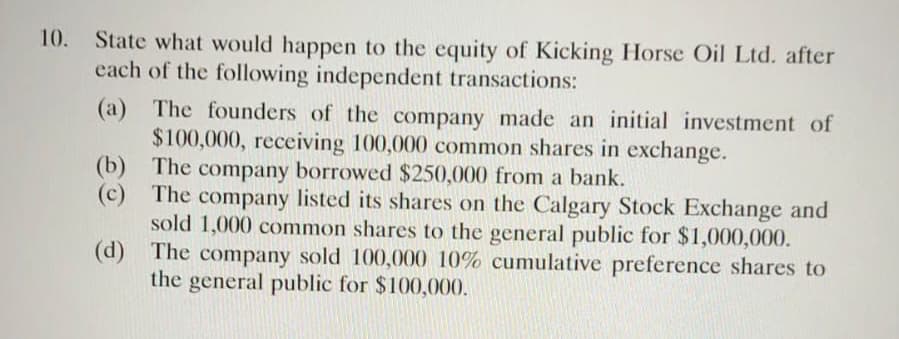

Transcribed Image Text:10.

State what would happen to the equity of Kicking Horse Oil Ltd. after

each of the following independent transactions:

(a) The founders of the company made an initial investment of

$100,000, receiving 100,000 common shares in exchange.

(b) The company borrowed $250,000 from a bank.

(c) The company listed its shares on the Calgary Stock Exchange and

sold 1,000 common shares to the general public for $1,000,000.

(d) The company sold 100,000 10% cumulative preference shares to

the general public for $100,000.

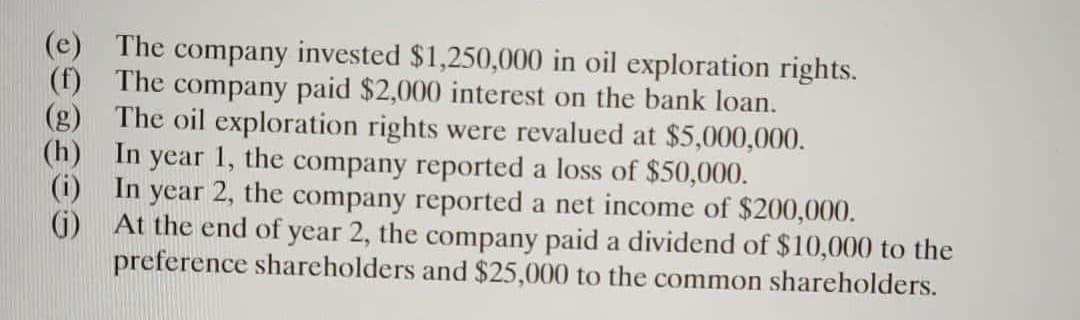

Transcribed Image Text:(e) The company invested $1,250,000 in oil exploration rights.

(f) The company paid $2,000 interest on the bank loan.

(g) The oil exploration rights were revalued at $5,000,000.

(h) In year 1, the company reported a loss of $50,000.

In

(i)

G) At the end of year 2, the company paid a dividend of $10,000 to the

preference shareholders and $25,000 to the common shareholders.

year 2, the company reported a net income of $200,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning