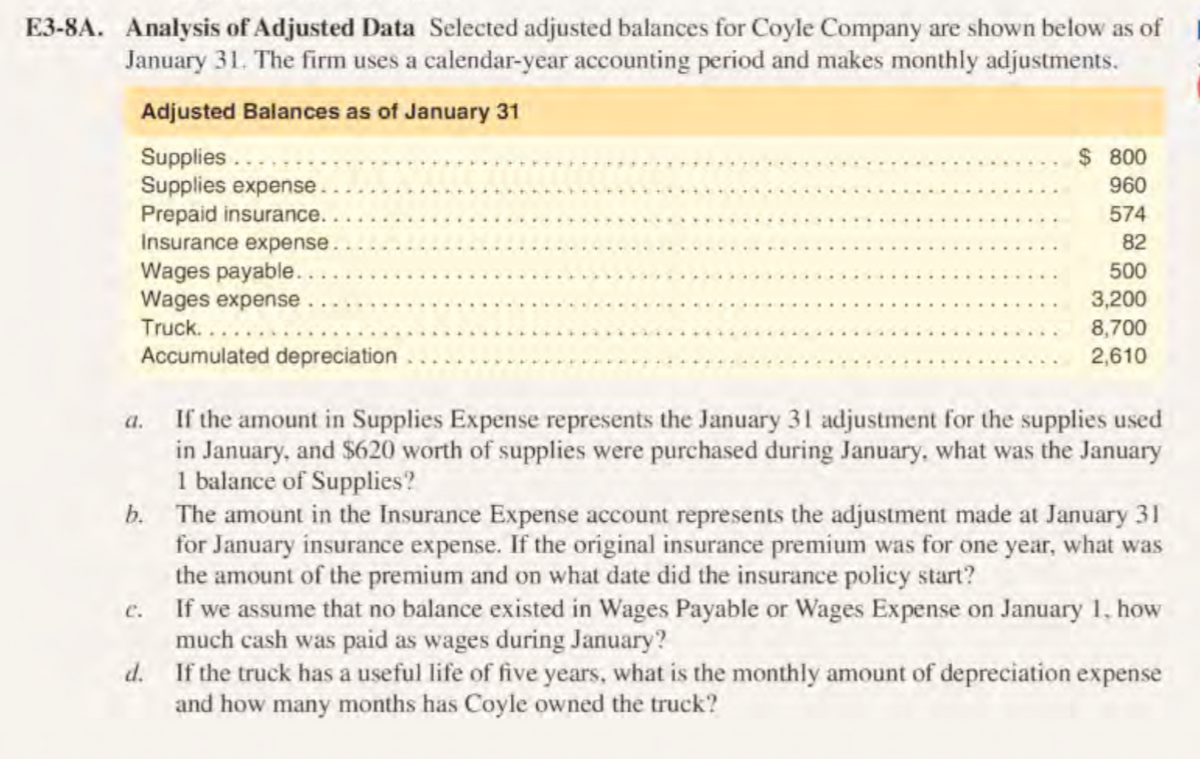

E3-8A. Analysis of Adjusted Data Selected adjusted balances for Coyle Company are shown below as of January 31. The firm uses a calendar-year accounting period and makes monthly adjustments. Adjusted Balances as of January 31 Supplies .... Supplies expense. Prepaid insurance.. Insurance expense. $ 800 960 574 82 Wages payable. Wages expense Truck... 500 3,200 8,700 Accumulated depreciation 2,610 a. If the amount in Supplies Expense represents the January 31 adjustment for the supplies used in January, and $620 worth of supplies were purchased during January, what was the January 1 balance of Supplies? b. The amount in the Insurance Expense account represents the adjustment made at January 31 for January insurance expense. If the original insurance premium was for one year, what was the amount of the premium and on what date did the insurance policy start? If we assume that no balance existed in Wages Payable or Wages Expense on January 1, how much cash was paid as wages during January? d. If the truck has a useful life of five years, what is the monthly amount of depreciation expense and how many months has Coyle owned the truck? C.

E3-8A. Analysis of Adjusted Data Selected adjusted balances for Coyle Company are shown below as of January 31. The firm uses a calendar-year accounting period and makes monthly adjustments. Adjusted Balances as of January 31 Supplies .... Supplies expense. Prepaid insurance.. Insurance expense. $ 800 960 574 82 Wages payable. Wages expense Truck... 500 3,200 8,700 Accumulated depreciation 2,610 a. If the amount in Supplies Expense represents the January 31 adjustment for the supplies used in January, and $620 worth of supplies were purchased during January, what was the January 1 balance of Supplies? b. The amount in the Insurance Expense account represents the adjustment made at January 31 for January insurance expense. If the original insurance premium was for one year, what was the amount of the premium and on what date did the insurance policy start? If we assume that no balance existed in Wages Payable or Wages Expense on January 1, how much cash was paid as wages during January? d. If the truck has a useful life of five years, what is the monthly amount of depreciation expense and how many months has Coyle owned the truck? C.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 4PB: The following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal...

Related questions

Question

Transcribed Image Text:E3-8A. Analysis of Adjusted Data Selected adjusted balances for Coyle Company are shown below as of

January 31. The firm uses a calendar-year accounting period and makes monthly adjustments.

Adjusted Balances as of January 31

Supplies ....

Supplies expense.

Prepaid insurance..

Insurance expense.

$ 800

960

574

82

Wages payable.

Wages expense

Truck...

500

3,200

8,700

Accumulated depreciation

2,610

a. If the amount in Supplies Expense represents the January 31 adjustment for the supplies used

in January, and $620 worth of supplies were purchased during January, what was the January

1 balance of Supplies?

b. The amount in the Insurance Expense account represents the adjustment made at January 31

for January insurance expense. If the original insurance premium was for one year, what was

the amount of the premium and on what date did the insurance policy start?

If we assume that no balance existed in Wages Payable or Wages Expense on January 1, how

much cash was paid as wages during January?

d. If the truck has a useful life of five years, what is the monthly amount of depreciation expense

and how many months has Coyle owned the truck?

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College