Accounting The shareholders' equity section of Sweet Acacia Corporation at January 1, 2024, included the following: Share capital: $1.25 preferred shares, 258,000 shares authorized, 51,600 shares issued Common shares, unlimited number of shares authorized 105,000 shares issued Total share capital Retained earnings Total shareholders' equity (a) 1. 2. 3. $928,800 Record the journal entries required for the transactions of Sweet Acacia Corporation for the fiscal year ended December 31. 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) 4. 840,000 1,768,800 505,000 $2,273,800 Paid $5,700 cash and issued 1,500 common shares to the company's lawyers for legal services rendered valued at $29,000. Sold an additional 1,500 shares of $1.25 preferred shares for cash of $19 per share. Exchanged an additional 7,500 shares of $1.25 preferred shares for land. The asking price for the land was $134,000 and the fair market value of the land at the date of the exchange was $127,000. Issued 1,000 common shares in exchange for a patent that had a fair market value of $15,000 and a useful life of 5 years.

Accounting The shareholders' equity section of Sweet Acacia Corporation at January 1, 2024, included the following: Share capital: $1.25 preferred shares, 258,000 shares authorized, 51,600 shares issued Common shares, unlimited number of shares authorized 105,000 shares issued Total share capital Retained earnings Total shareholders' equity (a) 1. 2. 3. $928,800 Record the journal entries required for the transactions of Sweet Acacia Corporation for the fiscal year ended December 31. 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) 4. 840,000 1,768,800 505,000 $2,273,800 Paid $5,700 cash and issued 1,500 common shares to the company's lawyers for legal services rendered valued at $29,000. Sold an additional 1,500 shares of $1.25 preferred shares for cash of $19 per share. Exchanged an additional 7,500 shares of $1.25 preferred shares for land. The asking price for the land was $134,000 and the fair market value of the land at the date of the exchange was $127,000. Issued 1,000 common shares in exchange for a patent that had a fair market value of $15,000 and a useful life of 5 years.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 16E: Contributed Capital Adams Companys records provide the following information on December 31, 2019:...

Related questions

Question

Please help me

Transcribed Image Text:Accounting

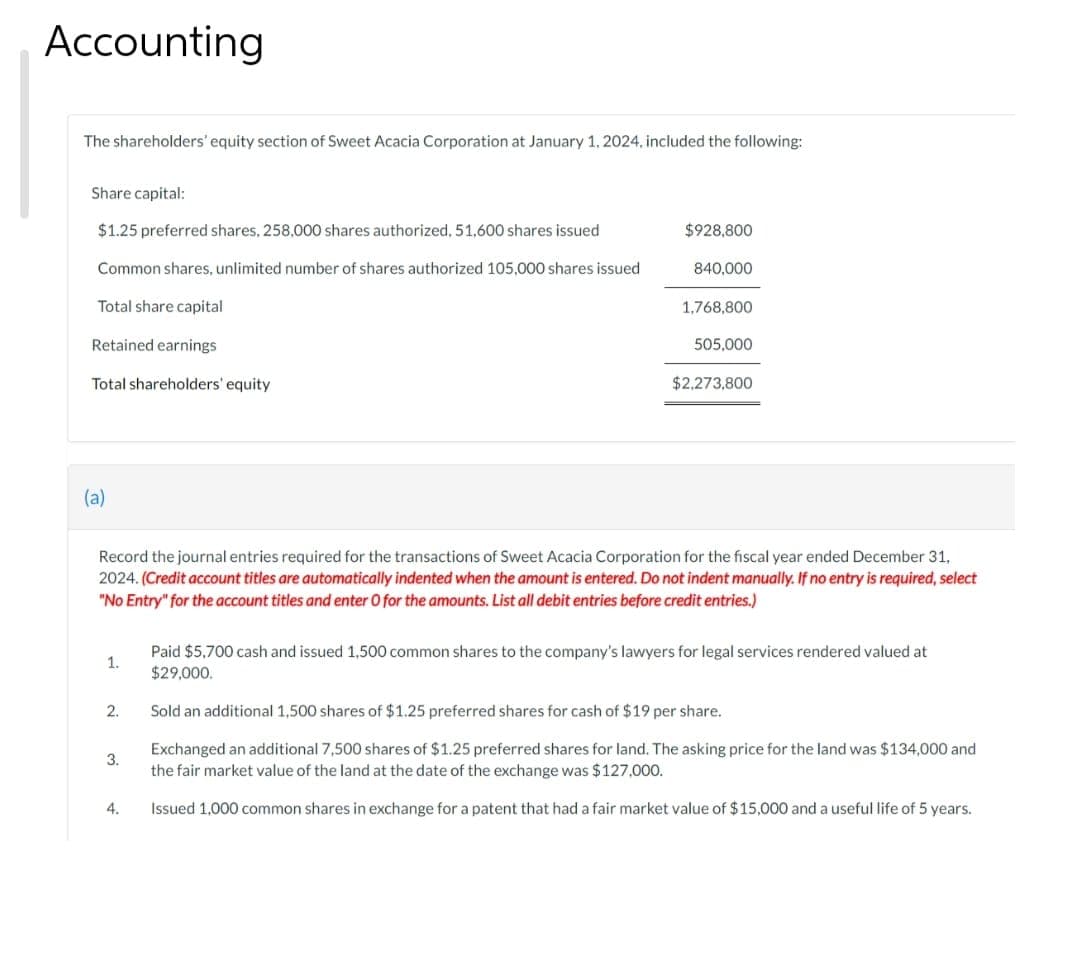

The shareholders' equity section of Sweet Acacia Corporation at January 1, 2024, included the following:

Share capital:

$1.25 preferred shares, 258,000 shares authorized, 51,600 shares issued

Common shares, unlimited number of shares authorized 105,000 shares issued

Total share capital

Retained earnings

Total shareholders' equity

(a)

1.

2.

3.

$928,800

840,000

Record the journal entries required for the transactions of Sweet Acacia Corporation for the fiscal year ended December 31,

2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select

"No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)

4.

1,768,800

505,000

$2,273,800

Paid $5,700 cash and issued 1,500 common shares to the company's lawyers for legal services rendered valued at

$29,000.

Sold an additional 1,500 shares of $1.25 preferred shares for cash of $19 per share.

Exchanged an additional 7,500 shares of $1.25 preferred shares for land. The asking price for the land was $134,000 and

the fair market value of the land at the date of the exchange was $127,000.

Issued 1,000 common shares in exchange for a patent that had a fair market value of $15,000 and a useful life of 5 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning