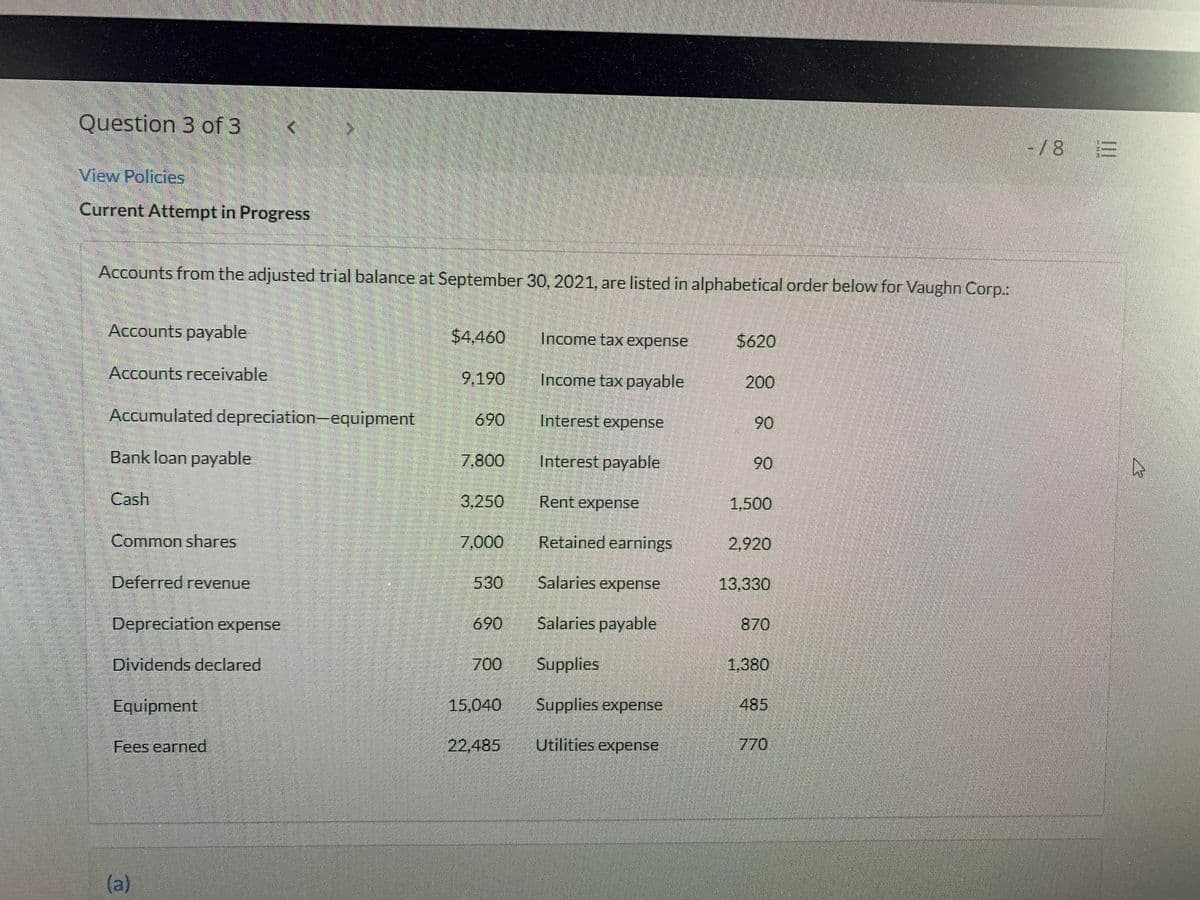

Accounts from the adjusted trial balance at September 30, 2021, are listed in alphabetical order below for Vaughn Corp.: Accounts payable $4,460 Income tax expense $620 Accounts receivable 9,190 Income tax payable 200 Accumulated depreciation-equipment 690 Interest expense 90 Bank loan payable 7,800 Interest payable 90 Cash 3,250 Rent expense 1,500 Common shares 7,000 Retained earnings 2,920 Deferred revenue 530 Salaries expense 13,330 Depreciation expense 690 Salaries payable 870 Dividends declared 700 Supplies 1,380 Equipment 15,040 Supplies expense 485 Fees earned 22,485 Utilities expense 770 (a)

Accounts from the adjusted trial balance at September 30, 2021, are listed in alphabetical order below for Vaughn Corp.: Accounts payable $4,460 Income tax expense $620 Accounts receivable 9,190 Income tax payable 200 Accumulated depreciation-equipment 690 Interest expense 90 Bank loan payable 7,800 Interest payable 90 Cash 3,250 Rent expense 1,500 Common shares 7,000 Retained earnings 2,920 Deferred revenue 530 Salaries expense 13,330 Depreciation expense 690 Salaries payable 870 Dividends declared 700 Supplies 1,380 Equipment 15,040 Supplies expense 485 Fees earned 22,485 Utilities expense 770 (a)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 58E: Exercise 3-58 Preparing a Balance Sheet Refer to the unadjusted trial balance for Oxmoor Corporation...

Related questions

Question

Transcribed Image Text:Question 3 of 3

-/8

View Policies

Current Attempt in Progress

Accounts from the adjusted trial balance at September 30, 2021, are listed in alphabetical order below for Vaughn Corp.:

Accounts payable

$4,460

Income tax expense

$620

Accounts receivable

9,190

Income tax payable

200

Accumulated depreciation-equipment

Interest expense

690

90

Bank loan payable

7,800

Interest payable

90

Cash

3,250

Rent expense

1,500

Common shares

7,000

Retained earnings

2,920

Deferred revenue

530

Salaries expense

13,330

Depreciation expense

690

Salaries payable

870

Dividends declared

700

Supplies

1,380

Equipment

15,040

Supplies expense

485

Fees earned

22,485

Utilities expense

770

(a)

II

Transcribed Image Text:Question 3 of 3

-/8 E

Prepare an adjusted trial balance.

VAUGHN CORP.

Adjusted Trial Balance

September 30, 2021

Debit

Credit

24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,