Accounts payable Accounts receivable CAPITAL NORTHEAST CORPORATION POST-CLOSING TRIAL BALANCE DECEMBER 31, 2017 Accumulated depreciation equipment Additional paid-in capital-common In excess of par value From sale of treasury stock Allowance for doubtful accounts Equipment Cash Common stock ($1 par value) Dividends payable on common stock-cash Inventories Investments Preferred stock ($100 par value) Prepaid insurance Retained earnings Treasury stock-common at cost Totals Dr. $ 605,000 Authorized Issued Outstanding 6,800,000 260,000 750,000 2,500,000 65,000 125,000 $11,105,000 Cr. $ 668,000 450,000 1,900,000 35,000 20,000 500,000 50,000 6,500,000 982,000 $11,105,000 31, 2017, Capital Northeast had the following number of common and preferred shares. Common Preferred 2,500,000 1,000,000 500,000 65,000 490,000 65,000 on preferred stock are 6% cumulative. In addition, the preferred stock has a preference in liquidation of $102

Accounts payable Accounts receivable CAPITAL NORTHEAST CORPORATION POST-CLOSING TRIAL BALANCE DECEMBER 31, 2017 Accumulated depreciation equipment Additional paid-in capital-common In excess of par value From sale of treasury stock Allowance for doubtful accounts Equipment Cash Common stock ($1 par value) Dividends payable on common stock-cash Inventories Investments Preferred stock ($100 par value) Prepaid insurance Retained earnings Treasury stock-common at cost Totals Dr. $ 605,000 Authorized Issued Outstanding 6,800,000 260,000 750,000 2,500,000 65,000 125,000 $11,105,000 Cr. $ 668,000 450,000 1,900,000 35,000 20,000 500,000 50,000 6,500,000 982,000 $11,105,000 31, 2017, Capital Northeast had the following number of common and preferred shares. Common Preferred 2,500,000 1,000,000 500,000 65,000 490,000 65,000 on preferred stock are 6% cumulative. In addition, the preferred stock has a preference in liquidation of $102

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter15: Contributed Capital

Section: Chapter Questions

Problem 17E

Related questions

Topic Video

Question

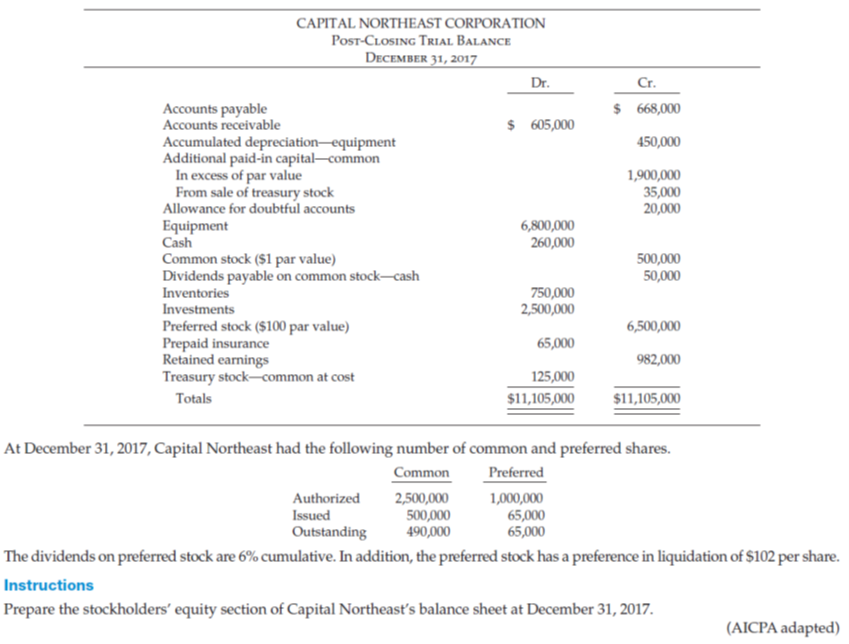

Transcribed Image Text:Accounts payable

Accounts receivable

CAPITAL NORTHEAST CORPORATION

POST-CLOSING TRIAL BALANCE

DECEMBER 31, 2017

Accumulated depreciation-equipment

Additional paid-in capital-common

In excess of par value

From sale of treasury stock

Allowance for doubtful accounts

Equipment

Cash

Common stock ($1 par value)

Dividends payable on common stock-cash

Inventories

Investments

Preferred stock ($100 par value)

Prepaid insurance

Retained earnings

Treasury stock-common at cost

Totals

Dr.

$ 605,000

6,800,000

260,000

750,000

2,500,000

65,000

125,000

$11,105,000

Cr.

$ 668,000

450,000

1,900,000

35,000

20,000

500,000

50,000

6,500,000

982,000

$11,105,000

At December 31, 2017, Capital Northeast had the following number of common and preferred shares.

Common

Preferred

Authorized

2,500,000

1,000,000

500,000

65,000

Issued

Outstanding

490,000

65,000

The dividends on preferred stock are 6% cumulative. In addition, the preferred stock has a preference in liquidation of $102 per share.

Instructions

Prepare the stockholders' equity section of Capital Northeast's balance sheet at December 31, 2017.

(AICPA adapted)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning