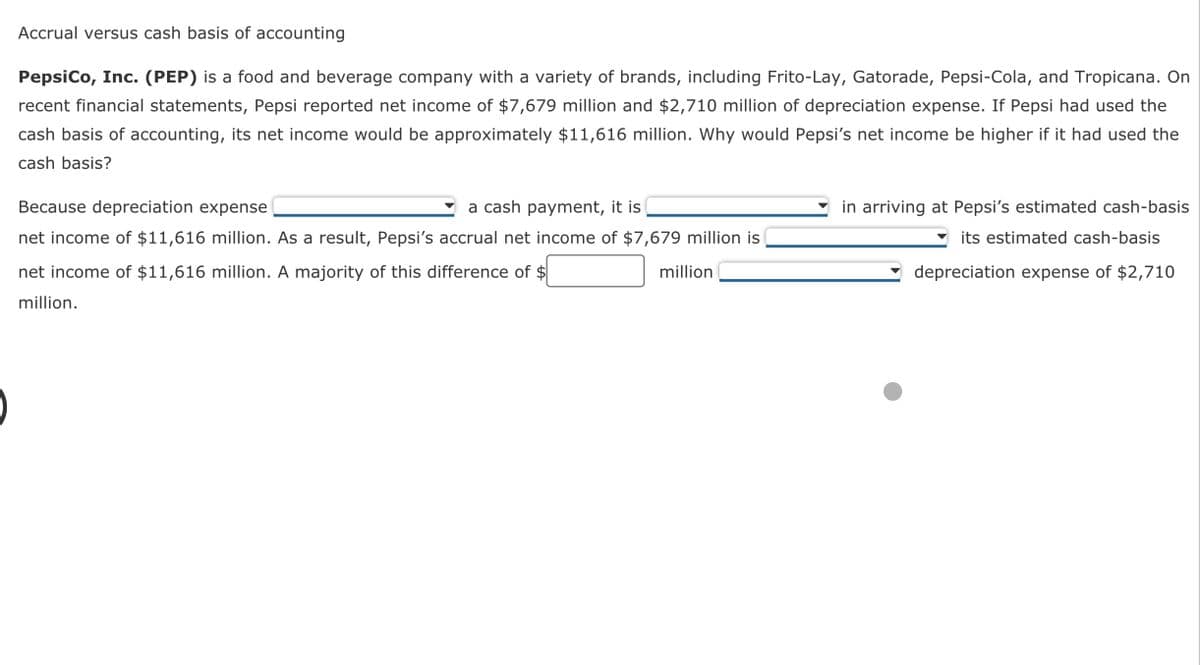

Accrual versus cash basis of accounting PepsiCo, Inc. (PEP) is a food and beverage company with a variety of brands, including Frito-Lay, Gatorade, Pepsi-Cola, and Tropicana. O recent financial statements, Pepsi reported net income of $7,679 million and $2,710 million of depreciation expense. If Pepsi had used the cash basis of accounting, its net income would be approximately $11,616 million. Why would Pepsi's net income be higher if it had used the cash basis? Because depreciation expense a cash payment, it is net income of $11,616 million. As a result, Pepsi's accrual net income of $7,679 million is net income of $11,616 million. A majority of this difference of $ million. million in arriving at Pepsi's estimated cash-bas its estimated cash-basis depreciation expense of $2,710

Accrual versus cash basis of accounting PepsiCo, Inc. (PEP) is a food and beverage company with a variety of brands, including Frito-Lay, Gatorade, Pepsi-Cola, and Tropicana. O recent financial statements, Pepsi reported net income of $7,679 million and $2,710 million of depreciation expense. If Pepsi had used the cash basis of accounting, its net income would be approximately $11,616 million. Why would Pepsi's net income be higher if it had used the cash basis? Because depreciation expense a cash payment, it is net income of $11,616 million. As a result, Pepsi's accrual net income of $7,679 million is net income of $11,616 million. A majority of this difference of $ million. million in arriving at Pepsi's estimated cash-bas its estimated cash-basis depreciation expense of $2,710

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 31E

Related questions

Question

Transcribed Image Text:Accrual versus cash basis of accounting

PepsiCo, Inc. (PEP) is a food and beverage company with a variety of brands, including Frito-Lay, Gatorade, Pepsi-Cola, and Tropicana. On

recent financial statements, Pepsi reported net income of $7,679 million and $2,710 million of depreciation expense. If Pepsi had used the

cash basis of accounting, its net income would be approximately $11,616 million. Why would Pepsi's net income be higher if it had used the

cash basis?

Because depreciation expense

a cash payment, it is

net income of $11,616 million. As a result, Pepsi's accrual net income of $7,679 million is

net income of $11,616 million. A majority of this difference of $

million.

million

in arriving at Pepsi's estimated cash-basis

its estimated cash-basis

depreciation expense of $2,710

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub