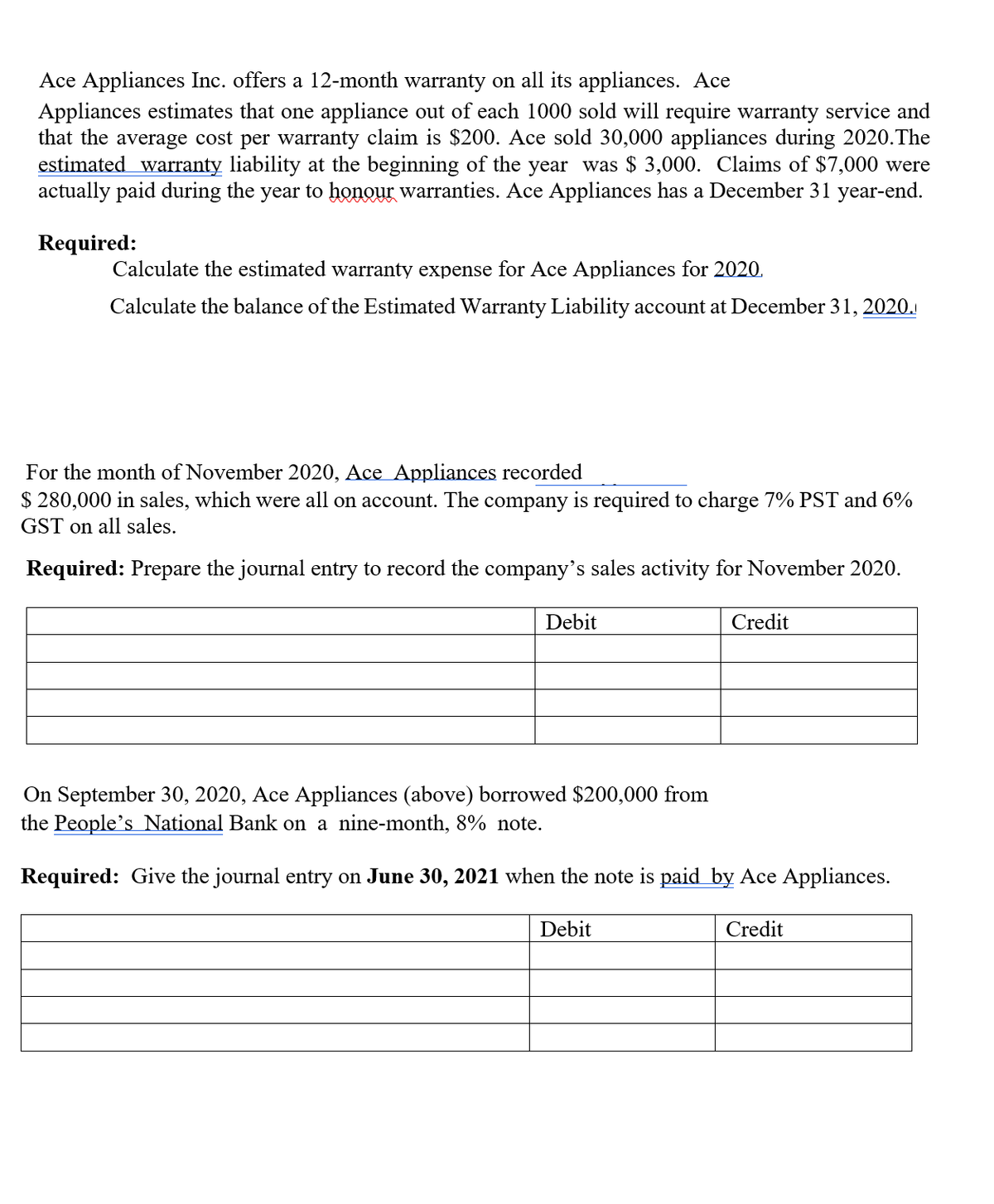

Ace Appliances Inc. offers a 12-month warranty on all its appliances. Ace Appliances estimates that one appliance out of each 1000 sold will require warranty service and that the average cost per warranty claim is $200. Ace sold 30,000 appliances during 2020.The estimated warranty liability at the beginning of the year was $ 3,000. Claims of $7,000 were actually paid during the year to honour warranties. Ace Appliances has a December 31 year-end. Required: Calculate the estimated warranty expense for Ace Appliances for 2020. Calculate the balance of the Estimated Warranty Liability account at December 31, 2020. For the month of November 2020, Ace Appliances recorded $ 280,000 in sales, which were all on account. The company is required to charge 7% PST and 6% GST on all sales. Required: Prepare the journal entry to record the company's sales activity for November 2020. Debit Credit On September 30, 2020, Ace Appliances (above) borrowed $200,000 from the People's National Bank on a nine-month, 8% note. Required: Give the journal entry on June 30, 2021 when the note is paid by Ace Appliances. Debit Credit

Ace Appliances Inc. offers a 12-month warranty on all its appliances. Ace Appliances estimates that one appliance out of each 1000 sold will require warranty service and that the average cost per warranty claim is $200. Ace sold 30,000 appliances during 2020.The estimated warranty liability at the beginning of the year was $ 3,000. Claims of $7,000 were actually paid during the year to honour warranties. Ace Appliances has a December 31 year-end. Required: Calculate the estimated warranty expense for Ace Appliances for 2020. Calculate the balance of the Estimated Warranty Liability account at December 31, 2020. For the month of November 2020, Ace Appliances recorded $ 280,000 in sales, which were all on account. The company is required to charge 7% PST and 6% GST on all sales. Required: Prepare the journal entry to record the company's sales activity for November 2020. Debit Credit On September 30, 2020, Ace Appliances (above) borrowed $200,000 from the People's National Bank on a nine-month, 8% note. Required: Give the journal entry on June 30, 2021 when the note is paid by Ace Appliances. Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10E

Related questions

Question

Refer to the photo

Transcribed Image Text:Ace Appliances Inc. offers a 12-month warranty on all its appliances. Ace

Appliances estimates that one appliance out of each 1000 sold will require warranty service and

that the average cost per warranty claim is $200. Ace sold 30,000 appliances during 2020.The

estimated warranty liability at the beginning of the year was $ 3,000. Claims of $7,000 were

actually paid during the year to honour warranties. Ace Appliances has a December 31 year-end.

Required:

Calculate the estimated warranty expense for Ace Appliances for 2020.

Calculate the balance of the Estimated Warranty Liability account at December 31, 2020.

For the month of November 2020, Ace Appliances recorded

$ 280,000 in sales, which were all on account. The company is required to charge 7% PST and 6%

GST on all sales.

Required: Prepare the journal entry to record the company's sales activity for November 2020.

Debit

Credit

On September 30, 2020, Ace Appliances (above) borrowed $200,000 from

the People's National Bank on a nine-month, 8% note.

Required: Give the journal entry on June 30, 2021 when the note is paid by Ace Appliances.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT