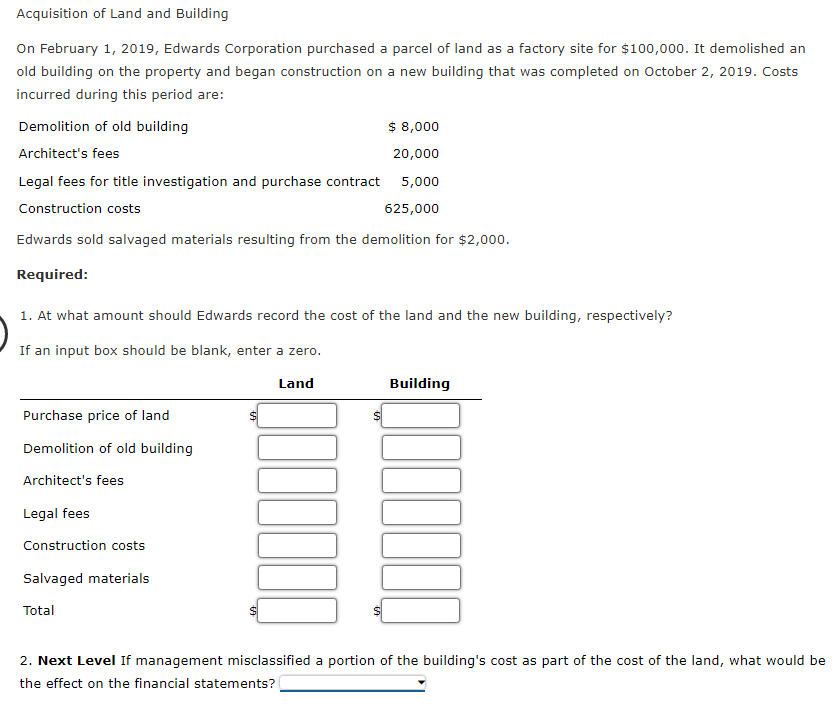

Acquisition of Land and Building On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building on the property and began construction on a new building that was completed on October 2, 2019. Costs incurred during this period are: Demolition of old building $ 8,000 Architect's fees 20,000 Legal fees for title investigation and purchase contract 5,000 Construction costs 625,000 Edwards sold salvaged materials resulting from the demolition for $2,000. Required: 1. At what amount should Edwards record the cost of the land and the new building, respectively?

Acquisition of Land and Building On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building on the property and began construction on a new building that was completed on October 2, 2019. Costs incurred during this period are: Demolition of old building $ 8,000 Architect's fees 20,000 Legal fees for title investigation and purchase contract 5,000 Construction costs 625,000 Edwards sold salvaged materials resulting from the demolition for $2,000. Required: 1. At what amount should Edwards record the cost of the land and the new building, respectively?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Acquisition of Land and Building

On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an

old building on the property and began construction on a new building that was completed on October 2, 2019. Costs

incurred during this period are:

Demolition of old building

$ 8,000

Architect's fees

20,000

Legal fees for title investigation and purchase contract 5,000

Construction costs

625,000

Edwards sold salvaged materials resulting from the demolition for $2,000.

Required:

1. At what amount should Edwards record the cost of the land and the new building, respectively?

If an input box should be blank, enter a zero.

Land

Building

Purchase price of land

Demolition of old building

Architect's fees

Legal fees

Construction costs

Salvaged materials

Total

2. Next Level If management misclassified a portion of the building's cost as part of the cost of the land, what would be

the effect on the financial statements?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning