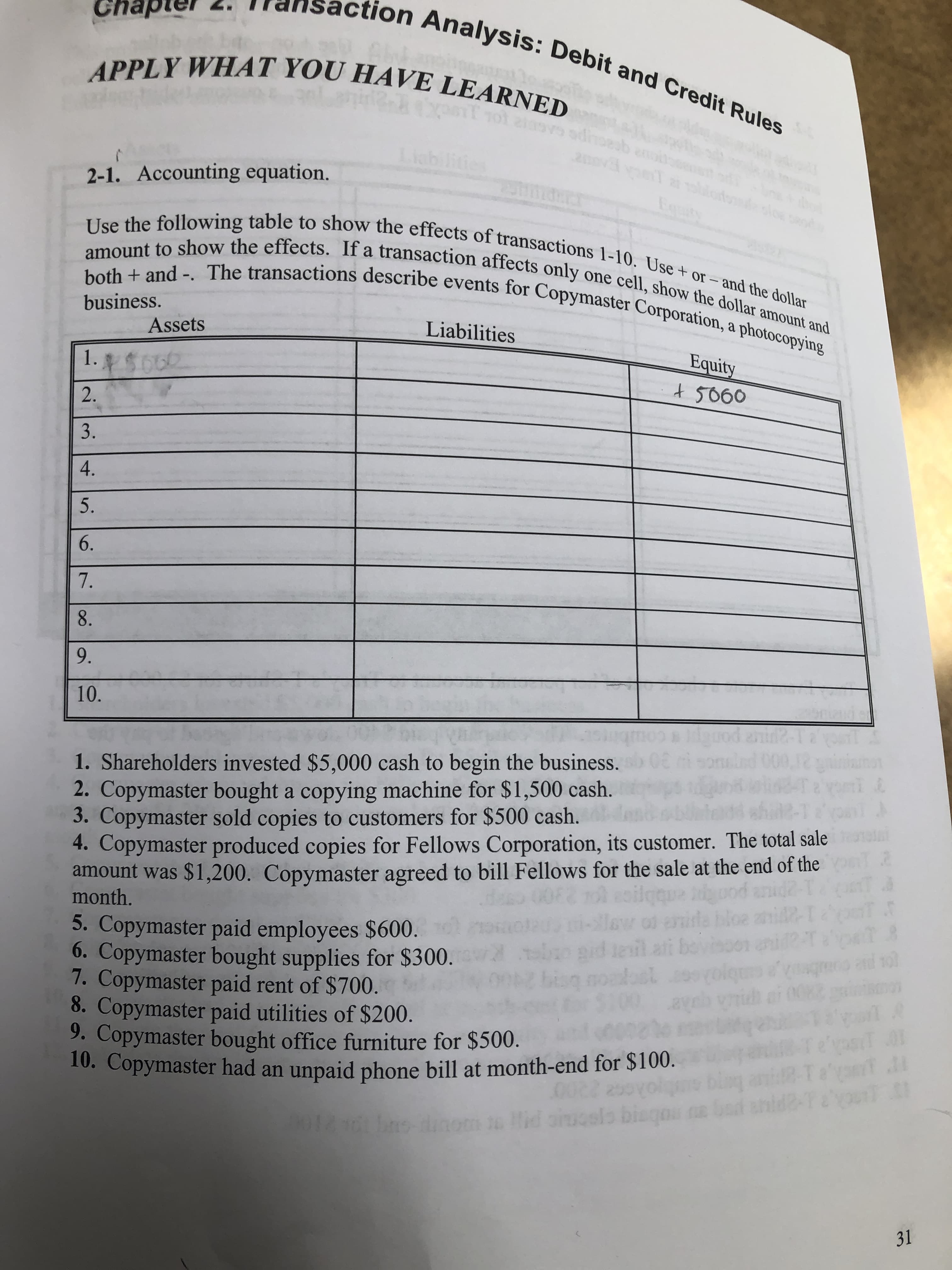

action Analysis: Debit and Credit Rules Chap APPLY WHAT YOU HAVE LEARNED 2-1. Accounting equation. Use the following table to show the effects of transactions 1-10. Use+ or – and the dollar amount to show the effects. If a transaction affects only one cell, show the dollar amount and both + and -. The transactions describe events for Copymaster Corporation, a photocopying business. Assets Liabilities 1. 000 Equity t 5060 2. 5. 6. 7. 8. 9. 10. 1. Shareholders invested $5,000 cash to begin the business. 2. Copymaster bought a copying machine for $1,500 cash. 3. Copymaster sold copies to customers for $500 cash. 4. Copymaster produced copies for Fellows Corporation, its customer. The total sale amount was $1,200. Copymaster agreed to bill Fellows for the sale at the end of the month. bloe 5. Copymaster paid employees $600. 6. Copymaster bought supplies for $300. 7. Copymaster paid rent of $700. 8. Copymaster paid utilities of $200. 9. Copymaster bought office furniture for $500. 10. Copymaster had an unpaid phone bill at month-end for $100. low bo gid leil ati bisg noalost 101 2-720u aiucels bisgou e bad Hid s dino 31 3. 4.

action Analysis: Debit and Credit Rules Chap APPLY WHAT YOU HAVE LEARNED 2-1. Accounting equation. Use the following table to show the effects of transactions 1-10. Use+ or – and the dollar amount to show the effects. If a transaction affects only one cell, show the dollar amount and both + and -. The transactions describe events for Copymaster Corporation, a photocopying business. Assets Liabilities 1. 000 Equity t 5060 2. 5. 6. 7. 8. 9. 10. 1. Shareholders invested $5,000 cash to begin the business. 2. Copymaster bought a copying machine for $1,500 cash. 3. Copymaster sold copies to customers for $500 cash. 4. Copymaster produced copies for Fellows Corporation, its customer. The total sale amount was $1,200. Copymaster agreed to bill Fellows for the sale at the end of the month. bloe 5. Copymaster paid employees $600. 6. Copymaster bought supplies for $300. 7. Copymaster paid rent of $700. 8. Copymaster paid utilities of $200. 9. Copymaster bought office furniture for $500. 10. Copymaster had an unpaid phone bill at month-end for $100. low bo gid leil ati bisg noalost 101 2-720u aiucels bisgou e bad Hid s dino 31 3. 4.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 2PA: To demonstrate the difference between cash account activity and accrual basis profits (net income),...

Related questions

Question

Transcribed Image Text:action Analysis: Debit and Credit Rules

Chap

APPLY WHAT YOU HAVE LEARNED

2-1. Accounting equation.

Use the following table to show the effects of transactions 1-10. Use+ or – and the dollar

amount to show the effects. If a transaction affects only one cell, show the dollar amount and

both + and -. The transactions describe events for Copymaster Corporation, a photocopying

business.

Assets

Liabilities

1. 000

Equity

t 5060

2.

5.

6.

7.

8.

9.

10.

1. Shareholders invested $5,000 cash to begin the business.

2. Copymaster bought a copying machine for $1,500 cash.

3. Copymaster sold copies to customers for $500 cash.

4. Copymaster produced copies for Fellows Corporation, its customer. The total sale

amount was $1,200. Copymaster agreed to bill Fellows for the sale at the end of the

month.

bloe

5. Copymaster paid employees $600.

6. Copymaster bought supplies for $300.

7. Copymaster paid rent of $700.

8. Copymaster paid utilities of $200.

9. Copymaster bought office furniture for $500.

10. Copymaster had an unpaid phone bill at month-end for $100.

low

bo gid leil ati

bisg noalost

101

2-720u

aiucels bisgou e bad

Hid

s dino

31

3.

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning