Activity: 1. Entity A (customer) enters into a contract with Entity B (supplier) for the use of a data processing equipment. According to the contract, Entity A shall operate the equipment only in accordance with the standard operating procedures stated in the accompanying user's manual. In assessing the existence of a lease, does Entity A have the right to direct the usg of the asset? a No, because the asset's use is restricted. b. Yes, because Entity A has the right to direct how and for what purpose the asset is used. c. Yes, because the asset's use is predetermined and Entity B is precluded from changing that predetermined use. d. Maybe yes, maybe no, but exactly I don't know.

Activity: 1. Entity A (customer) enters into a contract with Entity B (supplier) for the use of a data processing equipment. According to the contract, Entity A shall operate the equipment only in accordance with the standard operating procedures stated in the accompanying user's manual. In assessing the existence of a lease, does Entity A have the right to direct the usg of the asset? a No, because the asset's use is restricted. b. Yes, because Entity A has the right to direct how and for what purpose the asset is used. c. Yes, because the asset's use is predetermined and Entity B is precluded from changing that predetermined use. d. Maybe yes, maybe no, but exactly I don't know.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Show your Solution

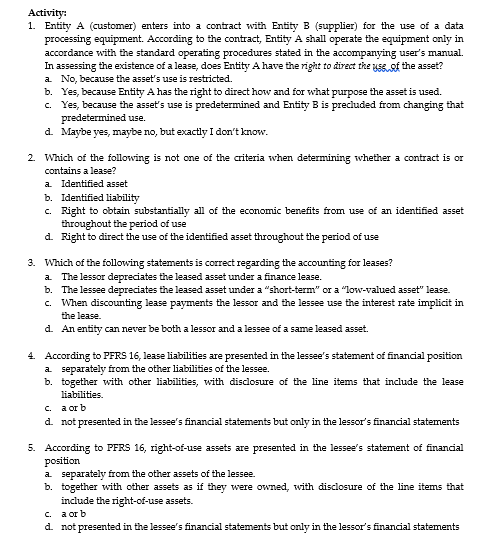

Transcribed Image Text:Activity:

1. Entity A (customer) enters into a contract with Entity B (supplier) for the use of a data

processing equipment. According to the contract, Entity A shall operate the equipment only in

accordance with the standard operating procedures stated in the accompanying user's manual.

In assessing the existence of a lease, does Entity A have the right to direct the us.of the asset?

a No, because the asset's use is restricted.

b. Yes, because Entity A has the right to direct how and for what purpose the asset is used.

c. Yes, because the asset's use is predetermined and Entity B is preciuded from changing that

predetermined use.

d. Maybe yes, maybe no, but exactly I don't know.

2. Which of the following is not one of the criteria when determining whether a contract is or

contains a lease?

a Identified asset

b. Identified liability

c. Right to obtain substantially all of the economic benefits from use of an identified asset

throughout the period of use

d. Right to direct the use of the identified asset throughout the period of use

3. Which of the following statements is correct regarding the accounting for leases?

a The lessor depreciates the leased asset under a finance lease.

b. The lessee depreciates the leased asset under a "short-term" or a "low-valued asset" lease.

c. When discounting lease payments the lessor and the lessee use the interest rate implicit in

the lease.

d. An entity can never be both a lessor and a lessee of a same leased asset.

4. According to PFRS 16, lease liabilities are presented in the lessee's statement of financial position

a separately from the other liabilities of the lessee.

b. together with other liabilities, with disclosure of the line items that include the lease

liabilities.

с. а оть

d. not presented in the lessee's financial statements but only in the lessor's financial statements

5. According to PFRS 16, right-of-use assets are presented in the lessee's statement of financial

position

a separately from the other assets of the lessee.

b. together with other assets as if they were owned, with disclosure of the line items that

include the right-of-use assets.

C. a or b

d. not presented in the lessee's financial statements but only in the lessor's financial statements

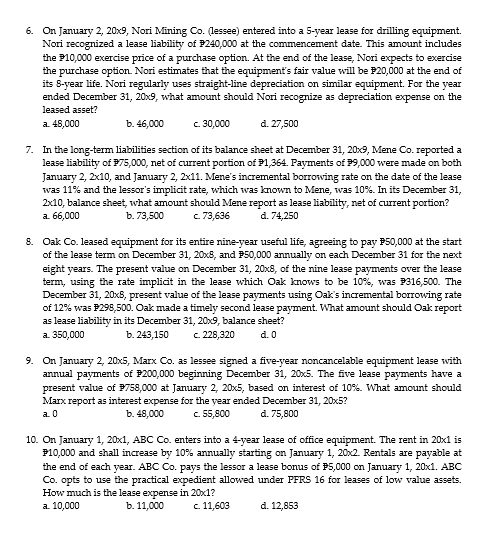

Transcribed Image Text:6. On January 2, 20x9, Nori Mining Co. (lessee) entered into a 5-year lease for drilling equipment.

Nori recognized a lease liability of P240,000 at the commencement date. This amount includes

the P10,000 exercise price of a purchase option. At the end of the lease, Nori expects to exercise

the purchase option Nori estimates that the equipment's fair value will be P20,000 at the end of

its 8-year life. Nori regularly uses straight-line depreciation on similar equipment. For the year

ended December 31, 20x9, what amount should Nori recognize as depreciation expense on the

leased asset?

a. 45,000

b. 46,000

c. 30,000

d. 27,500

7. In the long-term liabilities section of its balance sheet at December 31, 20x9, Mene Co. reported a

lease liability of P75,000, net of current portion of P1,364. Payments of P9,000 were made on both

January 2, 2x10, and January 2, 2x11. Mene's incremental borrowing rate on the date of the lease

was 11% and the lessor's implicit rate, which was known to Mene, was 10%. In its December 31,

2x10, balance sheet, what amount should Mene report as lease liability, net of current portion?

a. 66,000

b. 73,500

c.73,636

d. 74,250

8. Oak Co. leased equipment for its entire nine-year useful life, agreeing to pay P50,000 at the start

of the lease term on December 31, 20x8, and P50,000 annually on each December 31 for the next

eight years. The present value on December 31, 20x8, of the nine lease payments over the lease

term, using the rate implicit in the lease which Oak knows to be 10%, was P316,500. The

December 31, 20xS, present value of the lease payments using Oak's incremental borrowing rate

of 12% was P298,500. Oak made a timely second lease payment. What amount should Oak report

as lease liability in its December 31, 20x9, balance sheet?

a. 350,000

b. 243,150

c. 228,320

d. 0

9. On January 2, 20x5, Marx Co. as lessee signed a five-year noncancelable equipment lease with

annual payments of P200,000 beginning December 31, 20x5. The five lease payments have a

present value of P758,000 at January 2, 20x5, based on interest of 10%. What amount should

Marx report as interest expense for the year ended December 31, 20x5?

a. 0

b. 48,000

c. 55,800

d. 75,800

10. On January 1, 20x1, ABC Co. enters into a 4-year lease of office equipment. The rent in 20x1 is

P10,000 and shall increase by 10% annually starting on January 1, 20x2. Rentals are payable at

the end of each year. ABC Co. pays the lessor a lease bonus of P5,000 on January 1, 20x1. ABC

Co. opts to use the practical expedient allowed under PFRS 16 for leases of low value assets.

How much is the lease expense in 20x1?

a. 10,000

b. 11,000

c 11,603

d. 12,853

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education