Activity 1.2 Dayana Merchandising Dayana Company had the following transactions during December: a. Sold merchandise on credit for Php5,000, terms 3/10, n/30. The items sold had a cost of Php3,500. b. Purchased merchandise for cash, Php720. c. Purchased merchandise on credit for Php2,600, terms 1/20, n/30. d. Issued a credit memorandum for Php300 to a customer who returned merchandise purchased November 29. The returned items had a cost of Php210. e. Received payment for merchandise sold December 1. f. Received credit memorandum for the return of faulty merchandise purchased on December 4 for Php600. g. Paid freight charges of Php200 for merchandise ordered last month. (FOB shipping point). h. Paid for the merchandise purchased December 4 less the portion that was returned. i. Sold merchandise on credit for Php7,000, terms 2/10, n/30. The items had a cost of Php4,900. j. Received payment for merchandise sold on December 24. Required: Prepare the general journal entries to record these transactions using a perpetual inventory system. (Record all purchases initially at the gross invoice amount.)

Activity 1.2 Dayana Merchandising Dayana Company had the following transactions during December: a. Sold merchandise on credit for Php5,000, terms 3/10, n/30. The items sold had a cost of Php3,500. b. Purchased merchandise for cash, Php720. c. Purchased merchandise on credit for Php2,600, terms 1/20, n/30. d. Issued a credit memorandum for Php300 to a customer who returned merchandise purchased November 29. The returned items had a cost of Php210. e. Received payment for merchandise sold December 1. f. Received credit memorandum for the return of faulty merchandise purchased on December 4 for Php600. g. Paid freight charges of Php200 for merchandise ordered last month. (FOB shipping point). h. Paid for the merchandise purchased December 4 less the portion that was returned. i. Sold merchandise on credit for Php7,000, terms 2/10, n/30. The items had a cost of Php4,900. j. Received payment for merchandise sold on December 24. Required: Prepare the general journal entries to record these transactions using a perpetual inventory system. (Record all purchases initially at the gross invoice amount.)

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter8: Receivables

Section: Chapter Questions

Problem 8.6APR: Sales and notes receivable transactions The following were selected from among the transactions...

Related questions

Question

100%

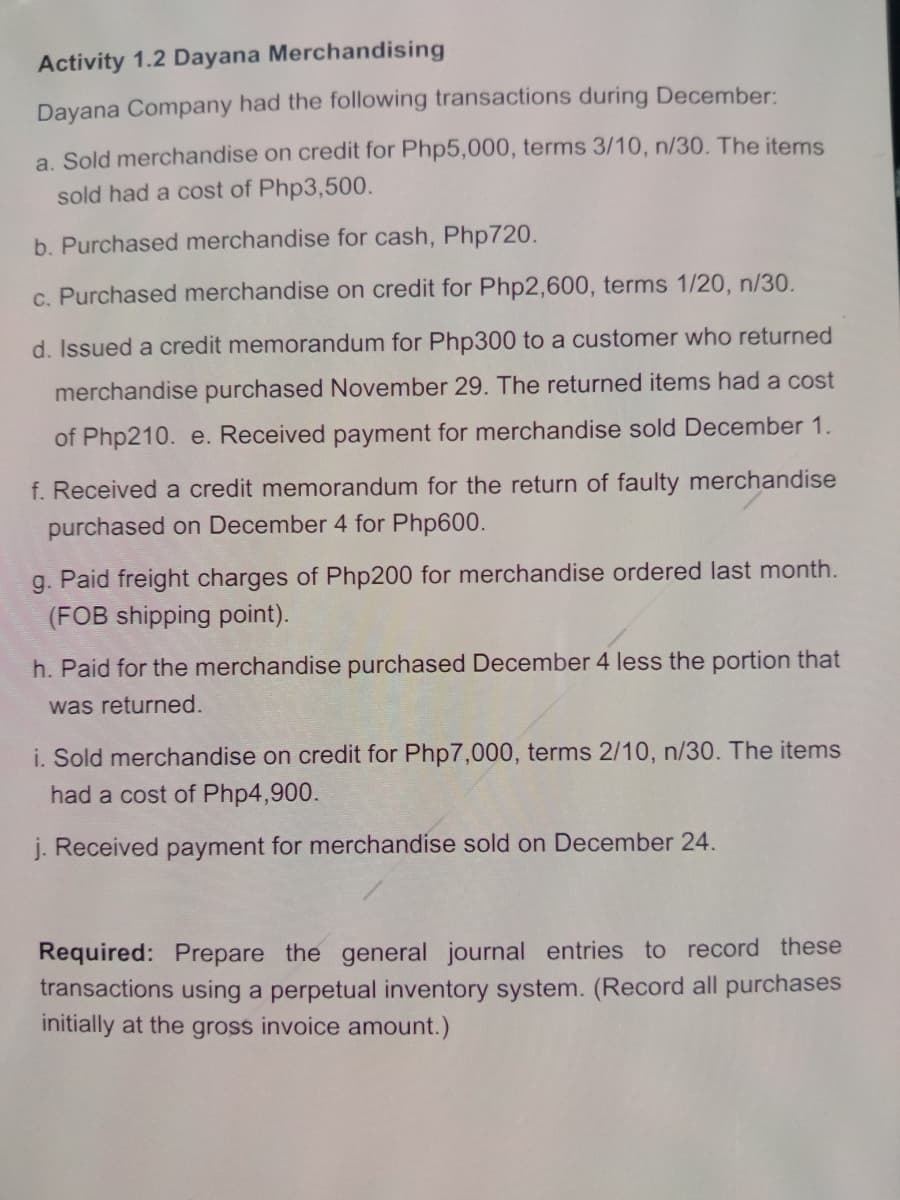

Transcribed Image Text:Activity 1.2 Dayana Merchandising

Dayana Company had the following transactions during December:

a. Sold merchandise on credit for Php5,000, terms 3/10, n/30. The items

sold had a cost of Php3,500.

b. Purchased merchandise for cash, Php720.

c. Purchased merchandise on credit for Php2,600, terms 1/20, n/30.

d. Issued a credit memorandum for Php300 to a customer who returned

merchandise purchased November 29. The returned items had a cost

of Php210. e. Received payment for merchandise sold December 1.

f. Received a credit memorandum for the return of faulty merchandise

purchased on December 4 for Php600.

g. Paid freight charges of Php200 for merchandise ordered last month.

(FOB shipping point).

h. Paid for the merchandise purchased December 4 less the portion that

was returned.

i. Sold merchandise on credit for Php7,000, terms 2/10, n/30. The items

had a cost of Php4,900.

j. Received payment for merchandise sold on December 24.

Required: Prepare the general journal entries to record these

transactions using a perpetual inventory system. (Record all purchases

initially at the gross invoice amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning