Activity 4.b-Using the Expanded Accounting Equation Using the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions. Beginning of Year: End of Year Assets $25.000 $40,000 Owner, Withdrawals Liabilities $17,000 $27,000 1) What is the equity at the beginning of the year? Beginning Equity 3) If the owner contributes $5,400 and the owner withdraws $39,600, how much is net income (loss)? Net Income (Loss) 5) If the owner contributes $17,500 and net income is $19,300, how much did the owner withdraw (owner, withdrawals)? 2) What is the equity at the end of the year? Ending Equity 4) If net income is $2,500 and owner withdrawals are $7,500, how much did the owner contribute (owner, capital)? Owner, Capital 6) If the owner contributes $41,900 and the owner withdraws $2,700, how much is net income (loss)? Net income (Loss)

Activity 4.b-Using the Expanded Accounting Equation Using the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions. Beginning of Year: End of Year Assets $25.000 $40,000 Owner, Withdrawals Liabilities $17,000 $27,000 1) What is the equity at the beginning of the year? Beginning Equity 3) If the owner contributes $5,400 and the owner withdraws $39,600, how much is net income (loss)? Net Income (Loss) 5) If the owner contributes $17,500 and net income is $19,300, how much did the owner withdraw (owner, withdrawals)? 2) What is the equity at the end of the year? Ending Equity 4) If net income is $2,500 and owner withdrawals are $7,500, how much did the owner contribute (owner, capital)? Owner, Capital 6) If the owner contributes $41,900 and the owner withdraws $2,700, how much is net income (loss)? Net income (Loss)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.5E: The Accounting Equation Using the accounting equation, answer each of the following independent...

Related questions

Topic Video

Question

Transcribed Image Text:g.com

gg.com

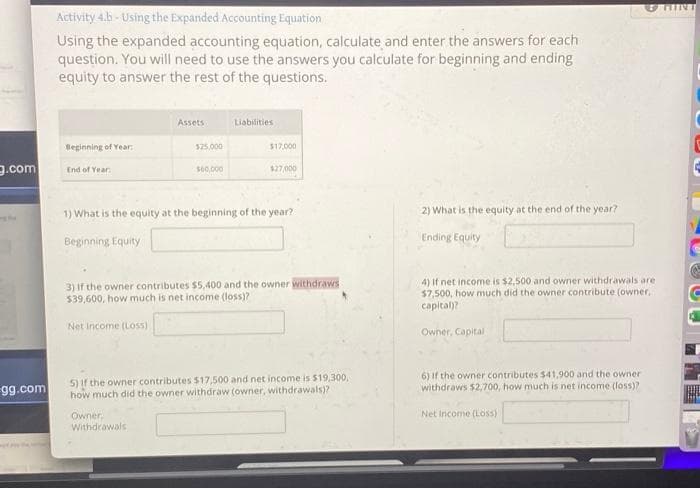

Activity 4.b - Using the Expanded Accounting Equation

Using the expanded accounting equation, calculate and enter the answers for each

question. You will need to use the answers you calculate for beginning and ending

equity to answer the rest of the questions.

Beginning of Year

End of Year

Assets

$25,000

$60,000

Owner.

Withdrawals

Liabilities

$17,000

$27,000

1) What is the equity at the beginning of the year?

Beginning Equity

3) If the owner contributes $5,400 and the owner withdraws

$39,600, how much is net income (loss)?

Net Income (Loss)

5) If the owner contributes $17,500 and net income is $19,300,

how much did the owner withdraw (owner, withdrawals)?

2) What is the equity at the end of the year?

Ending Equity

4) If net income is $2,500 and owner withdrawals are.

$7,500, how much did the owner contribute (owner,

capital)?

Owner, Capital

6) If the owner contributes $41,900 and the owner

withdraws $2,700, how much is net income (loss)?

Net Income (Loss)

HINT

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning