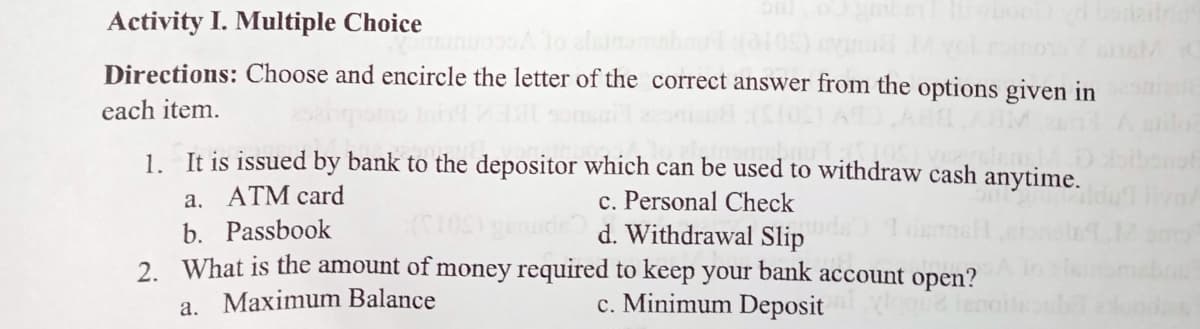

Activity I. Multiple Choice Alo alnam Directions: Choose and encircle the letter of the correct answer from the options given in each item. 1. It is issued by bank to the depositor which can be used to withdraw cash anytime. ATM card c. Personal Check d. Withdrawal Slip a, b. Passbook

Activity I. Multiple Choice Alo alnam Directions: Choose and encircle the letter of the correct answer from the options given in each item. 1. It is issued by bank to the depositor which can be used to withdraw cash anytime. ATM card c. Personal Check d. Withdrawal Slip a, b. Passbook

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter7: Accounting For Cash

Section: Chapter Questions

Problem 1CE: Match the following words with their definitions by entering the correct number in the spaces below....

Related questions

Question

Transcribed Image Text:Activity I. Multiple Choice

Directions: Choose and encircle the letter of the correct answer from the options given in

each item.

1. It is issued by bank to the depositor which can be used to withdraw cash anytime.

a. ATM card

c. Personal Check

d. Withdrawal Slip

b. Passbook

2. What is the amount of money required to keep your bank account open?

a. Maximum Balance

c. Minimum Deposit

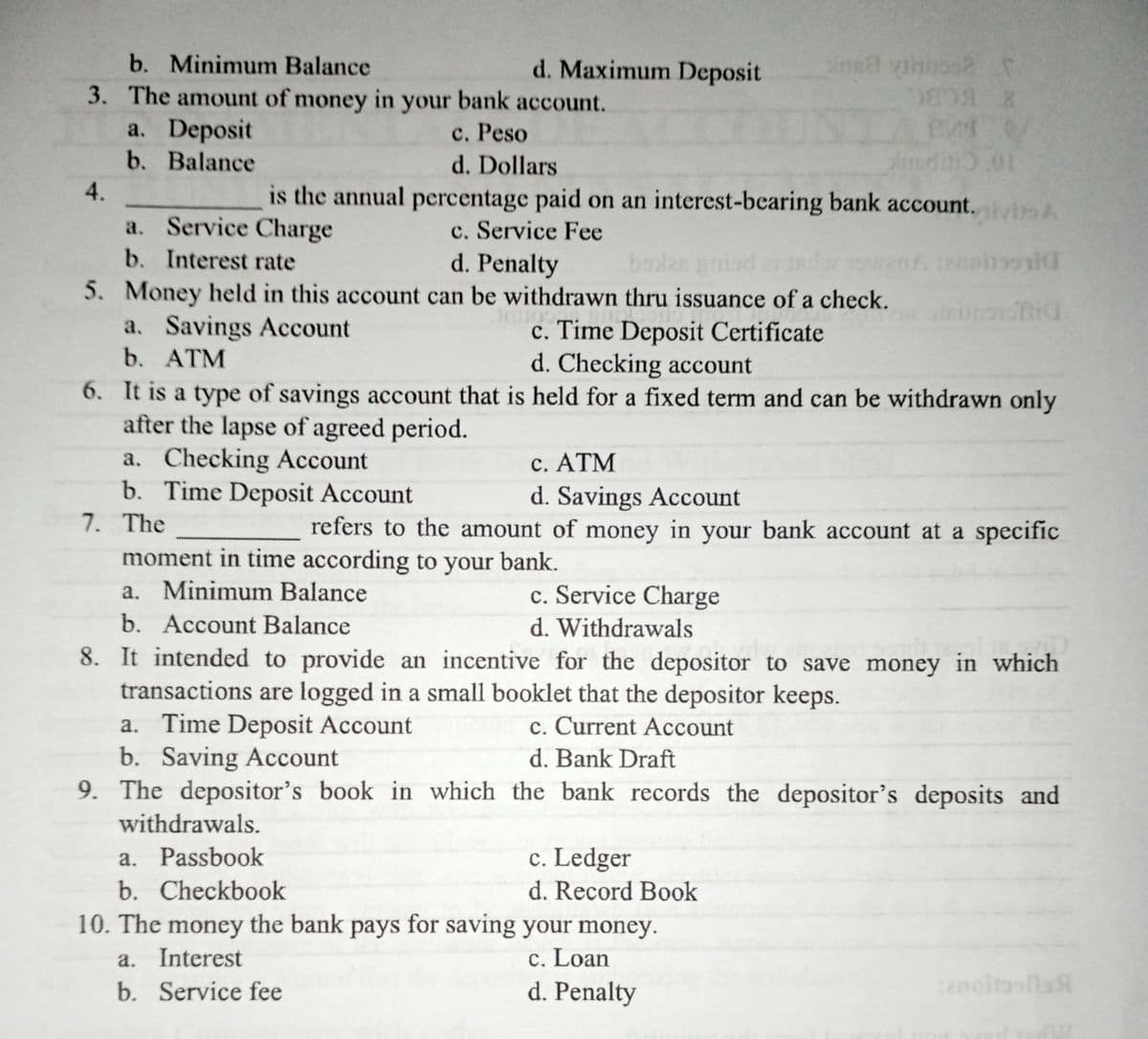

Transcribed Image Text:b. Minimum Balance

d. Maximum Deposit

inad vinuoo2r

3. The amount of money in your bank account.

a. Deposit

b. Balance

c. Peso

d. Dollars

4.

is the annual percentage paid on an interest-bearing bank account.

a. Service Charge

c. Service Fee

d. Penalty

b. Interest rate

bolas

5. Money held in this account can be withdrawn thru issuance of a check.

a. Savings Account

b. ATM

c. Time Deposit Certificate

d. Checking account

6. It is a type of savings account that is held for a fixed term and can be withdrawn only

after the lapse of agreed period.

a. Checking Account

b. Time Deposit Account

7. The

c. ATM

d. Savings Account

refers to the amount of money in your bank account at a specific

moment in time according to your bank.

a. Minimum Balance

b. Account Balance

8. It intended to provide an incentive for the depositor to save money in which

transactions are logged in a small booklet that the depositor keeps.

a. Time Deposit Account

b. Saving Account

9. The depositor's book in which the bank records the depositor's deposits and

c. Service Charge

d. Withdrawals

c. Current Account

d. Bank Draft

withdrawals.

c. Ledger

d. Record Book

10. The money the bank pays for saving your money.

a. Passbook

b. Checkbook

c. Loan

d. Penalty

a.

Interest

b. Service fee

anoitaofla

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning