adjusted its inventory and cost of goods sold accordingly. The merchandise was sold in the next year and inventory was correctly stated at February 28, 2018. Ignoring income tax, indicate the effect of this error (overstated, understated, or no effect) on each of the following at year end: (a) (b) (c) (d) (e) (f) Cash Cost of goods sold Net income Retained earnings Ending inventory Gross profit margin ratio (40%) Inventory turnover ratio (10 times) 2018 No effect Understated Overstated 2017

adjusted its inventory and cost of goods sold accordingly. The merchandise was sold in the next year and inventory was correctly stated at February 28, 2018. Ignoring income tax, indicate the effect of this error (overstated, understated, or no effect) on each of the following at year end: (a) (b) (c) (d) (e) (f) Cash Cost of goods sold Net income Retained earnings Ending inventory Gross profit margin ratio (40%) Inventory turnover ratio (10 times) 2018 No effect Understated Overstated 2017

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 71BPSB

Related questions

Question

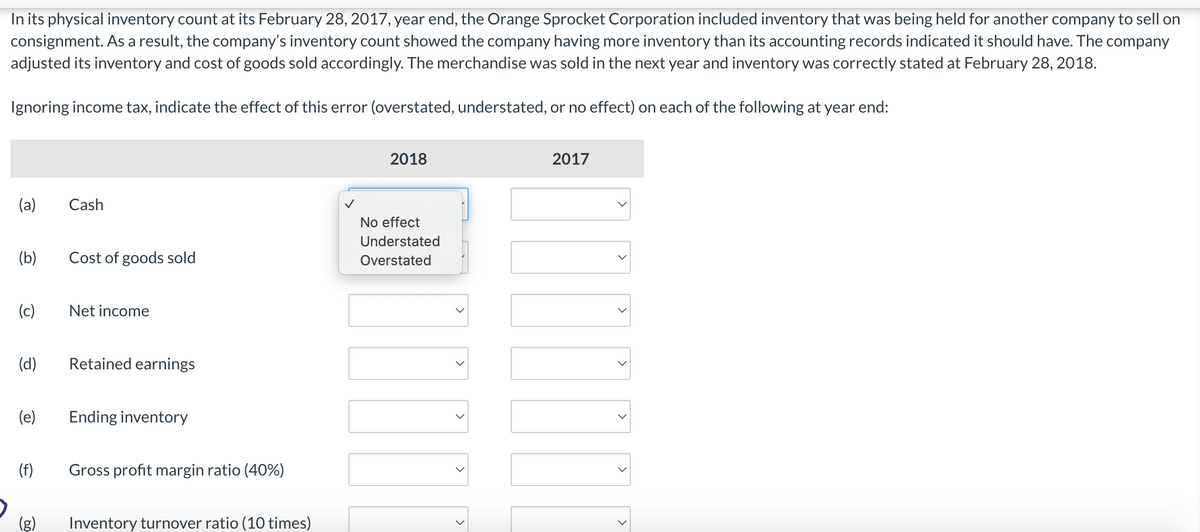

Transcribed Image Text:In its physical inventory count at its February 28, 2017, year end, the Orange Sprocket Corporation included inventory that was being held for another company to sell on

consignment. As a result, the company's inventory count showed the company having more inventory than its accounting records indicated it should have. The company

adjusted its inventory and cost of goods sold accordingly. The merchandise was sold in the next year and inventory was correctly stated at February 28, 2018.

Ignoring income tax, indicate the effect of this error (overstated, understated, or no effect) on each of the following at year end:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Cash

Cost of goods sold

Net income

Retained earnings

Ending inventory

Gross profit margin ratio (40%)

Inventory turnover ratio (10 times)

2018

No effect

Understated

Overstated

>

2017

>

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College