- adjusted total current liabilities

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 59P

Related questions

Question

Solve and explain the reason why it is the answer.

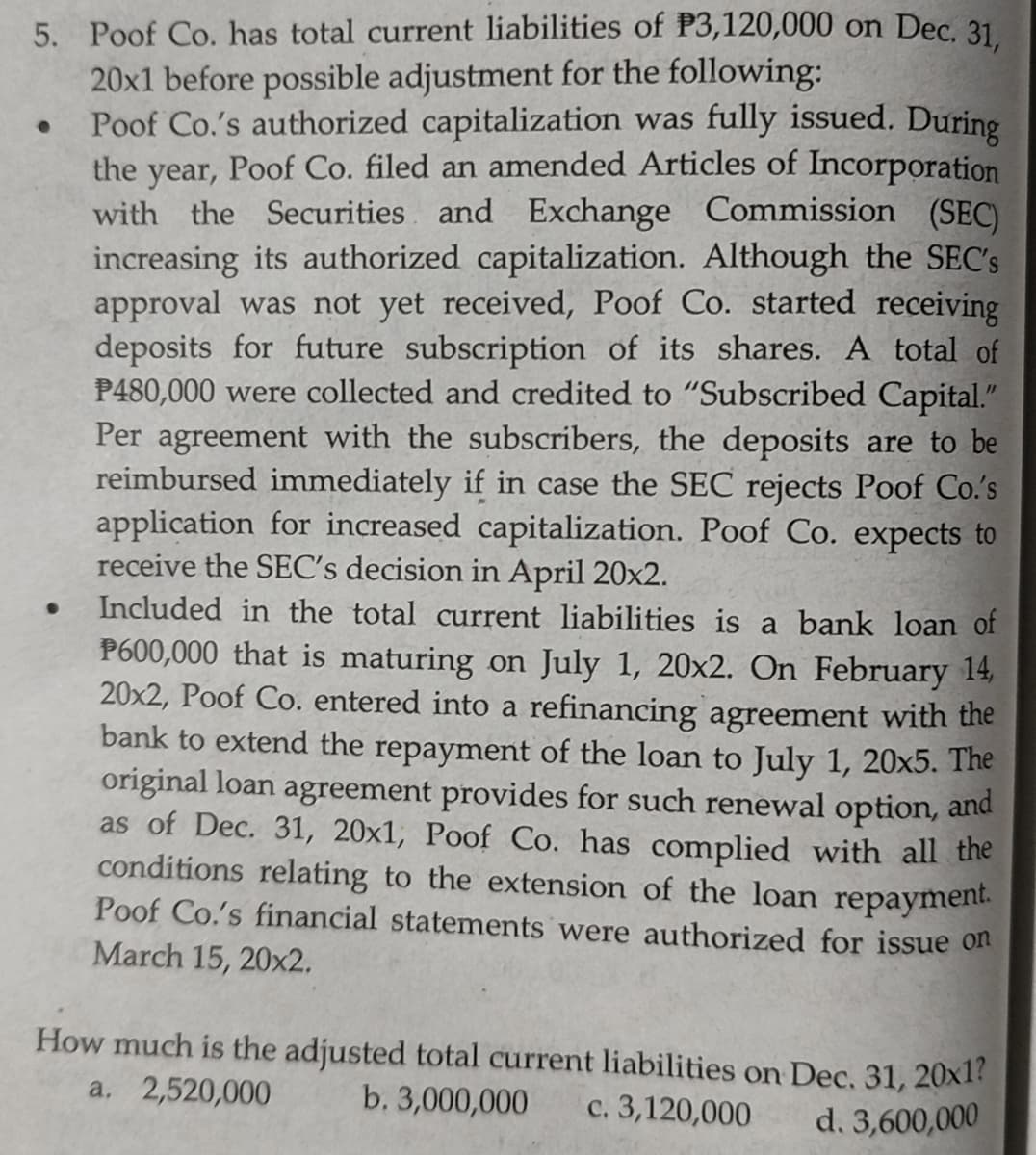

Transcribed Image Text:5. Poof Co. has total current liabilities of P3,120,000 on Dec. 31

20x1 before possible adjustment for the following:

Poof Co.'s authorized capitalization was fully issued. During

the year, Poof Co. filed an amended Articles of Incorporation

with the Securities and Exchange Commission (SEC)

increasing its authorized capitalization. Although the SEC's

approval was not yet received, Poof Co. started receiving

deposits for future subscription of its shares. A total of

P480,000 were collected and credited to "Subscribed Capital."

Per agreement with the subscribers, the deposits are to be

reimbursed immediately if in case the SEC rejects Poof Co.'s

application for increased capitalization. Poof Co. expects to

receive the SEC's decision in April 20x2.

Included in the total current liabilities is a bank loan of

P600,000 that is maturing on July 1, 20x2. On February 14,

20x2, Poof Co. entered into a refinancing agreement with the

bank to extend the repayment of the loan to July 1, 20x5. The

original loan agreement provides for such renewal option, and

as of Dec. 31, 20x1, Poof Co. has complied with all the

conditions relating to the extension of the loan repayment.

Poof Co.'s financial statements were authorized for issue on

March 15, 20x2.

How much is the adjusted total current liabilities on Dec, 31, 20x1?

a. 2,520,000

b. 3,000,000

c. 3,120,000

d. 3,600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning