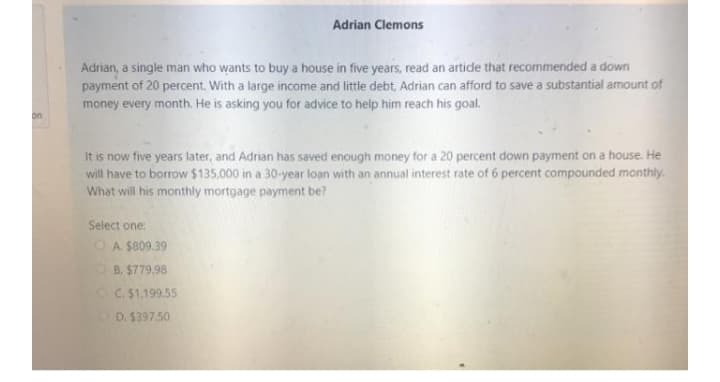

Adrian, a single man who wants to buy a house in five years, read an artide that recommended a down payment of 20 percent. With a large income and little debt, Adrian can afford to save a substantial amount of money every month. He is asking you for advice to help him reach his goal. It is now five years later, and Adrian has saved enough money for a 20 percent down payment on a house. He will have to borrow $135,000 in a 30-year loan with an annual interest rate of 6 percent compounded monthly. What will his monthly mortgage payment be? Select one: OA $809.39 O B. $779,98 OC. $1,199.55 D. $397.50

Adrian, a single man who wants to buy a house in five years, read an artide that recommended a down payment of 20 percent. With a large income and little debt, Adrian can afford to save a substantial amount of money every month. He is asking you for advice to help him reach his goal. It is now five years later, and Adrian has saved enough money for a 20 percent down payment on a house. He will have to borrow $135,000 in a 30-year loan with an annual interest rate of 6 percent compounded monthly. What will his monthly mortgage payment be? Select one: OA $809.39 O B. $779,98 OC. $1,199.55 D. $397.50

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter27: Time Value Of Money (compound)

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:Adrian Clemons

Adrian, a single man who wants to buy a house in five years, read an artide that recommended a down

payment of 20 percent. With a large income and little debt, Adrian can afford to save a substantial amount of

money every month. He is asking you for advice to help him reach his goal.

on

It is now five years later, and Adrian has saved enough money for a 20 percent down payment on a house. He

will have to borrow $135,000 in a 30-year loạn with an annual interest rate of 6 percent compounded monthly.

What will his monthly mortgage payment be?

Select one:

O A. $809.39

O B. $779,98

OC. $1.199.55

OD. $397.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning