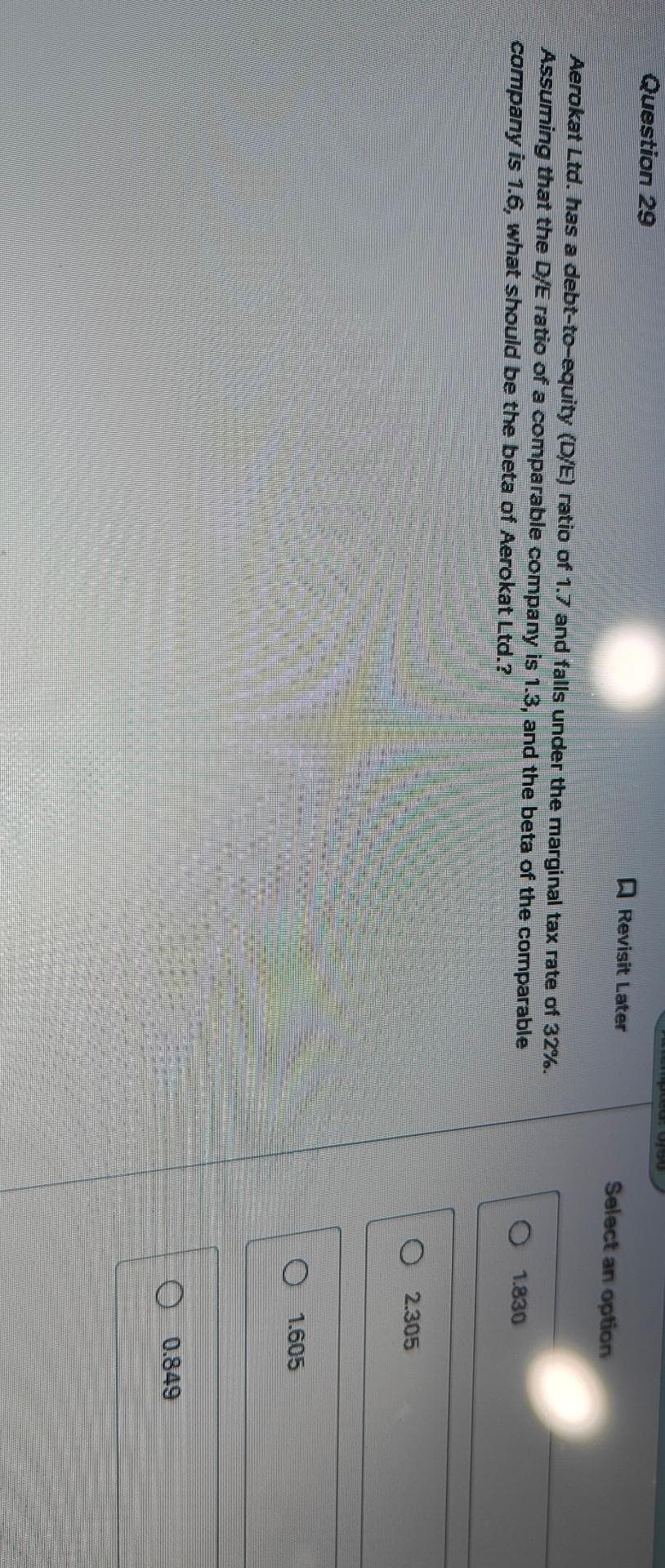

Aerokat Ltd. has a debt-to-equity (D/E) ratio of 1.7 and falls under the marginal tax rate of 32%. Assuming that the D/E ratio of a comparable company is 1.3, and the beta of the comparable company is 1.6, what should be the beta of Aerokat Ltd.? 1.830 O 2.305 O 1.605 O 0.849

Q: If the price of a $10,000 par Treasury bond is $10,431.25, the quote would be listed in the…

A: The price of the treasury bond will be listed as a % of the par value. We can determine the % using…

Q: South Airlines generated the following information from its financial statements: (1) P/E ratio…

A: Profitability ratios are used for determining profitability of the company and these shows the…

Q: You run a construction firm. You have just won a contract to build a government office building. It…

A: a. The net present value is the difference between the present value of cash inflows and cash…

Q: MARNI COMPANY Balance Sheet As of December 31 ASSETS Cash $ 50,000 Accounts receivable 100,000…

A: Total assets = ta = $1,000,000Sales = s = $2,000,000

Q: What is the percentage change in the price of this bond if the market yield falls to 3 percent from…

A: Price of the bond is the PV of all future coupons and par value discounted at the YTM. The price of…

Q: What is the value today of $5,100 per year, at a discount rate of 7.9 percent, if the first payment…

A: Value today is the present value of the cash flow from the project based on the discount rate and…

Q: A hedge fund purchased credit default swaps on securities it did not own because it believed that…

A: Speculation refers to a transaction done on a high-risk financial instrument because of the…

Q: . If you were to deposit $399.27 into an account today that pays 8% interest annually, with a…

A: Present Value = pv = $399.27Interest Rate = rate = 8%Payment = pmt = $100Time = nper = 5 Years

Q: Suppose you invest $2,500 in a fund earning 15% simple interest. Further suppose that you have the…

A: We can solve the question using Excel's Solver. Our objective is to maximize the following by…

Q: Give four reasons why it is necessary to regulate banks, especially after the COVID pandemic.

A: Regulations of banks refer to the rules, laws, and guidelines established by government authorities…

Q: 6. In this question, you are asked to evaluate the common portfolio advice of a 60/40 split between…

A: Given information,Expected Rate of Return (E(r)): Frisk free rate, Treasury Bills (U): Standard…

Q: Summary: I was probably one of the many people who didn't realize that Fidelity had such a long and…

A: The world of cryptocurrency has been a rollercoaster ride, characterized by immense volatility and…

Q: A shop that sells fine glassware offers gift wrapping at no extra cost. Rationale

A: Offering gift wrapping at no extra cost in a shop that sells fine glassware can be a strategic and…

Q: A firm wishes to maintain an internal growth rate of 6.4 percent and a dividend payout ratio of 25…

A: Here,InternalGrowth Rate is 6.4%Profit Margin is 5.7%Dividend Payout Ratio is 25%

Q: 1898, Simon North announced plans to construct a funeral home on land he owned and rented out as a…

A: NPV is the most used capital budgeting method based on the time value of money and used for…

Q: Compute lower and upper arbitrage-free price bounds of a European call op

A: A call option gives the right but not the obligation to buy at the strike price. To ensure there is…

Q: ics has nine operating plants in seven southwestern states. Sales for last year were $100 million,…

A: To maintain the growth in sales investment is required in assets and liabilities and if retained…

Q: . The expected return. The standard deviation of the return. Data table Click on the following icon…

A: Expected return is a statistical measure that calculates the average return an investment is likely…

Q: Use the following information for Taco Swell, Incorporated, (assume the tax rate is 24 percent):…

A: Sales$18,888Less: Cost of goods sold $6,771Less: Other expenses $1,198Less:…

Q: Toying With Nature wants to take advantage of children's current fascination with dinosaurs by…

A: Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or…

Q: Calculate the dollar rate of return on a 5000 pound sterling deposit in a London bank in a year when…

A: Given:Principal = £5000Interest rate = 8%Interest earned:Interest=£5000×0.08=£400The total amount in…

Q: Calculate the company's asset beta, if the firm's equity beta is 1.6, the debt equity ratio is 0.6…

A: The present case wants to calculate the asset beta of the firm. This is an unleveled beta for the…

Q: You purchased 1,150 shares of stock in Natural Chicken Wings, Incorporated, at a price of $43.46 per…

A: Here,Purchase Price of Stock (P) is $43.46Sale Price of Srock (S) is $46.71Dividend Received (D) is…

Q: The first issue in strategic pay is internal alignment, which addresses pay relationships inside the…

A: The internal alignment is associated with human resources of because it is a term which refers to…

Q: Accounting equation Determine the missing amount for each of the following: Liabilities a. b. C.…

A: Total Liabilities + Owner's Equity = Total Liabilities and EquityTotal Liabilities and Equity =…

Q: Which of the following can have a VERY high amount of accounts receivable & long receivables…

A: The receivables collection period is the number of days the firm takes to collect its outstanding…

Q: One year ago, your company purchased a machine used in manufacturing for $ You have learned that a…

A: NPV of replacement can be found as the difference between the present value of additional cash flow…

Q: 90 per share, with an expiration date of May 31, 2019. The option contract premiu timated the time…

A: Call Option: A call option is a financial contract that gives the holder the right, but not the…

Q: ge Which one of the following instruments has a maximum maturity of 5 years? a. Bankers Acceptances…

A: Euro Commercial Paper, also known simply as ECP, is a type of short-term debt that is issued by…

Q: Disadvantages of the corporate form include: Multiple Choice double taxation agency costs

A: A Corporation is an entity created by law, in which owners have limited liability. They can lose up…

Q: You need $88,000 in 9 years. If you can earn .55 percent per month, how much will you have to…

A: We will use the below formula to calculate the amount of the deposit.Deposit amount =…

Q: You buy stock on margin in your brokerage account when it is trading at $42.76 per share. You have…

A: The amount to be maintained in equity account at the broker to start trading in the stock market is…

Q: A 6 months (182 day) investment of CAD 15,500,000 yields a return of CAD 100000. What is the rate of…

A: The rate of return must be understood in connection to an investor's investment objectives and…

Q: Assume that in 2020, a Liberty Seated half dollar issued in 1890 was sold for $197,000. What was the…

A: Rate of Return:The rate of return represents a measure of profit and loss for investment over…

Q: Long-term investment decision, payback method Personal Finance Problem Bill Williams has the…

A: Year Project A Cash flow Cumulative Project A cash flowProject B Cash flow Cumulative Project B Cash…

Q: A fully discrete 30-year endowment insurance policy of 400,000 is sold to Jenna who is 50 years old.…

A: To calculate the amount of the monthly payment for the whole life annuity due with a 10-year…

Q: "What is the future value of an investment in which you deposit $988 into an account at the end of…

A: The concept of time value of money will be used here. As per the concept of time value of money the…

Q: What's the present value of a $890 annuity payment over six years if interest rates are 10 percent?…

A: Annuity payment (C) = $890Rate (r) = 0.10Period (n) = 6 YearsPresent value = ?We will use present…

Q: Carl Voigt, who recently won K10,000 in the lottery, wants to buy a car in five years. Carl…

A: Initial value (I) = K10,000Amount required (F) = K16,105Period (n) = 5 YearsInterest rate = ?We will…

Q: The portfolio consists of 40% BHP and 60% WOW. Boom Moderate Recession Probability 30% 50% 20%…

A: A portfolio is the combination of different asset class in one basket. The aim for creating…

Q: tire 35 years from today. In retirement, you will withdraw $200,000 from your retirement account…

A: There is a need for adequate planning for retirement and that should be done on the time to have…

Q: Sara wants to make a deposit now into an account that earns 3% annually so that she will be able to…

A: Annual withdrawal (C) = $125Interest rate (r) = 0.03Period (n) = 5 YearsAmount need to deposit today…

Q: You are thinking about investing $5,000 in your friend's landscaping business. Even though you know…

A: In this question, the present value of money concept is applied, and the formula of which is shown…

Q: Atlas spends $327,800 a week to pay bills and maintains a lower cash balance limit of $50,000. The…

A: Baumol-Tobin (BAT) model - This model is used to determine the optimal cash balance for a company.…

Q: You have just won a lottery that pays out $2.25 million in a lump sum. If you invest this in a…

A: Present Value = pv = $2.25 millionRate of Return = r = 7.5%Time = t = 30 Years

Q: Consider a 25-year term insurance issued to a life aged 35 with annual premiums payable throughout…

A: Given information,time period: yearsRate: Future value: To calculate,annual premium

Q: Harrimon Industries bonds have 4 years left to maturity. Interest is paid annually, and the bonds…

A: YTM is also known as Yield to maturity. It is the rate earned when the bond is held till the end of…

Q: ect has multiples rates of return (i.e., multiple values of IRR), it means that the project is…

A: IRR is the internal rate of return and is the break even rate of return at which the present value…

Q: The Pirerras are planning to go to Europe 2 years from now and have agreed to set aside $180/month…

A: An annuity is a fixed payment paid for a fixed interval of time with a specified interest rate. This…

Q: Hagement ratios measure how effectively the firm uses its plant and equipment. Which of the…

A: The TIE ratio measures the extent to which operating income can increase before the firm is unable…

Typed plz and asap thsnks

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- Ch. 13. For questions 7, 8, and 9, use the following information: Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX"Question 28: MM and Taxes Solar Industries has a debt-equity ratio of 1.25. Its WACC is 7.8 percent, and its cost of debt is 4.7 percent. The corporate tax rate is 21 percent. What is the company’s cost of equity capital? What is the company’s unlevered cost of equity capital? What would the cost of equity be if the debt-equity ratio were 2? What if it were 1? What if it were zero?Ch. 13. For questions 7, 8, and 9, use the following information: 7.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX" 5.53 8.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. Using the pretax cost of debt from Question…

- for question 9 Ch. 13. For questions 7, 8, and 9, use the following information: 7.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. What is the aftertax cost of debt? Format as a percentage and round to two places past the decimal point as "X.XX" 5.53 8.) Consider a firm whose debt has a market value of $35 million and whose stock has a market value of $55 million. The firm pays a 7 percent rate of interest on its new debt and has a beta of 1.23. The corporate tax rate is 21%. Assume that the security market line holds, that the risk premium on the market is 10.5 percent, and that the current Treasury bill is rate is 1 percent. Using the pretax cost of…Question 1Firm A’s capital structure contains 20% debt and 80% equity. Firm B’s capital structurecontains 50% debt and 50% equity.Both firms pay 7% annual interest on their debt. Firm A’s shares have a beta of 1.0and Firm B’s beta of 1.375. The risk-free rate of interest equals 4%, and the expectedreturn on the market portfolio equals 12%. RequiredA. Calculate the WACC for each firm assuming there are no taxes.B. Recalculate the WACC figures assuming that the two firms face a marginaltax rate of 34%. What do you conclude about the impact of taxes from yourWACC calculations? C. Explain the simplifying assumptions managers make when using WACC asa project discounting method and discuss some of the common pitfallswhen using WACC in capital budgeting.Question 3 The market risk premium for FCIB is 9 percent, and has a tax rate of 35 percent. The risk-freerate of interest is 5%.Willow-Woods Inc. has a capital structure comprised of the following: 8,500,000 shares of common stock outstanding, 200,000 shares of 7 percent preferred stock outstanding, and 85,000, 8.5 percent semiannual bonds outstanding, par value of $1,000 each.The common stock currently sells for $34 per share and has a beta of 1.2, the preferred stock currently sells for $83 per share, and the bonds have 15 years to maturity and sell for 93 percent of par. a) What is the market value of Willow-Woods’ capital structure? b) What rate should Willow-Woods should use to discount the cash flows of a new investment project that has the same risk as the company’s typical project?

- Q. 13 Before Pay Inc. (BPI) currently has an ROE of 10%, total assets of $1000 and a dividend payout ratio of 100%. BPI's beta is currently equal to 1 and they have no debt. The marginal corporate income tax rate is equal to 0%. The long-term risk free rate is currently equal to 3% and the expected stock market risk premium is equal to 7%. If BPI increase their debt-to-equity ratio to 3 with an after-tax cost of debt equal to 3% and simultaneously reduce their dividend payout ratio to 50% then BPI's new intrinsic value of equity will be equal to: a) $500 b) $250 c) $1000 d) $333Question 2: Bermuda Cruises issues only common stock and couponbonds. The firm has a debt-equity ratio of .45. The cost of equity is 17.6percent and.Required: What is the pre-tax cost of the company debt if weightedaverage costs of the company is 13.5% and the firm's tax rate is 35percent?Question: 4 S.ALAM group financed using the following weights: 35% long term debt, 15% preferred stock and 40% common stock equity, and 10% retained earnings. The firm’s corporate tax rate is 38% The firm can sell for tk. 990 an 8 years bond, Tk. 1000 par-value bond paying at an 11% coupon rate, flotation cost of per bond is 3.75% and under pricing by 2%. Eleven percent (annual dividend) preferred stock having a par value of tk. 100 can be sold for tk. 85. An additional fee of tk. 5 per share must be paid to the underwriters. The firm’s common stock currently selling for tk. 55 per share. The dividend expected to be paid at the end of the year is Tk. 5.35 per share. Dividends have been growing at an annual rate of 8.5%. Moreover, underwriting fees per share Tk. 7. Calculate the WACC of the project and implications of investment decisions. b.The following two mutually…

- Question 2 Given the following information for Huntington Power Co., find the WACC. Assume the company’s tax rate is 35 percent. Debt: 5,000 6 percent coupon bonds outstanding, GH¢ 1,000 par value, 25 years to maturity, selling for 105 percent of par; the bonds make annual payments. Common stock: 175,000 shares outstanding, selling for GH¢ 58 per share; the beta is 1.10. Market: 7 percent market risk premium and 5 percent risk-free rate.6. Corporation A traded at a P/B (price-to-book) ratio of 0.5. Its most recent reported ROCE is 10% and its cost of equity is also about 10%. Which of the following is most likely to be true?A. On average, the market expects future ROCEs to increase to above 10%;B. On average, the market expects future ROCEs to decrease to below 10%;C. On average, the market expects future ROCEs to maintain at 10%;D On average, the market does not know what to expect.Question 5: CLO 4 Long-term Financing Choices / CLO 5 Short-term Financial Management Calculate the weighted average cost of capital for Limp Linguini Noodle Makers Inc. under the following conditions: *The capital structure is 40% debt and 60% equity. *The before-tax cost of debt (which includes flotation costs) is 20% and the firm is in the 40% tax bracket. *The firm’s beta is 1.7. *The risk-free rate is 7% and the market risk premium is 6%.