After reading the description, Applying the risk management process, Should Coe's expand to Mexico ? Justify your decision? Why? Or why not ?

After reading the description, Applying the risk management process, Should Coe's expand to Mexico ? Justify your decision? Why? Or why not ?

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

After reading the description,

Applying the risk management process, Should Coe's expand to Mexico ? Justify your decision? Why? Or why not ?

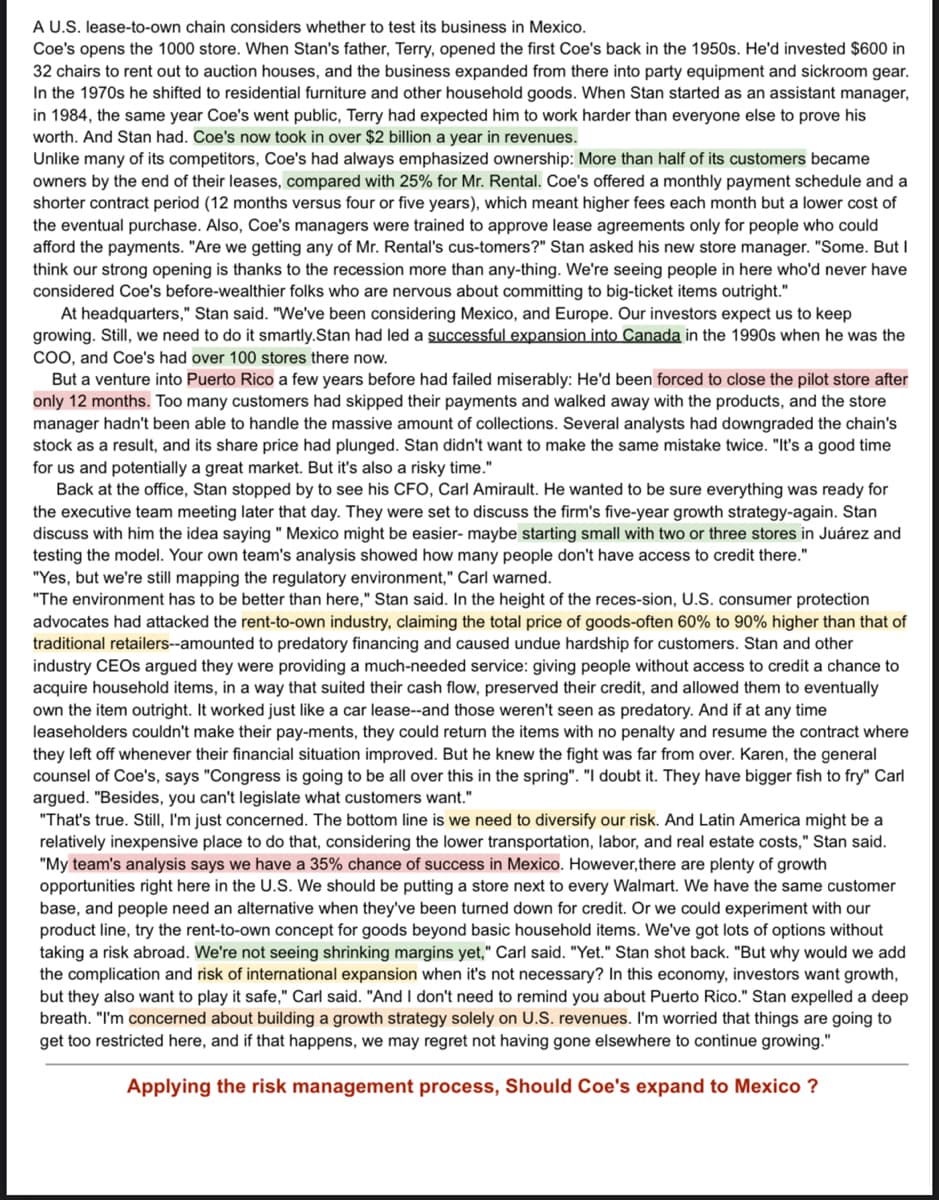

Transcribed Image Text:A U.S. lease-to-own chain considers whether to test its business in Mexico.

Coe's opens the 1000 store. When Stan's father, Terry, opened the first Coe's back in the 1950s. He'd invested $600 in

32 chairs to rent out to auction houses, and the business expanded from there into party equipment and sickroom gear.

In the 1970s he shifted to residential furniture and other household goods. When Stan started as an assistant manager,

in 1984, the same year Coe's went public, Terry had expected him to work harder than everyone else to prove his

worth. And Stan had. Coe's now took in over $2 billion a year in revenues.

Unlike many of its competitors, Coe's had always emphasized ownership: More than half of its customers became

owners by the end of their leases, compared with 25% for Mr. Rental. Coe's offered a monthly payment schedule and a

shorter contract period (12 months versus four or five years), which meant higher fees each month but a lower cost of

the eventual purchase. Also, Coe's managers were trained to approve lease agreements only for people who could

afford the payments. "Are we getting any of Mr. Rental's cus-tomers?" Stan asked his new store manager. "Some. But I

think our strong opening is thanks to the recession more than any-thing. We're seeing people in here who'd never have

considered Coe's before-wealthier folks who are nervous about committing to big-ticket items outright."

At headquarters," Stan said. "We've been considering Mexico, and Europe. Our investors expect us to keep

growing. Still, we need to do it smartly.Stan had led a successful expansion into Canada in the 1990s when he was the

COO, and Coe's had over 100 stores there now.

But a venture into Puerto Rico a few years before had failed miserably: He'd been forced to close the pilot store after

only 12 months. Too many customers had skipped their payments and walked away with the products, and the store

manager hadn't been able to handle the massive amount of collections. Several analysts had downgraded the chain's

stock as a result, and its share price had plunged. Stan didn't want to make the same mistake twice. "It's a good time

for us and potentially a great market. But it's also a risky time."

Back at the office, Stan stopped by to see his CFO, Carl Amirault. He wanted to be sure everything was ready for

the executive team meeting later that day. They were set to discuss the firm's five-year growth strategy-again. Stan

discuss with him the idea saying " Mexico might be easier- maybe starting small with two or three stores in Juárez and

testing the model. Your own team's analysis showed how many people don't have access to credit there."

"Yes, but we're still mapping the regulatory environment," Carl warned.

"The environment has to be better than here," Stan said. In the height of the reces-sion, U.S. consumer protection

advocates had attacked the rent-to-own industry, claiming the total price of goods-often 60% to 90% higher than that of

traditional retailers--amounted to predatory financing and caused undue hardship for customers. Stan and other

industry CEOs argued they were providing a much-needed service: giving people without access to credit a chance to

acquire household items, in a way that suited their cash flow, preserved their credit, and allowed them to eventually

own the item outright. It worked just like a car lease--and those weren't seen as predatory. And if at any time

leaseholders couldn't make their pay-ments, they could return the items with no penalty and resume the contract where

they left off whenever their financial situation improved. But he knew the fight was far from over. Karen, the general

counsel of Coe's, says "Congress is going to be all over this in the spring". "I doubt it. They have bigger fish to fry" Carl

argued. "Besides, you can't legislate what customers want."

"That's true. Still, I'm just concerned. The bottom line is we need to diversify our risk. And Latin America might be a

relatively inexpensive place to do that, considering the lower transportation, labor, and real estate costs," Stan said.

"My team's analysis says we have a 35% chance of success in Mexico. However, there are plenty of growth

opportunities right here in the U.S. We should be putting a store next to every Walmart. We have the same customer

base, and people need an alternative when they've been turned down for credit. Or we could experiment with our

product line, try the rent-to-own concept for goods beyond basic household items. We've got lots of options without

taking a risk abroad. We're not seeing shrinking margins yet," Carl said. "Yet." Stan shot back. "But why would we add

the complication and risk of international expansion when it's not necessary? In this economy, investors want growth,

but they also want to play it safe," Carl said. "And I don't need to remind you about Puerto Rico." Stan expelled a deep

breath. "I'm concerned about building a growth strategy solely on U.S. revenues. I'm worried that things are going to

get too restricted here, and if that happens, we may regret not having gone elsewhere to continue growing."

Applying the risk management process, Should Coe's expand to Mexico ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON