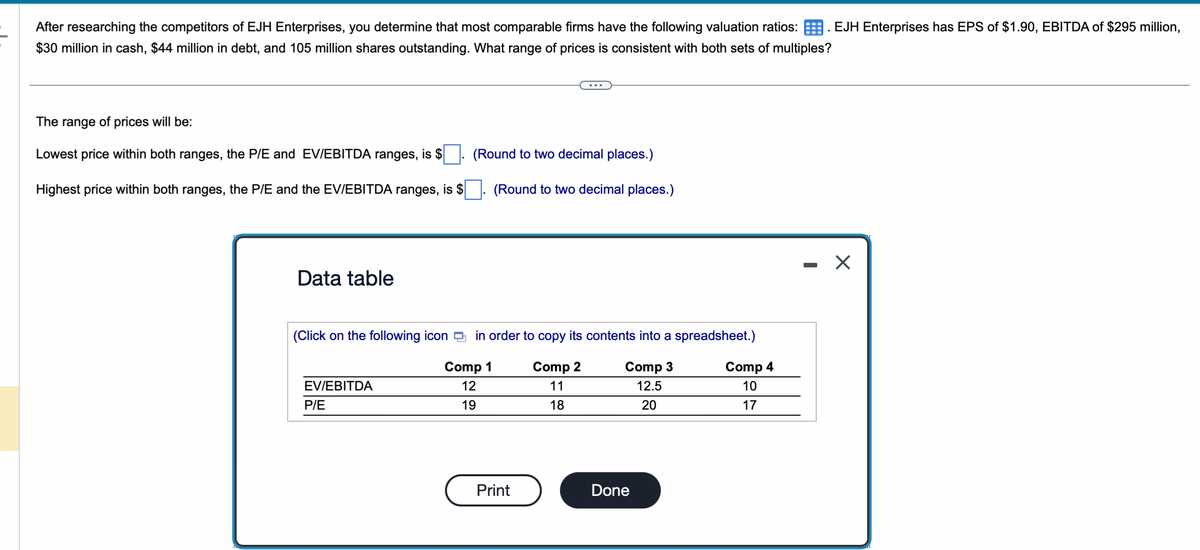

After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios:. EJH Enterprises has EPS of $1.90, EBITDA of $295 million, $30 million in cash, $44 million in debt, and 105 million shares outstanding. What range of prices is consistent with both sets of multiples? The range of prices will be: Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $. (Round to two decimal places.) Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $ (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Comp 1 Comp 3 Comp 2 11 12 12.5 19 18 20 EV/EBITDA P/E Print Done Comp 4 10 17 - X

After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios:. EJH Enterprises has EPS of $1.90, EBITDA of $295 million, $30 million in cash, $44 million in debt, and 105 million shares outstanding. What range of prices is consistent with both sets of multiples? The range of prices will be: Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $. (Round to two decimal places.) Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $ (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Comp 1 Comp 3 Comp 2 11 12 12.5 19 18 20 EV/EBITDA P/E Print Done Comp 4 10 17 - X

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: . EJH Enterprises has EPS of $1.90, EBITDA of $295 million,

$30 million in cash, $44 million in debt, and 105 million shares outstanding. What range of prices is consistent with both sets of multiples?

The range of prices will be:

Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $

Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $

Data table

EV/EBITDA

(Round to two decimal places.)

(Click on the following icon in order to copy its contents into a spreadsheet.)

Comp 2

Comp 3

Comp 1

12

11

12.5

19

18

20

P/E

(Round to two decimal places.)

Print

Done

Comp 4

10

17

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning