Agditional Information relating to 1. Treasury bills were purchased on October 1, 2006. Total interest of $2,400 will be received at maturity. No accrual adjustments were made in 2006. 2. Treasury bonds, were purchased on December 1, 2006. Total interest of $5,000 will be received at maturity. 3. IBM Co. Stock of 5,000 shares were purchased on February 8, 2005 for $2 per share. As of December 31, 2006 the market value of IBM was $13 per share. 4. The company uses the Allowance method, and estimates its uncollectible accounts by analyzing the aging of its receivables. After analyzing its December 31, 2006 Accounts Receivable aging, the company determined the amount of its "Uncollectible Accounts" to be $2.600. tments 5. Prepaid rent account represents rent prepaid on December 1, 2006, covering the months of December & January. 6. Unearned revenue of $10,000 was received from a customer on November 1, 2006. Of this account, 60% of sales is still unearned as of December 31, 2006. 7. Property Plant and Equipment has a useful life of 5 years. The Company prepares the depreciation adjustment only once a year on December 31. Required: a) Prepare the adjusting entries (1-7 above) as of December 31, 2006 using the journal entry format. b) List the 'cash and cash equivalents' of the company (only account names).

Agditional Information relating to 1. Treasury bills were purchased on October 1, 2006. Total interest of $2,400 will be received at maturity. No accrual adjustments were made in 2006. 2. Treasury bonds, were purchased on December 1, 2006. Total interest of $5,000 will be received at maturity. 3. IBM Co. Stock of 5,000 shares were purchased on February 8, 2005 for $2 per share. As of December 31, 2006 the market value of IBM was $13 per share. 4. The company uses the Allowance method, and estimates its uncollectible accounts by analyzing the aging of its receivables. After analyzing its December 31, 2006 Accounts Receivable aging, the company determined the amount of its "Uncollectible Accounts" to be $2.600. tments 5. Prepaid rent account represents rent prepaid on December 1, 2006, covering the months of December & January. 6. Unearned revenue of $10,000 was received from a customer on November 1, 2006. Of this account, 60% of sales is still unearned as of December 31, 2006. 7. Property Plant and Equipment has a useful life of 5 years. The Company prepares the depreciation adjustment only once a year on December 31. Required: a) Prepare the adjusting entries (1-7 above) as of December 31, 2006 using the journal entry format. b) List the 'cash and cash equivalents' of the company (only account names).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 17P: (Appendix 21.1) Comprehensive The following are Adair Companys December 31, 2018, post-closing trial...

Related questions

Question

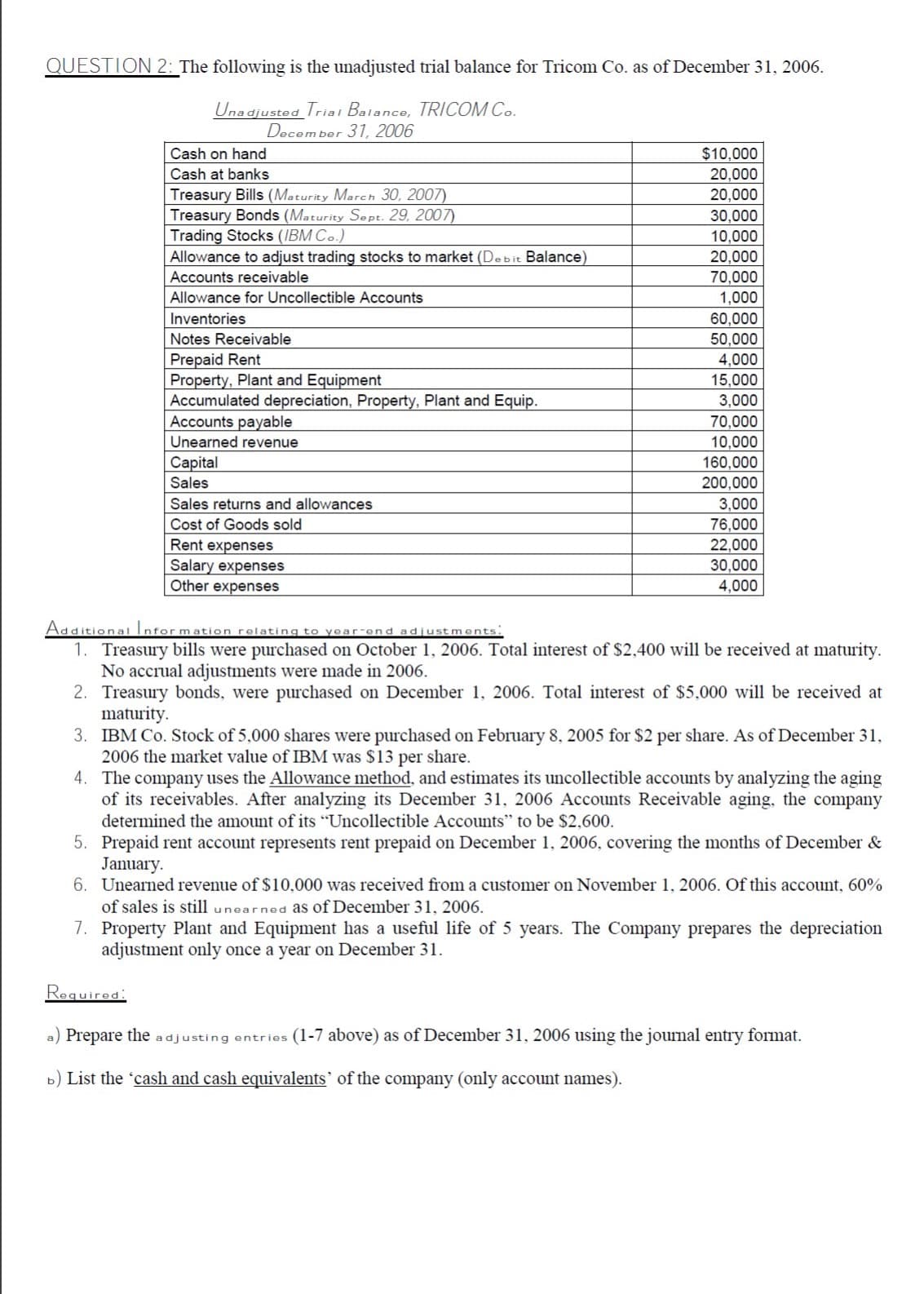

Transcribed Image Text:QUESTION 2: The following is the unadjusted trial balance for Tricom Co. as of December 31, 2006.

Una djusted Trial Balance, TRICOM Co.

December 31, 2006

Cash on hand

$10,000

20,000

20,000

Cash at banks

Treasury Bills (Maturity March 30, 2007)

Treasury Bonds (Maturity Sept. 29, 2007)

Trading Stocks (IBM C..)

Allowance to adjust trading stocks to market (Debit Balance)

30,000

10,000

20,000

70,000

1,000

Accounts receivable

Allowance for Uncollectible Accounts

Inventories

60,000

50,000

4,000

15,000

3,000

Notes Receivable

Prepaid Rent

Property, Plant and Equipment

Accumulated depreciation, Property, Plant and Equip.

Accounts payable

Unearned revenue

70,000

10,000

Capital

Sales

160,000

200,000

Sales returns and allowances

3,000

Cost of Goods sold

Rent expenses

Salary expenses

Other expenses

76,000

22,000

30,000

4,000

AdditionaiInformation relating to year-end adjustments.

1. Treasury bills were purchased on October 1, 2006. Total interest of $2,400 will be received at maturity.

No accrual adjustments were made in 2006.

2. Treasury bonds, were purchased on December 1, 2006. Total interest of $5,000 will be received at

maturity.

3. IBM Co. Stock of 5,000 shares were purchased on February 8, 2005 for $2 per share. As of December 31,

2006 the market value of IBM was $13 per share.

4. The company uses the Allowance method, and estimates its uncollectible accounts by analyzing the aging

of its receivables. After analyzing its December 31, 2006 Accounts Receivable aging, the company

determined the amount of its Uncollectible Accounts" to be $2,600.

5. Prepaid rent account represents rent prepaid on December 1, 2006, covering the months of December &

January.

6. Unearned revenue of $10,000 was received from a customer on November 1, 2006. Of this account, 60%

of sales is still unearned as of December 31, 2006.

7. Property Plant and Equipment has a useful life of 5 years. The Company prepares the depreciation

adjustment only once a year on December 31.

Required:

a) Prepare the adjusting entries (1-7 above) as of December 31, 2006 using the journal entry format.

b) List the 'cash and cash equivalents' of the company (only account names).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning