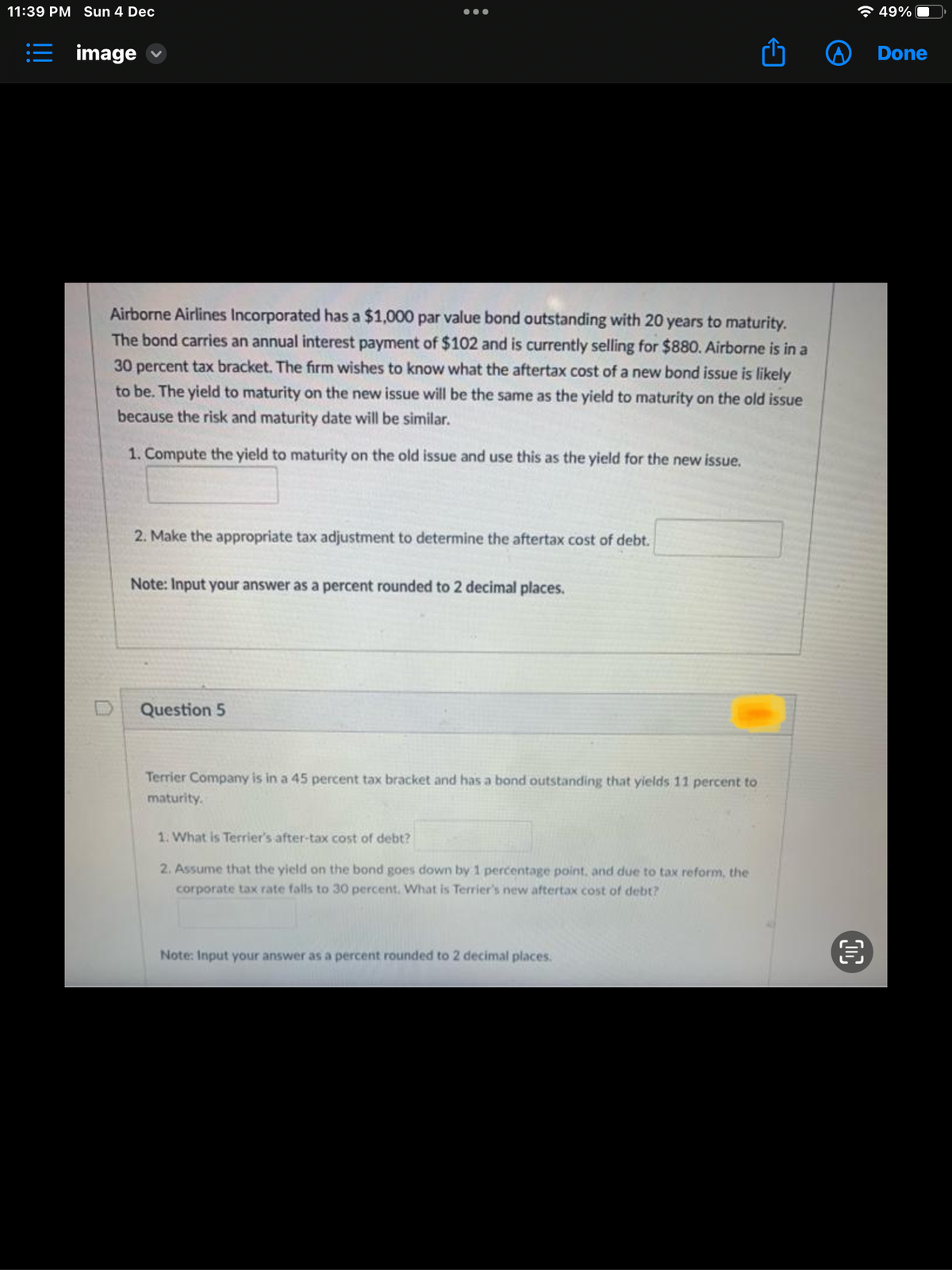

Airborne Airlines Incorporated has a $1,000 par value bond outstanding with 20 years to maturity. The bond carries an annual interest payment of $102 and is currently selling for $880. Airborne is in a 30 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar. 1. Compute the yield to maturity on the old issue and use this as the yield for the new issue. 2. Make the appropriate tax adjustment to determine the aftertax cost of debt. Note: Input your answer as a percent rounded to 2 decimal places.

Airborne Airlines Incorporated has a $1,000 par value bond outstanding with 20 years to maturity. The bond carries an annual interest payment of $102 and is currently selling for $880. Airborne is in a 30 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar. 1. Compute the yield to maturity on the old issue and use this as the yield for the new issue. 2. Make the appropriate tax adjustment to determine the aftertax cost of debt. Note: Input your answer as a percent rounded to 2 decimal places.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.4E

Related questions

Question

Transcribed Image Text:11:39 PM Sun 4 Dec

= image ✓

Airborne Airlines Incorporated has a $1,000 par value bond outstanding with 20 years to maturity.

The bond carries an annual interest payment of $102 and is currently selling for $880. Airborne is in a

30 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely

to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue

because the risk and maturity date will be similar.

1. Compute the yield to maturity on the old issue and use this as the yield for the new issue.

2. Make the appropriate tax adjustment to determine the aftertax cost of debt.

Note: Input your answer as a percent rounded to 2 decimal places.

Question 5

Terrier Company is in a 45 percent tax bracket and has a bond outstanding that yields 11 percent to

maturity.

1. What is Terrier's after-tax cost of debt?

2. Assume that the yield on the bond goes down by 1 percentage point, and due to tax reform, the

corporate tax rate falls to 30 percent. What is Terrier's new aftertax cost of debt?

Note: Input your answer as a percent rounded to 2 decimal places.

€

49%

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning