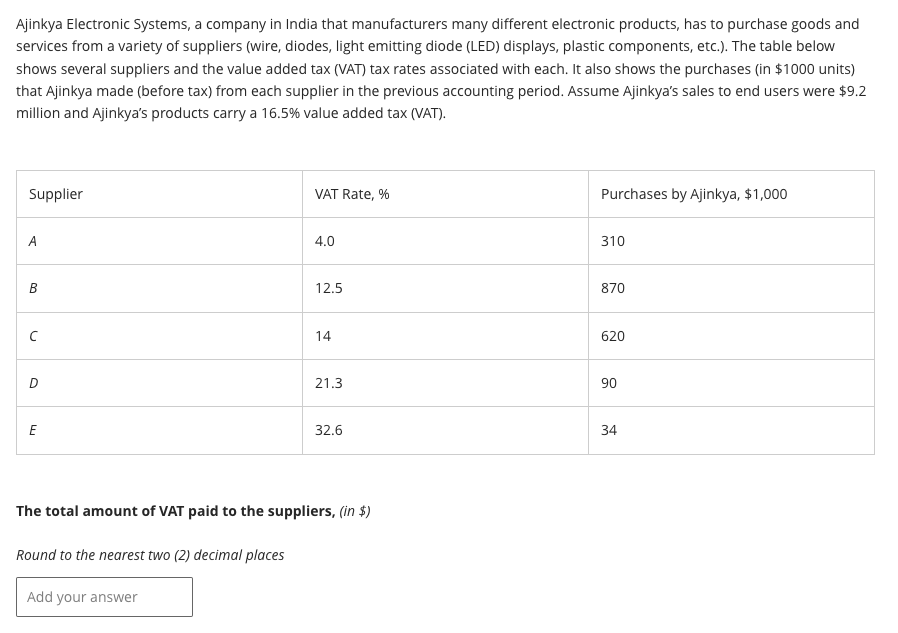

Ajinkya Electronic Systems, a company in India that manufacturers many different electronic products, has to purchase goods and services from a variety of suppliers (wire, diodes, light emitting diode (LED) displays, plastic components, etc.). The table below shows several suppliers and the value added tax (VAT) tax rates associated with each. It also shows the purchases (in $1000 units) that Ajinkya made (before tax) from each supplier in the previous accounting period. Assume Ajinkya's sales to end users were $9.2 million and Ajinkya's products carry a 16.5% value added tax (VAT). Supplier B с D E Round to the nearest two (2) decimal places VAT Rate, % Add your answer 4.0 12.5 14 21.3 The total amount of VAT paid to the suppliers, (in $) 32.6 Purchases by Ajinkya, $1,000 310 870 620 90 34

Ajinkya Electronic Systems, a company in India that manufacturers many different electronic products, has to purchase goods and services from a variety of suppliers (wire, diodes, light emitting diode (LED) displays, plastic components, etc.). The table below shows several suppliers and the value added tax (VAT) tax rates associated with each. It also shows the purchases (in $1000 units) that Ajinkya made (before tax) from each supplier in the previous accounting period. Assume Ajinkya's sales to end users were $9.2 million and Ajinkya's products carry a 16.5% value added tax (VAT). Supplier B с D E Round to the nearest two (2) decimal places VAT Rate, % Add your answer 4.0 12.5 14 21.3 The total amount of VAT paid to the suppliers, (in $) 32.6 Purchases by Ajinkya, $1,000 310 870 620 90 34

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 17P

Related questions

Question

6abc. Help me answer the given question. Do not round off answers while solving, instead just the final answer will be rounded off to two decimal places.

Transcribed Image Text:Ajinkya Electronic Systems, a company in India that manufacturers many different electronic products, has to purchase goods and

services from a variety of suppliers (wire, diodes, light emitting diode (LED) displays, plastic components, etc.). The table below

shows several suppliers and the value added tax (VAT) tax rates associated with each. It also shows the purchases (in $1000 units)

that Ajinkya made (before tax) from each supplier in the previous accounting period. Assume Ajinkya's sales to end users were $9.2

million and Ajinkya's products carry a 16.5% value added tax (VAT).

Supplier

A

B

с

D

E

Round to the nearest two (2) decimal places

VAT Rate, %

Add your answer

4.0

12.5

14

21.3

The total amount of VAT paid to the suppliers, (in $)

32.6

Purchases by Ajinkya, $1,000

310

870

620

90

34

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning