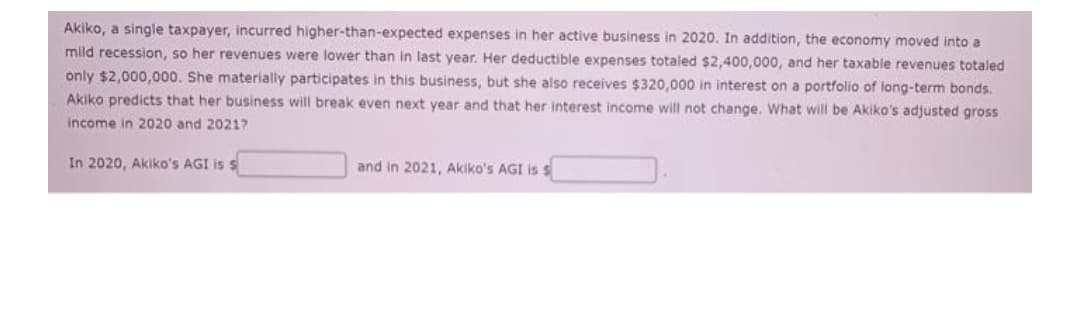

Akiko, a single taxpayer, incurred higher-than-expected expenses in her active business in 2020. In addition, the economy moved into a mild recession, so her revenues were lower than in last year. Her deductible expenses totaled $2,400,000, and her taxable revenues totaled only $2,000,000. She materially participates in this business, but she also receives $320,000 in interest on a portfolio of long-term bonds. Akiko predicts that her business will break even next year and that her interest income will not change. What will be Akiko's adjusted gross income in 2020 and 20217 In 2020, Akiko's AGI is and in 2021, Akiko's AGI is

Akiko, a single taxpayer, incurred higher-than-expected expenses in her active business in 2020. In addition, the economy moved into a mild recession, so her revenues were lower than in last year. Her deductible expenses totaled $2,400,000, and her taxable revenues totaled only $2,000,000. She materially participates in this business, but she also receives $320,000 in interest on a portfolio of long-term bonds. Akiko predicts that her business will break even next year and that her interest income will not change. What will be Akiko's adjusted gross income in 2020 and 20217 In 2020, Akiko's AGI is and in 2021, Akiko's AGI is

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:Akiko, a single taxpayer, incurred higher-than-expected expenses in her active business in 2020. In addition, the economy moved into a

mild recession, so her revenues were lower than in last year. Her deductible expenses totaled $2,400,000, and her taxable revenues totaled

only $2,000,000. She materially participates in this business, but she also receives $320,000 in interest on a portfolio of iong-term bonds.

Akiko predicts that her business will break even next year and that her interest income will not change. What will be Akiko's adjusted gross

income in 2020 and 20217

In 2020, Akiko's AGI is s

and in 2021, Akiko's AGI is s

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT