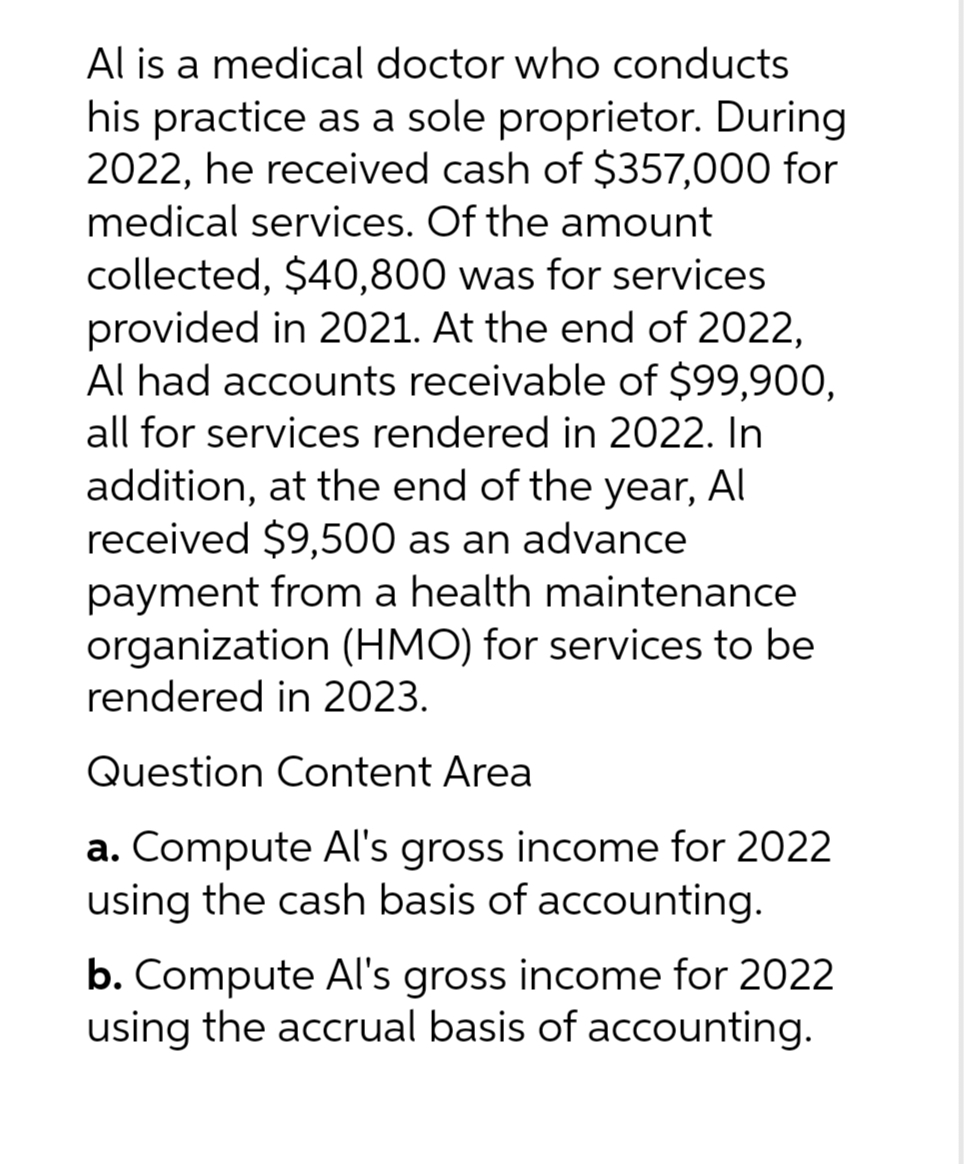

Al is a medical doctor who conducts his practice as a sole proprietor. During 2022, he received cash of $357,000 for medical services. Of the amount collected, $40,800 was for services provided in 2021. At the end of 2022, Al had accounts receivable of $99,900, all for services rendered in 2022. In addition, at the end of the year, Al received $9,500 as an advance payment from a health maintenance organization (HMO) for services to be rendered in 2023. Question Content Area a. Compute Al's gross income for 2022 using the cash basis of accounting. b. Compute Al's gross income for 2022 using the accrual basis of accounting.

Al is a medical doctor who conducts his practice as a sole proprietor. During 2022, he received cash of $357,000 for medical services. Of the amount collected, $40,800 was for services provided in 2021. At the end of 2022, Al had accounts receivable of $99,900, all for services rendered in 2022. In addition, at the end of the year, Al received $9,500 as an advance payment from a health maintenance organization (HMO) for services to be rendered in 2023. Question Content Area a. Compute Al's gross income for 2022 using the cash basis of accounting. b. Compute Al's gross income for 2022 using the accrual basis of accounting.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 32P

Related questions

Question

Transcribed Image Text:Al is a medical doctor who conducts

his practice as a sole proprietor. During

2022, he received cash of $357,000 for

medical services. Of the amount

collected, $40,800 was for services

provided in 2021. At the end of 2022,

Al had accounts receivable of $99,900,

all for services rendered in 2022. In

addition, at the end of the year, Al

received $9,500 as an advance

payment from a health maintenance

organization (HMO) for services to be

rendered in 2023.

Question Content Area

a. Compute Al's gross income for 2022

using the cash basis of accounting.

b. Compute Al's gross income for 2022

using the accrual basis of accounting.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT