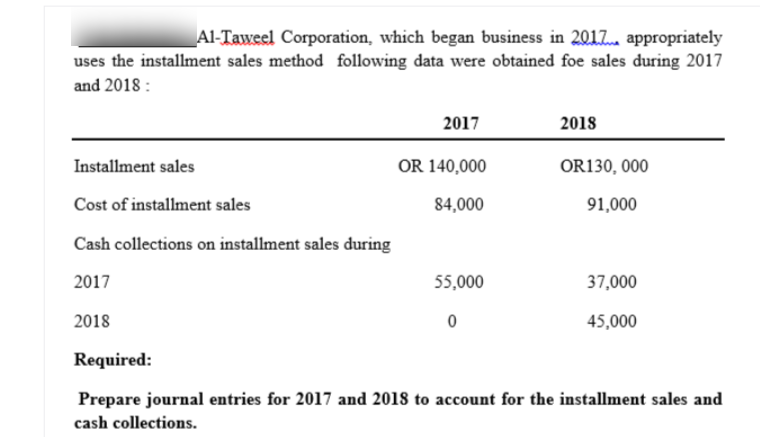

Al-Taweel Corporation, which began business in 2017. appropriately uses the installment sales method following data were obtained foe sales during 2017 and 2018 : 2017 2018 Installment sales OR 140,000 OR130, 000 Cost of installment sales 84,000 91,000 Cash collections on installment sales during 2017 55,000 37,000 2018 45,000 Required: Prepare journal entries for 2017 and 2018 to account for the installment sales and cash collections.

Q: KMC Inc. provided a loan to Jim Ltd on January 1st, 2016 and received in exchange a 4-year, $120,000…

A: "Since you have posted a question with multiple sub-parts, we will solver first three sub-parts for…

Q: The following selected accounts were taken from the trial balance of Romen Company as December 31,…

A: The question is based on the concept of Financial Accounting.

Q: Alfred Company lends $40,000 with 9% interest to a customer on August 1, 2015, in exchange for a…

A: Interest revenue is credited for $1,500.

Q: On April 1, 2017, Indigo Company assigns $549,400 of its accounts receivable to the Third National…

A: Account receivable:The amount of money to be received by a company for the sale of goods and…

Q: On June 1, 2017, Santos Furniture Co. borrowed P5,000,000 (face value) from Sonic Co., a major…

A: Answer - Working Note : Computation of Discount on Note Payable : = Borrowed amount - (borrowed…

Q: On January 1, 2016, the Merit Group issued to its bank a $41 million, five-year installment note to…

A: Interest Expense = Note value x rate of interest x period = $41,000,000*7%*1 year = $2,870,000…

Q: current liabilities in connection with the note at December 31, 2017?

A: Current liabilities are obligations arise from conduct of business which are repayable within one…

Q: On july 1, 2017 LA company sold equipment to NA company for 1,000,000. LA accepted a 10% note…

A: Discounting a note receivable refers to the selling of the notes receivable in the future for a…

Q: Assume that on December 1, 2015, your company borrowed $15,000, a portion of which is to berepaid…

A: Balance sheet: This financial statement reports a company’s resources (assets) and claims of…

Q: On January 1, 2017, Oldham Company sold goods to Windall Company in exchange for a 3-year,…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Abardeen Corporation borrowed $136,000 from the bank on October 1, 2018. The note had an 7 percent…

A: Abardeen Corporation borrowed $136,000 from the bank on October 1, 2018. The note had an 7 percent…

Q: The following summary transactions occurred during 2018 for Bluebonnet Bakers:Cash Received…

A:

Q: Prepare 2017 entries for Nash. Assume that Nash estimates the total cost of servicing the warranties…

A: Given information is: Early in 2017, Nash Equipment Company sold 400 Rollomatics during 2017 at…

Q: The following transactions apply to Ozark Sales for 2018: The business was started when the…

A: In terms of accountancy, liabilities can be defined as the obligations which the company is required…

Q: Wolf Computer Company began operations in 2018. The company allows customers to pay in installments…

A: 1.

Q: 30,000 to apply for 2020 was received from a sublease contract. P40,000 total interest income from…

A: Net Sales = 20,00,000 Purchases = 12,00,000 Opening Inventory = 2,00,000 Closing Inventory =…

Q: The balance of the unrealized gross profit account as at the end of 2011 was:

A: Gross Profit is the profit which a company earns on the selling of products or services to the…

Q: HELLO reported the following items on its December 31, 2020 trial balance: Accounts Payable,…

A: Current liabilities: Liabilities that have to be paid within one year or one operating cycle,…

Q: TIKTOK Company which began business on January 1, 2020, appropriately uses the installment sales…

A: The question is multiple choice question. Required Choose the Correct Option.

Q: You are given the following figures as of December 31, 2021: Installment contracts receivable -…

A: Installment method is used when item is sold on installment basis. Buyer will pay a down payment and…

Q: The following transactions apply to Walnut Enterprises for 2018, its first year of operations:…

A: Balance sheet is the financial statement of a company. It helps in maintaining the records of…

Q: On January 1, 2016, Nantucket Ferry borrowed $14,000,000 cash from BankOne and issued a four-year,…

A: Prepare journal entry to record in the books of Borrower as on 31st December 2018.

Q: Husemann Co.'s assets include notes receivable from customers. During fiscal 2019, the amount of…

A: Notes Receivables: If the notes receivable have a life of less than a year, they are generally shown…

Q: Sunlight Co. Started operations on January 1, 2018, selling home appliances on instalment basis. For…

A: What is meant by Gross Profit Ratio? Gross profit ratio shows the relationship of cost of goods sold…

Q: For the next two items: A company sold a factory on January 1, 2016 for P7,000,000. The entity…

A: When a factory is sold the payment can be received outrightly or over a period of when credit is…

Q: Consider the following note payable transactions of Cigliano Video Productions. 2017 May 1…

A: Accrued Interest expense on Dec. 31, 2017 = Notes payable x rate of interest x period =…

Q: please find the attchement .can someone solve this

A: Following are the calculations:

Q: Each year, Pacific Enterprises (PE) prepares a reconciliation schedule that compares its income…

A: Bank reconciliation statement is s statement which is prepared at the end of the month to correct…

Q: Keesha Co. borrows $200,000 cash on November 1, 2017, by signing a 90-day, 9% note with a face value…

A: Notes are a form of debt taken by the company, on which business has to pay interest payments. This…

Q: On January 1, 2017, Eagle borrows $100,000 cash by signing a four-year, 7% installment note. The…

A: Notes payable: It can be defined as a liability account that is used by the borrower to record the…

Q: ABC Corporation sells merchandise on the installment basis, and the uncertainties of cash collection…

A: Under installment sales method, the profit is realized on the basis of receipt of cash.

Q: Dimagiba Company began operation at the beginning of 2021. During the year, it had cash sales of…

A: Gross profit on cash sales = 6875,000× 25/125 = 13,75,000

Q: Berlin Corp. reported the following data for 2019: Total net sales made to customers were P2,000,000…

A: Introduction:- Earned money that is subject to federal or state taxation is referred to as taxable…

Q: Barton Chocolates used a promissory note to borrow $1,000,000 on July 1, 2015, at an annualinterest…

A: Promissory note is defined as the notes payable which is the financial instrument borrowed by the…

Q: Included in Allen Corp.'s balance sheet at June 30, 2015 is a 10%, $3,000,000 note payable. The note…

A: Accrued interest payable represents the interest that has been accrued to be paid but not yet paid…

Q: The transaction below pertains to Boyer Coe Company, whose fiscal year ends December 31. On November…

A: Note is a document which works as a promissory note at the time when an entity is taking or…

Q: Black Corporation has entered into a long-term assignment agreement with a finance company. Under…

A: SOLUTION- A JOURNAL IS THE COMPANY'S OFFICIAL BOOK IN WHICH ALL TRANSACTIONS ARE RECORDED IN…

Q: Karr Co. began operations on January 1, 2009 and appropriately uses the installment method of…

A: Sales revenue means earnings from the sale or delivery of goods and services. Sales can be on a cash…

Q: Al-Taweel Corporation, which began business in 201Z appropriately uses the installment sales method…

A: The installment sales method record the sales revenue one time but the cash of that revenue is…

Q: Plantito Company began operations on January 1, 2019 and appropriately uses the installment method…

A: Under the installment method of accounting, the gross profit or income is recognized with respect to…

Q: On January 1, 2017, Oldham Company sold goods to Windall Company in exchange for a 3-year,…

A: Journal entry:Journal entry is a set of economic events which can be measured in monetary terms.…

Q: 오 uses the installment sales method following data were obtained foe sales during 2017 Al-Taweel…

A:

Q: Oro Company began operations on January 1, 2021 and appropriately uses the installment sales method…

A: Instalment sales is a type of sales arrangement in which customer do not pay amount in cash in…

Q: The following data for Roco Corp. Are available for 2021: Installment accounts, receivable 12/31/21…

A: Given information: Installment Accounts Receivable at year end = 100000 Installment Sales = 350000

Step by step

Solved in 2 steps

- Anderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on January 1, 2018, Handler Cleaning Operations issues a note with a principal amount of $1,255,000, 6% annual interest rate, and a 24-month maturity date on December 31, 2019. Record the journal entries for Handler Cleaning Operations for the following transactions. A. Entry for note issuance B. Subsequent interest entry on December 31, 2018 C. Honored note entry at maturity on December 31, 2019Plantito Company began operations on January 1, 2019 and appropriately uses the installment method of accounting. The following data are available for 2019 and 2020.2019 2020Installment Sales P1,200,000 P1,500,000Cash collections from:2019 sales P400,000 P500,0002020 sales P600,000Gross Profit on sales 30% 40%The realized gross profit for 2020 isa. P240,000 c. P440,000b. P390,000 d. P600,000TIKTOK Company which began business on January 1, 2020, appropriately uses the installment sales method of accounting, the following data are available for 2020:Installment accounts receivable, 12/31/2020 P200,000Deferred Gross Profit, 12/31/2020 (before recognition 140,000of realized gross profit)Gross Profit on Sales 40%The cash collections and the realized gross profit on installment sales for the year ended December 31, 2020 should be:Cash Collections Realized Gross Profita. P100,000 P80,000b. 100,000 60,000c. 150,000 80,000d. 150,000 60,000

- KMC Inc. provided a loan to Jim Ltd on January 1st, 2016 and received in exchange a 4-year, $120,000 note bearing interest at 8% to be paid annually on December 31. The market rate of interest for financial instruments of similar risk is 2%. KMC Inc. financial year ends December 31 and the company uses the effective interest method to amortize discount and recognize interest revenue. Required: Round to nearest whole number d) Prepare the journal entry in KMC’s books to record the issuance of the note on January 1, 2016. e) Prepare KMC’s 4-year Note Amortization schedule. f) Prepare the journal entry KMC records on December 31, 2017.GCASH accounts for sales under the installment method. On January 1, 2020 its ledger accounts included the following balances:Installment Receivable, 2018 P 38,500Installment Receivable, 2019 155,000Deferred Gross Profit, 2018 11,550Deferred Gross Profit, 2019 62,000Installment Sales in 2020 were made at 42% gross profit rate. December 31, 2019 account balances before adjustment were as follows:Installment Receivable, 2018 P 0Installment Receivable, 2019 42,000Installment Receivable, 2020 100,500Deferred Gross Profit, 2018 11,550Deferred Gross Profit, 2019 62,000Deferred Gross Profit, 2020 75,810The total realized gross profit on December 31, 2020 is:a. P90,350 c. P98,910b. P97,510 d. P97,350On December 31, 2020, Glare Company provided the following information: Accounts payable, including deposits and advances from customer of P250,000 Notes payable, including note payable to bank due on December 31, 2022 of P500,000 Shared dividend payable Credit balances in customer's accounts Serial bonds payable in semiannual installment of P500,000 Accrued interest on bonds payable Contested BIR Assessment - possible obligation Unearned rent income P1,250,000 P1.500.000 P400,000 P200.000 P5.000.000 P150,000 P300.000 P100,000 Notes: 1. Total liabilities of the Company amounted to P10,000,000 2. There are no other noncurrent liabilities of the Company aside from those listed above

- On December 31, 2019, Gliezel company provided the following information:Accounts payable, including deposits and advances from customer of 300,0001,500,000Notes payable, including note payable to bank due on December 31, 2021of 600,0001,800,000Stock dividend payable480,000Credit balances in customers accounts240,000Serial bonds payable in semiannual installment of 600,0006,000,000Accrued interest on bonds payable180,000Contested BIR tax assessment – possible obligation360,000Unearned rent income120,000Compute the total current liabilities.On January 1, 2025, Coronado Co. borrowed and received $150,000 from a major customer evidenced by a zero-interest-bearing note due in 4 years. As consideration for the zero-interest-bearing feature, Coronado agrees to supply the customer's inventory needs for the loan period at lower than the market price. The appropriate rate at which to impute interest is 9%. Prepare the journal entry to record the initial transaction on January 1, 2025. Prepare the journal entry to record any adjusting entries needed at December 31, 2025. Assume that the sales of Coronado's product to this customer occur evenly over the 4-year period and that the effective-interest method is used.Jazz Company lends Sullivan Company $30,000 on August 1, 2019 in exchange of a 9-month, 12% interest note. If Jazz Company accrued interest on its December 31, 2019 year-end, what is the financial statement effect of the collection of the note and interest at its maturity date? Select one: a. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash InterestReceivable NotesReceivable Retained Earnings InterestIncome A) +32,700 -1,200 -30,000 +1,500 +1,500 b. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash InterestReceivable NotesReceivable Retained Earnings InterestIncome B) -32,700 +1,500 +30,000 -1,200 -1,200 c. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash InterestReceivable NotesReceivable Retained Earnings InterestIncome…

- Takemoto Corporation borrowed $60,000 on November 1, 2017, by signing a $61,350, 3-month, zero-interest bearing note. Prepare Takemoto’s November 1, 2017, entry; the December 31, 2017, annual adjusting entry; and the February 1, 2018, entry.On July 1, 2018, ABC Company borrowed P1,000,000 on a 10% five-year note payable. OnDecember 31, 2018, the fair value of the note is determined to be P975,000 based on marketand interest factors. The entity has elected the fair value option for reporting the financialliability.Compute the following and show your solution:a. Interest expense for 2018b. carrying amount of the note payable on December 31, 2018On December 31, 2017, Eppel, Inc. borrowed $900,000 on an eight percent, 15‑year mortgage note payable. The note is to be repaid in equal semiannual installments of $52,047 (payable on June 30 and December 31). Prepare journal entries to reflect (a) the issuance of the mortgage note payable, (b) the payment of the first installment on June 30, 2018, and (c) the payment of the second installment on December 31, 2018. Round amounts to the nearest dollar. General Journal Date Description Debit Credit a.) Dec.31 Borrowed a mortgage note payable. b.) Jun.30 Interest Expense To record semiannual payment. c.) Dec.31 Mortgage Note Payable To record semiannual payment.