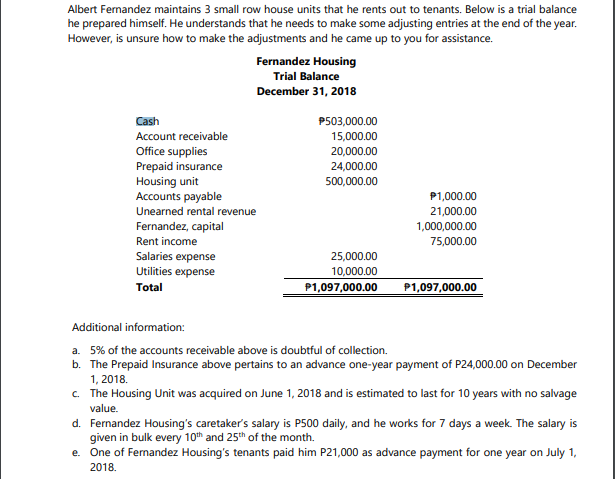

Albert Fernandez maintains 3 small row house units that he rents out to tenants. Below is a trial balance he prepared himself. He understands that he needs to make some adjusting entries at the end of the year. However, is unsure how to make the adjustments and he came up to you for assistance. Fernandez Housing Trial Balance December 31, 2018 Cash P503,000.00 15,000.00 20,000.00 Account receivable Office supplies Prepaid insurance Housing unit Accounts payable 24,000.00 500,0000 P1,000.00 21,000.00 1,000,000.00 75,000.00 Unearned rental revenue Fernandez, capital Rent income Salaries expense Utilities expense 25,000.00 10,000.00 P1,097,000.00 P1,097,000.00 Total Additional information: a. 5% of the accounts receivable above is doubtful of collection. b. The Prepaid Insurance above pertains to an advance one-year payment of P24,000.00 on December 1, 2018. c The Housing Unit was acquired on June 1, 2018 and is estimated to last for 10 years with no salvage value. d. Fernandez Housing's caretaker's salary is P500 daily, and he works for 7 days a week. The salary is given in bulk every 10 and 25h of the month. e. One of Fernandez Housing's tenants paid him P21,000 as advance payment for one year on July 1, 2018.

Albert Fernandez maintains 3 small row house units that he rents out to tenants. Below is a trial balance he prepared himself. He understands that he needs to make some adjusting entries at the end of the year. However, is unsure how to make the adjustments and he came up to you for assistance. Fernandez Housing Trial Balance December 31, 2018 Cash P503,000.00 15,000.00 20,000.00 Account receivable Office supplies Prepaid insurance Housing unit Accounts payable 24,000.00 500,0000 P1,000.00 21,000.00 1,000,000.00 75,000.00 Unearned rental revenue Fernandez, capital Rent income Salaries expense Utilities expense 25,000.00 10,000.00 P1,097,000.00 P1,097,000.00 Total Additional information: a. 5% of the accounts receivable above is doubtful of collection. b. The Prepaid Insurance above pertains to an advance one-year payment of P24,000.00 on December 1, 2018. c The Housing Unit was acquired on June 1, 2018 and is estimated to last for 10 years with no salvage value. d. Fernandez Housing's caretaker's salary is P500 daily, and he works for 7 days a week. The salary is given in bulk every 10 and 25h of the month. e. One of Fernandez Housing's tenants paid him P21,000 as advance payment for one year on July 1, 2018.

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 22MCQ

Related questions

Question

Transcribed Image Text:Albert Fernandez maintains 3 small row house units that he rents out to tenants. Below is a trial balance

he prepared himself. He understands that he needs to make some adjusting entries at the end of the year.

However, is unsure how to make the adjustments and he came up to you for assistance.

Fernandez Housing

Trial Balance

December 31, 2018

Cash

P503,000.00

Account receivable

15,000.00

Office supplies

Prepaid insurance

Housing unit

Accounts payable

Unearned rental revenue

20,000.00

24,000.00

500,000.00

P1,000.00

21,000.00

Fernandez, capital

Rent income

1,000,000.00

75,000.00

Salaries expense

Utilities expense

Total

25,000.00

10,000.00

P1,097,000.00

P1,097,000.00

Additional information:

a. 5% of the accounts receivable above is doubtful of collection.

b. The Prepaid Insurance above pertains to an advance one-year payment of P24,000.00 on December

1, 2018.

c. The Housing Unit was acquired on June 1, 2018 and is estimated to last for 10 years with no salvage

value.

d. Fernandez Housing's caretaker's salary is P500 daily, and he works for 7 days a week. The salary is

given in bulk every 10th and 25th of the month.

e. One of Fernandez Housing's tenants paid him P21,000 as advance payment for one year on July 1,

2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT