Albert has told you that one of his goals is to start his own business within three years. He has estimated that he will need $7,000 in five years to get his business off the ground. Based upon your research of historical, moderate investment returns you determine that Albert should reasonably be able to obtain a return of 5.5% per year over this timeframe. 1. How much does Albert need to deposit today in order to achieve this goal? Interest compounds annually on this investment. 2. Based upon Albert's liquidity, does he have enough currently saved to achieve this go red upon your analysis, Albert wonders if it might be better to put money away each mont ards this goal instead of molci

Albert has told you that one of his goals is to start his own business within three years. He has estimated that he will need $7,000 in five years to get his business off the ground. Based upon your research of historical, moderate investment returns you determine that Albert should reasonably be able to obtain a return of 5.5% per year over this timeframe. 1. How much does Albert need to deposit today in order to achieve this goal? Interest compounds annually on this investment. 2. Based upon Albert's liquidity, does he have enough currently saved to achieve this go red upon your analysis, Albert wonders if it might be better to put money away each mont ards this goal instead of molci

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 23P

Related questions

Question

question attached

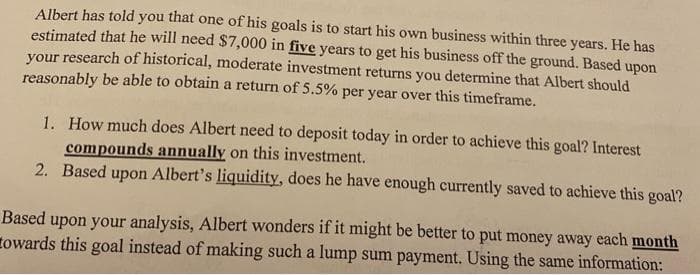

Transcribed Image Text:Albert has told you that one of his goals is to start his own business within three years. He has

estimated that he will need $7,000 in five years to get his business off the ground. Based upon

your research of historical, moderate investment returns you determine that Albert should

reasonably be able to obtain a return of 5.5% per year over this timeframe.

1. How much does Albert need to deposit today in order to achieve this goal? Interest

compounds annually on this investment.

2. Based upon Albert's liquidity, does he have enough currently saved to achieve this goal?

Based upon your analysis, Albert wonders if it might be better to put money away each month

towards this goal instead of making such a lump sum payment. Using the same information:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning