alculate ratios related to how quickly the company pays its trade debt and how quickly it collects from its customers. These are known as Accounts Payable (AP) Turnover and Accounts Receivable (AR) Turnover. The formula for AP Turnover is: Cost of Goods Sold/average accounts payable. The formula for AR Turnover is: credit sales/average accounts receivable. Calculate the AP and AR Turnover for each of 2011-2014. Interpret your calculations: what does this information mean? How is the company doing?

alculate ratios related to how quickly the company pays its trade debt and how quickly it collects from its customers. These are known as Accounts Payable (AP) Turnover and Accounts Receivable (AR) Turnover. The formula for AP Turnover is: Cost of Goods Sold/average accounts payable. The formula for AR Turnover is: credit sales/average accounts receivable. Calculate the AP and AR Turnover for each of 2011-2014. Interpret your calculations: what does this information mean? How is the company doing?

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

100%

- Calculate ratios related to how quickly the company pays its trade debt and how quickly it collects from its customers. These are known as Accounts Payable (AP) Turnover and Accounts Receivable (AR) Turnover. The formula for AP Turnover is: Cost of Goods Sold/average accounts payable. The formula for AR Turnover is: credit sales/average accounts receivable. Calculate the AP and AR Turnover for each of 2011-2014. Interpret your calculations: what does this information mean? How is the company doing?

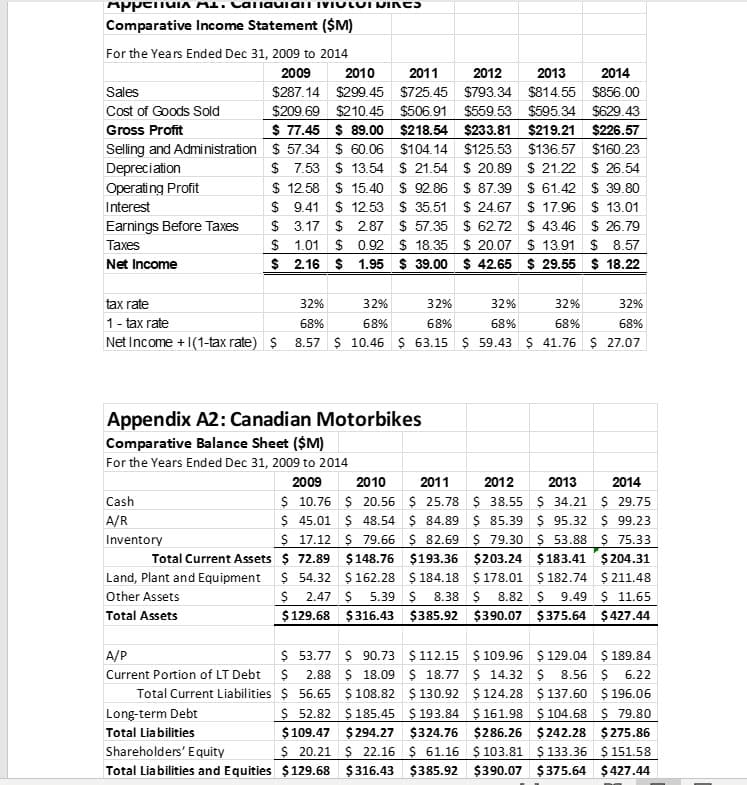

Transcribed Image Text:ANNETILIA ML. ναιιανιαιινιωιωι WINES

Comparative Income Statement ($M)

For the Years Ended Dec 31, 2009 to 2014

Sales

Cost of Goods Sold

Gross Profit

Selling and Administration

Depreciation

Operating Profit

Interest

Earnings Before Taxes

Taxes

Net Income

2011

2012

2013

2014

$725.45 $793.34 $814.55

$856.00

2009 2010

$287.14 $299.45

$209.69 $210.45 $506.91 $559.53 $595.34 $629.43

$ 77.45 $ 89.00 $218.54 $233.81 $219.21 $226.57

$ 57.34 $60.06 $104.14 $125.53 $136.57 $160.23

$7.53 $13.54 $21.54 $ 20.89 $21.22 $26.54

$ 12.58 $15.40 $ 92.86 $ 87.39 $61.42 $ 39.80

$9.41 $ 12.53 $35.51 $24.67 $17.96 $13.01

$ 3.17 $2.87 $57.35 $ 62.72 $ 43.46 $26.79

1.01 $0.92 $18.35 $20.07 $13.91 $ 8.57

$ 2.16 $ 1.95 $39.00 $42.65 $29.55 $18.22

$

tax rate

32%

1 - tax rate

68%

Net Income +1(1-tax rate) $ 8.57

Cash

A/R

Inventory

Appendix A2: Canadian Motorbikes

Comparative Balance Sheet ($M)

For the Years Ended Dec 31, 2009 to 2014

2009

Total Current Assets

Land, Plant and Equipment

Other Assets

Total Assets

32%

68%

$10.46 $ 63.15

A/P

Current Portion of LT Debt

Total Current Liabilities

Long-term Debt

Total Liabilities

Shareholders' Equity

Total Liabilities and Equities

32%

68%

32%

32%

32%

68%

68%

68%

$59.43 $ 41.76 $ 27.07

2011

2014

2010

2012 2013

$ 10.76 $ 20.56 $ 25.78 $ 38.55 $ 34.21 $ 29.75

$ 45.01 $ 48.54 $ 84.89 $ 85.39 $ 95.32 $ 99.23

$ 17.12 $79.66 $ 82.69 $ 79.30 $ 53.88 $ 75.33

$72.89 $148.76 $193.36 $203.24 $183.41 $204.31

$ 54.32 $ 162.28 $184.18 $ 178.01 $ 182.74 $211.48

$ 2.47 $ 5.39 $ 8.38 $ 8.82 $9.49 $ 11.65

$129.68 $316.43 $385.92 $390.07 $375.64 $427.44

$ 53.77 $ 90.73 $112.15 $109.96 $129.04 $189.84

$ 2.88 $ 18.09 $ 18.77 $ 14.32 $ 8.56 $ 6.22

$ 52.82 $185.45 $193.84 $161.98

$109.47 $294.27 $324.76 $286.26

$ 20.21 $ 22.16 $ 61.16 $ 103.81

$129.68 $316.43 $385.92 $390.07

$ 56.65 $108.82 $130.92 $124.28 $137.60 $ 196.06

$104.68 $ 79.80

$242.28 $275.86

$ 133.36 $ 151.58

$375.64 $427.44

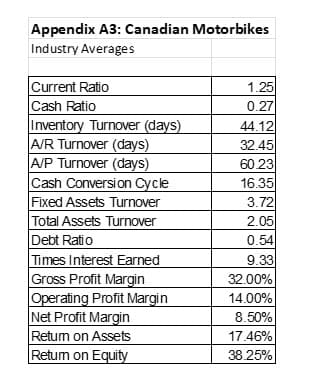

Transcribed Image Text:Appendix A3: Canadian Motorbikes

Industry Averages

Current Ratio

Cash Ratio

Inventory Turnover (days)

A/R Turnover (days)

A/P Turnover (days)

Cash Conversion Cycle

Fixed Assets Turnover

Total Assets Turnover

Debt Ratio

Times Interest Earned

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Retum on Assets

Retum on Equity

1.25

0.27

44.12

32.45

60.23

16.35

3.72

2.05

0.54

9.33

32.00%

14.00%

8.50%

17.46%

38.25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning