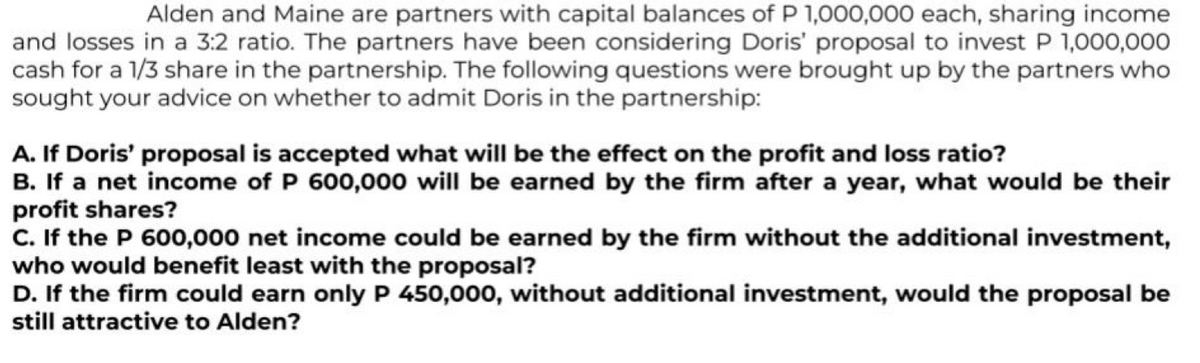

Alden and Maine are partners with capital balances of P 1,000,000 each, sharing income and losses in a 3:2 ratio. The partners have been considering Doris' proposal to invest P 1,000,000 cash for a 1/3 share in the partnership. The following questions were brought up by the partners who sought your advice on whether to admit Doris in the partnership: A. If Doris' proposal is accepted what will be the effect on the profit and loss ratio? B. If a net income of P 600,000 will be earned by the firm after a year, what would be their profit shares? C. If the P 600,000 net income could be earned by the firm without the additional investment, who would benefit least with the proposal? D. If the firm could earn only P 450,00o, without additional investment, would the proposal be still attractive to Alden?

Alden and Maine are partners with capital balances of P 1,000,000 each, sharing income and losses in a 3:2 ratio. The partners have been considering Doris' proposal to invest P 1,000,000 cash for a 1/3 share in the partnership. The following questions were brought up by the partners who sought your advice on whether to admit Doris in the partnership: A. If Doris' proposal is accepted what will be the effect on the profit and loss ratio? B. If a net income of P 600,000 will be earned by the firm after a year, what would be their profit shares? C. If the P 600,000 net income could be earned by the firm without the additional investment, who would benefit least with the proposal? D. If the firm could earn only P 450,00o, without additional investment, would the proposal be still attractive to Alden?

Chapter10: Partnerships: Formation, Operation, And Basis

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:Alden and Maine are partners with capital balances of P 1,000,000 each, sharing income

and losses in a 3:2 ratio. The partners have been considering Doris' proposal to invest P 1,000,000

cash for a 1/3 share in the partnership. The following questions were brought up by the partners who

sought your advice on whether to admit Doris in the partnership:

A. If Doris' proposal is accepted what will be the effect on the profit and loss ratio?

B. If a net income of P 600,000 will be earned by the firm after a year, what would be their

profit shares?

C. If the P 600,000 net income could be earned by the firm without the additional investment,

who would benefit least with the proposal?

D. If the firm could earn only P 450,000, without additional investment, would the proposal be

still attractive to Alden?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College