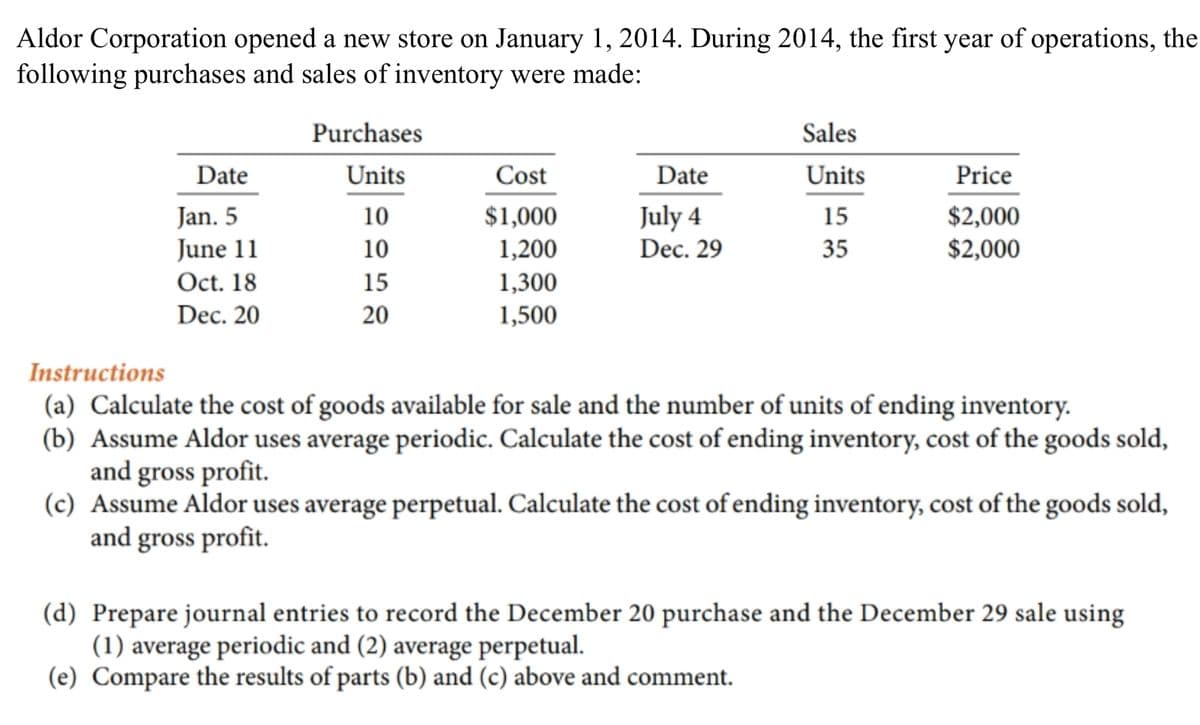

Aldor Corporation opened a new store on January 1, 2014. During 2014, the first year of operations, the following purchases and sales of inventory were made: Purchases Sales Date Units Cost Date Units Price $1,000 July 4 Jan. 5 June 11 Oct. 18 $2,000 $2,000 10 15 1,200 1,300 10 Dec. 29 35 15 Dec. 20 20 1,500 Instructions (a) Calculate the cost of goods available for sale and the number of units of ending inventory. (b) Assume Aldor uses average periodic. Calculate the cost of ending inventory, cost of the goods sold, and gross profit. (c) Assume Aldor uses average perpetual. Calculate the cost of ending inventory, cost of the goods sold, and gross profit. (d) Prepare journal entries to record the December 20 purchase and the December 29 sale using (1) average periodic and (2) average perpetual. (e) Compare the results of parts (b) and (c) above and comment.

Aldor Corporation opened a new store on January 1, 2014. During 2014, the first year of operations, the following purchases and sales of inventory were made: Purchases Sales Date Units Cost Date Units Price $1,000 July 4 Jan. 5 June 11 Oct. 18 $2,000 $2,000 10 15 1,200 1,300 10 Dec. 29 35 15 Dec. 20 20 1,500 Instructions (a) Calculate the cost of goods available for sale and the number of units of ending inventory. (b) Assume Aldor uses average periodic. Calculate the cost of ending inventory, cost of the goods sold, and gross profit. (c) Assume Aldor uses average perpetual. Calculate the cost of ending inventory, cost of the goods sold, and gross profit. (d) Prepare journal entries to record the December 20 purchase and the December 29 sale using (1) average periodic and (2) average perpetual. (e) Compare the results of parts (b) and (c) above and comment.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9RE: RE7-8 Johnson Company uses a perpetual inventory system. On October 23, Johnson purchased 100,000 of...

Related questions

Question

Please solve part D and E.

Transcribed Image Text:Aldor Corporation opened a new store on January 1, 2014. During 2014, the first year of operations, the

following purchases and sales of inventory were made:

Purchases

Sales

Date

Units

Cost

Date

Units

Price

Jan. 5

June 11

Oct. 18

July 4

Dec. 29

$2,000

$2,000

10

$1,000

15

10

1,200

35

15

1,300

Dec. 20

20

1,500

Instructions

(a) Calculate the cost of goods available for sale and the number of units of ending inventory.

(b) Assume Aldor uses average periodic. Calculate the cost of ending inventory, cost of the goods sold,

and gross profit.

(c) Assume Aldor uses average perpetual. Calculate the cost of ending inventory, cost of the goods sold,

and gross profit.

(d) Prepare journal entries to record the December 20 purchase and the December 29 sale using

(1) average periodic and (2) average perpetual.

(e) Compare the results of parts (b) and (c) above and comment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning