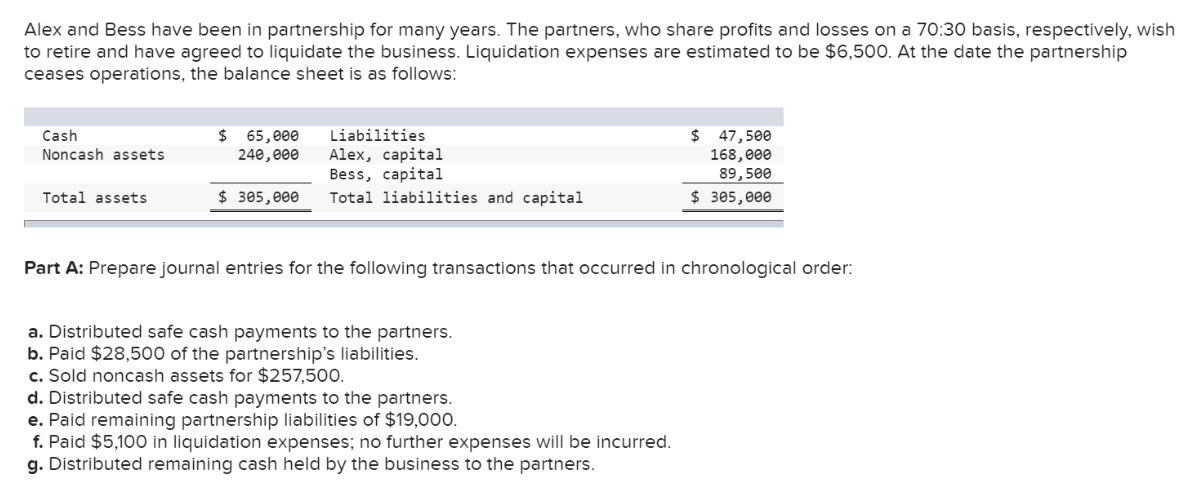

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: Cash Noncash assets Total assets Liabilities Alex, capital Bess, capital $ 305,000 Total liabilities and capital $ 65,000 240,000 Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. $ 47,500 168,000 89,500 $ 305,000 d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners.

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: Cash Noncash assets Total assets Liabilities Alex, capital Bess, capital $ 305,000 Total liabilities and capital $ 65,000 240,000 Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. $ 47,500 168,000 89,500 $ 305,000 d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 28P

Related questions

Question

PLEASE ANSWER ALL WITH COMPLETE AND CORRECT WORKING THANKS

1 Record the inıtial distribution of available cash based on safe capital balance.

2 Record the payment of the partnership's liabilities.

3 Record the sale of noncash assets.

4 Record the entry to distribute safe cash payments to the partners.

5 Record the payment of all remaining partnership liabilities.

6 Record the payment of liquidation expenses.

7 Record the entry to distribute remaining cash held by the business to the partners.

Transcribed Image Text:Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish

to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership

ceases operations, the balance sheet is as follows:

Cash

Noncash assets

Total assets

Liabilities

Alex, capital

Bess, capital

$ 305,000 Total liabilities and capital

$ 65,000

240,000

Part A: Prepare journal entries for the following transactions that occurred in chronological order:

a. Distributed safe cash payments to the partners.

b. Paid $28,500 of the partnership's liabilities.

c. Sold noncash assets for $257,500.

$ 47,500

168,000

89,500

$ 305,000

d. Distributed safe cash payments to the partners.

e. Paid remaining partnership liabilities of $19,000.

f. Paid $5,100 in liquidation expenses; no further expenses will be incurred.

g. Distributed remaining cash held by the business to the partners.

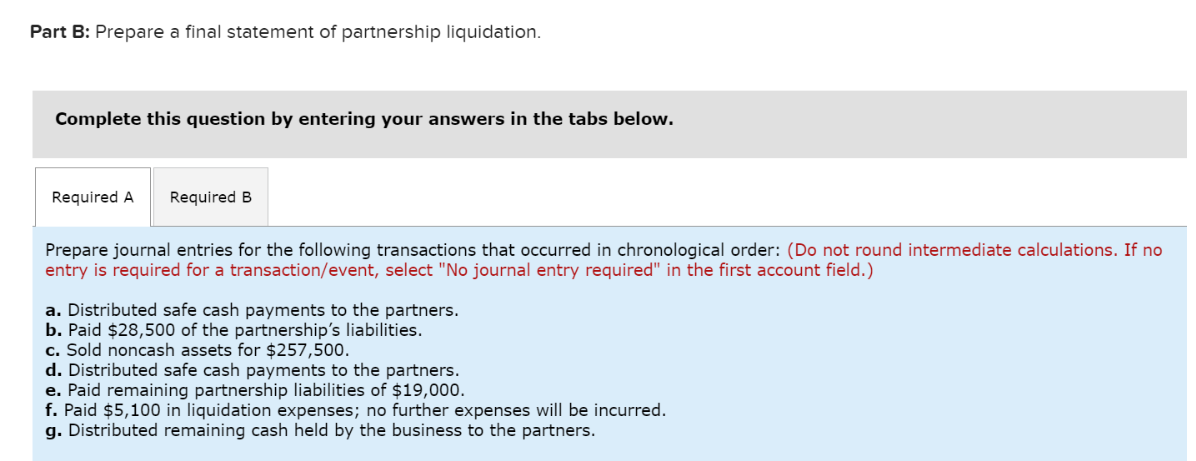

Transcribed Image Text:Part B: Prepare a final statement of partnership liquidation.

Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare journal entries for the following transactions that occurred in chronological order: (Do not round intermediate calculations. If no

entry is required for a transaction/event, select "No journal entry required" in the first account field.)

a. Distributed safe cash payments to the partners.

b. Paid $28,500 of the partnership's liabilities.

c. Sold noncash assets for $257,500.

d. Distributed safe cash payments to the partners.

e. Paid remaining partnership liabilities of $19,000.

f. Paid $5,100 in liquidation expenses; no further expenses will be incurred.

g. Distributed remaining cash held by the business to the partners.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning