Alex has a portfolio consisting of the below: A borrowing of €100 at the risk-free rate, a long position in a six-month put option on stock AA with an exercise price of €200 (1.e., EX = €200), and . a short position in a six-month put option on stock AA with an exercise price of €100 (i.e., EX = €100). Provide two other combinations of loans, options, and the underlying stock that would give Alex the same payoffs.

Alex has a portfolio consisting of the below: A borrowing of €100 at the risk-free rate, a long position in a six-month put option on stock AA with an exercise price of €200 (1.e., EX = €200), and . a short position in a six-month put option on stock AA with an exercise price of €100 (i.e., EX = €100). Provide two other combinations of loans, options, and the underlying stock that would give Alex the same payoffs.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:3.

Alex has a portfolio consisting of the below:

A borrowing of €100 at the risk-free rate,

a long position in a six-month put option on stock AA with an exercise price

of €200 (1.e., EX = €200), and

a short position in a six-month put option on stock AA with an exercise price

of €100 (i.e., EX = €100).

a.

Provide two other combinations of loans, options, and the underlying stock that

would give Alex the same payoffs.

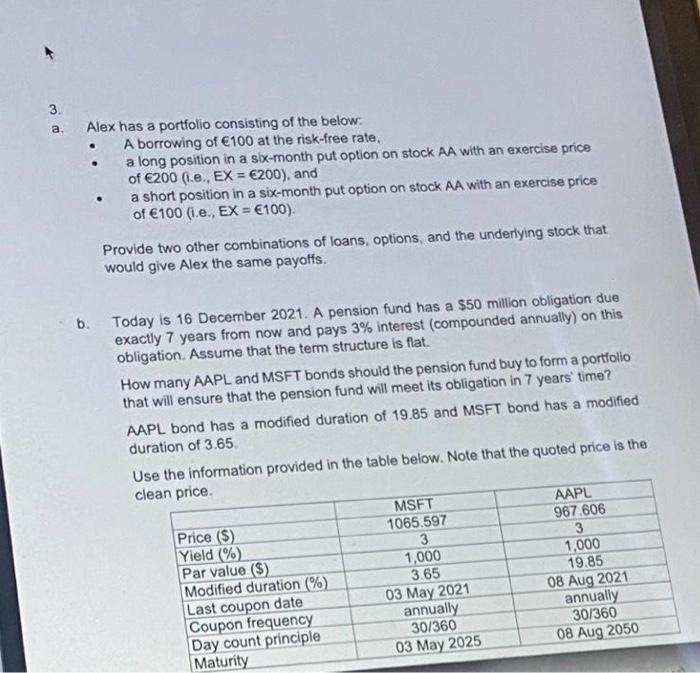

b. Today is 16 December 2021. A pension fund has a $50 million obligation due

exactly 7 years from now and pays 3% interest (compounded annually) on this

obligation. Assume that the term structure is flat.

How many AAPL and MSFT bonds should the pension fund buy to form a portfolio

that will ensure that the pension fund will meet its obligation in 7 years' time?

AAPL bond has a modified duration of 19.85 and MSFT bond has a modified

duration of 3.65.

Use the information provided in the table below. Note that the quoted price is the

clean price.

MSFT

AAPL

Price ($)

Yield (%)

Par value ($)

Modified duration (%)

Last coupon date

Coupon frequency

Day count principle

Maturity

967.606

3

1,000

19.85

08 Aug 2021

annually

30/360

08 Aug 2050

1065.597

3

1,000

3.65

03 May 2021

annually

30/360

03 May 2025

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT