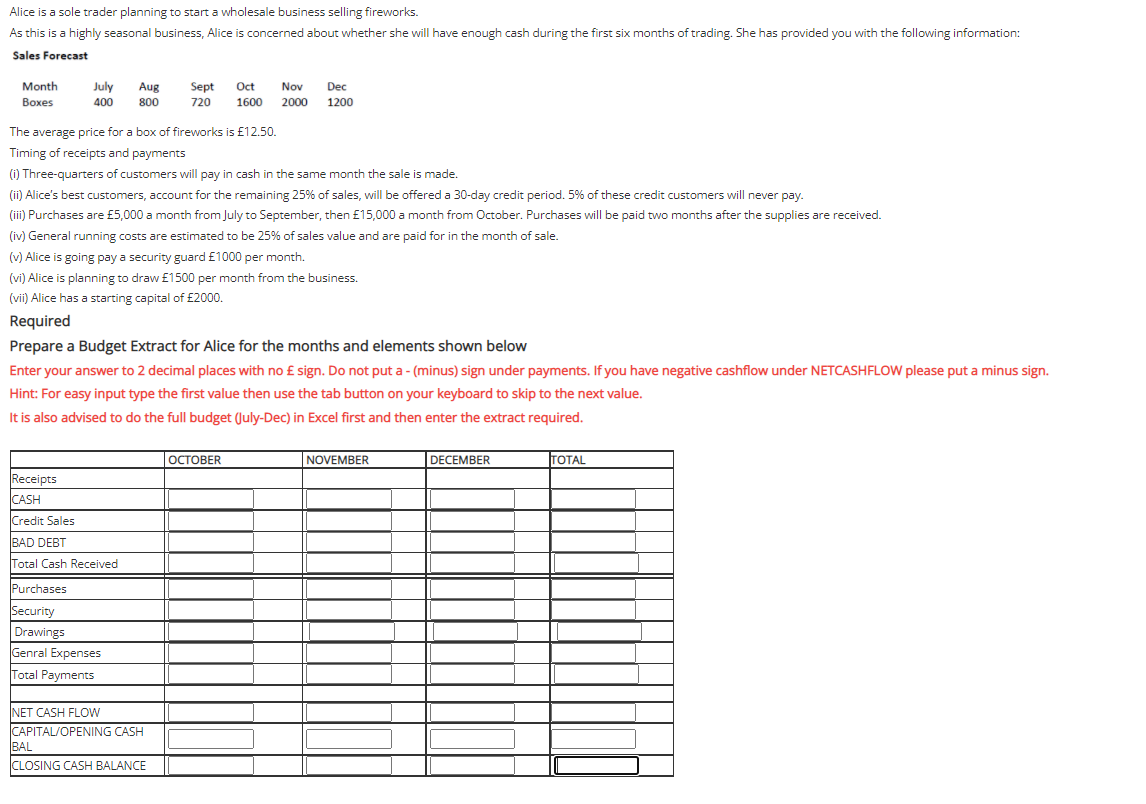

Alice is a sole trader planning to start a wholesale business selling fireworks. As this is a highly seasonal business, Alice is concerned about whether she will have enough cash during the first six months of trading. She has provided you with the following information: Sales Forecast Month July Aug Sept Oct Nov Dec Вохes 400 800 720 1600 2000 1200 The average price for a box of fireworks is £12.50. Timing of receipts and payments (i) Three-quarters of customers will pay in cash in the same month the sale is made. (ii) Alice's best customers, account for the remaining 25% of sales, will be offered a 30-day credit period. 5% of these credit customers will never pay. (iii) Purchases are £5,000 a month from July to September, then £15,000 a month from October. Purchases will be paid two months after the supplies are received. (iv) General running costs are estimated to be 25% of sales value and are paid for in the month of sale. (v) Alice is going pay a security guard £1000 per month. (vi) Alice is planning to draw £1500 per month from the business. (vii) Alice has a starting capital of £2000. Required Prepare a Budget Extract for Alice for the months and elements shown below Enter your answer to 2 decimal places with no £ sign. Do not put a - (minus) sign under payments. If you have negative cashflow under NETCASHFLOW please put a minus sign. Hint: For easy input type the first value then use the tab button on your keyboard to skip to the next value. It is also advised to do the full budget (July-Dec) in Excel first and then enter the extract required. |ОСТОВER | OCTOBER DECEMBER |TOTAL NOVEMBER Receipts CASH Credit Sales BAD DEBT Total Cash Received Purchases Security Drawings Genral Expenses Total Payments NET CASH FLOW CAPITAL/OPENING CASH BAL CLOSING CASH BALANCE

Alice is a sole trader planning to start a wholesale business selling fireworks. As this is a highly seasonal business, Alice is concerned about whether she will have enough cash during the first six months of trading. She has provided you with the following information: Sales Forecast Month July Aug Sept Oct Nov Dec Вохes 400 800 720 1600 2000 1200 The average price for a box of fireworks is £12.50. Timing of receipts and payments (i) Three-quarters of customers will pay in cash in the same month the sale is made. (ii) Alice's best customers, account for the remaining 25% of sales, will be offered a 30-day credit period. 5% of these credit customers will never pay. (iii) Purchases are £5,000 a month from July to September, then £15,000 a month from October. Purchases will be paid two months after the supplies are received. (iv) General running costs are estimated to be 25% of sales value and are paid for in the month of sale. (v) Alice is going pay a security guard £1000 per month. (vi) Alice is planning to draw £1500 per month from the business. (vii) Alice has a starting capital of £2000. Required Prepare a Budget Extract for Alice for the months and elements shown below Enter your answer to 2 decimal places with no £ sign. Do not put a - (minus) sign under payments. If you have negative cashflow under NETCASHFLOW please put a minus sign. Hint: For easy input type the first value then use the tab button on your keyboard to skip to the next value. It is also advised to do the full budget (July-Dec) in Excel first and then enter the extract required. |ОСТОВER | OCTOBER DECEMBER |TOTAL NOVEMBER Receipts CASH Credit Sales BAD DEBT Total Cash Received Purchases Security Drawings Genral Expenses Total Payments NET CASH FLOW CAPITAL/OPENING CASH BAL CLOSING CASH BALANCE

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter14: Adjustments For A Merchandising Business

Section: Chapter Questions

Problem 1CP: Block Foods, a retail grocery store, has agreed to purchase all of its merchandise from Square...

Related questions

Question

please fill in all the boxes thanks

Transcribed Image Text:Alice is a sole trader planning to start a wholesale business selling fireworks.

As this is a highly seasonal business, Alice is concerned about whether she will have enough cash during the first six months of trading. She has provided you with the followving information:

Sales Forecast

Month

July

Aug

Sept

Oct

Nov

Dec

Вохes

400

800

720

1600

2000 1200

The average price for a box of fireworks is £12.50.

Timing of receipts and payments

(1) Three-quarters of customers will pay in cash in the same month the sale is made.

(ii) Alice's best customers, account for the remaining 25% of sales, will be offered a 30-day credit period. 5% of these credit customers will never pay.

(iii) Purchases are £5,000 a month from July to September, then £15,000 a month from October. Purchases will be paid two months after the supplies are received.

(iv) General running costs are estimated to be 25% of sales value and are paid for in the month of sale.

(v) Alice is going pay a security guard £1000 per month.

(vi) Alice is planning to draw £1500 per month from the business.

(vii) Alice has a starting capital of £2000.

Required

Prepare a Budget Extract for Alice for the months and elements shown below

Enter your answer to 2 decimal places with no £ sign. Do not put a - (minus) sign under payments. If you have negative cashflow under NETCASHFLOW please put a minus sign.

Hint: For easy input type the first value then use the tab button on your keyboard to skip to the next value.

It is also advised to do the full budget (July-Dec) in Excel first and then enter the extract required.

ОСТОВER

NOVEMBER

DECEMBER

TOTAL

Receipts

CASH

Credit Sales

BAD DEBT

Total Cash Received

Purchases

Security

Drawings

Genral Expenses

Total Payments

NET CASH FLOW

ICAPITAL/OPENING CASH

BAL

CLOSING CASH BALANCE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College