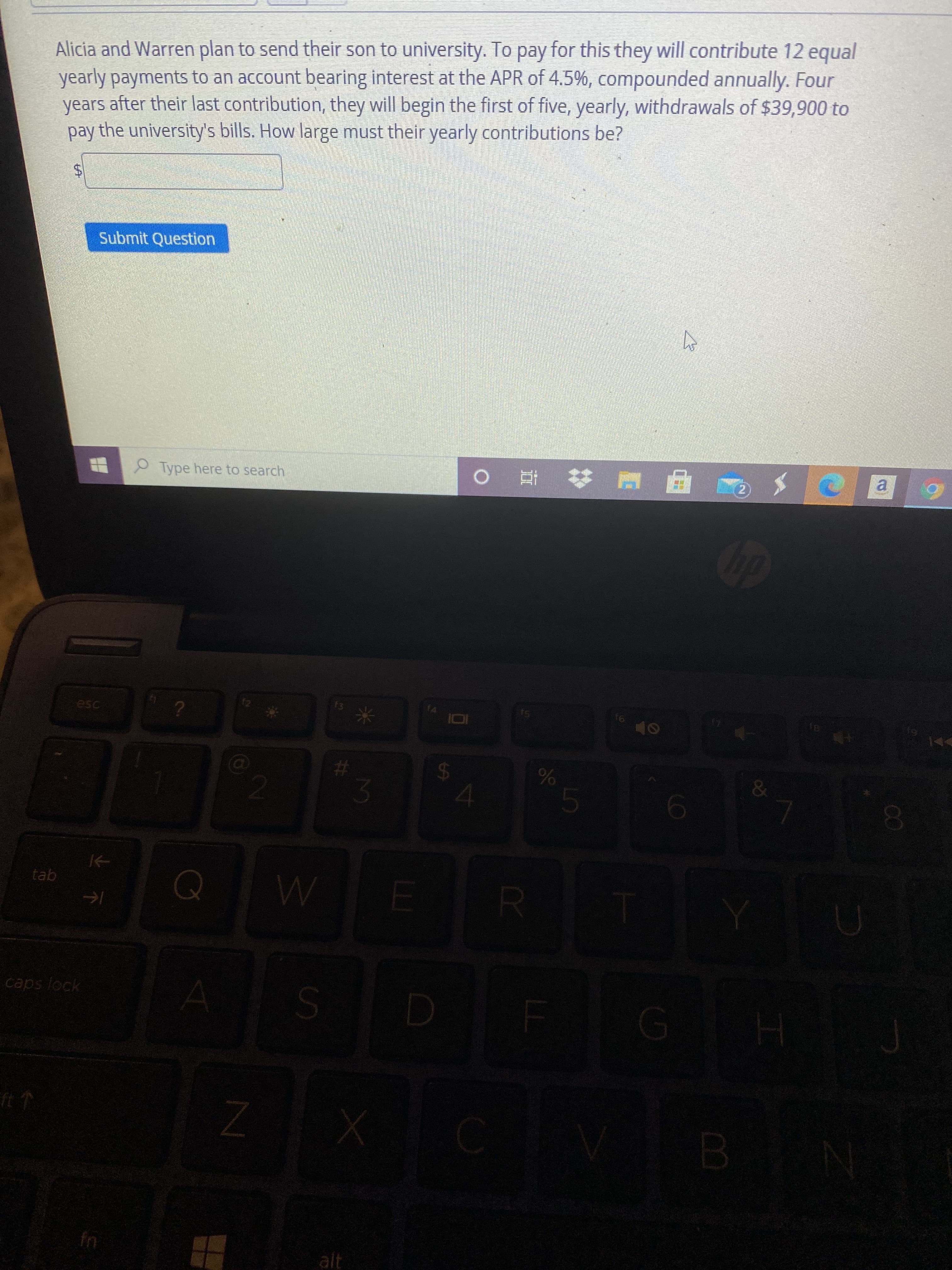

Alicia and Warren plan to send their son to university. To pay for this they will contribute 12 equal yearly payments to an account bearing interest at the APR of 4.5%, compounded annually. Four years after their last contribution, they will begin the first of five, yearly, withdrawals of $39,900 to pay the university's bills. How large must their yearly contributions be?

Alicia and Warren plan to send their son to university. To pay for this they will contribute 12 equal yearly payments to an account bearing interest at the APR of 4.5%, compounded annually. Four years after their last contribution, they will begin the first of five, yearly, withdrawals of $39,900 to pay the university's bills. How large must their yearly contributions be?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 10PROB

Related questions

Question

Transcribed Image Text:CO

%24

%24

Alicia and Warren plan to send their son to university. To pay for this they will contribute 12 equal

yearly payments to an account bearing interest at the APR of 4.5%, compounded annually. Four

years after their last contribution, they will begin the first of five, yearly, withdrawals of $39,900 to

pay the university's bills. How large must their yearly contributions be?

Submit Question

Type here to search

# 直0

2)

a.

13

%23

2.

tab

caps lock

alt

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning