Aljon Co. had the following bank reconciliation on June 30: Balance per bank statement, June 30 3,000,000 Deposit in transit 400,000 Total 3,400,000 Outstanding checks (900,000) Balance per book, June 30 2,500,000 The bank statement for the month of July showed the following: Deposits, including P200,000 note collected for Aljon 9,000,000 Disbursements, including P140,000 NSF customer check And P10,000 service charge All reconciling items on June 30 cleared through the bank in July. The outstanding checks totaled P600,000 and the deposit in transit amounte P1,000,000 on July 31. 7,000,000 1. What is adjusted cash in bank on July 31? 2. What is the cash balance per book on July 31? 3. What is the amount of cash receipts per book in July? 4. What is the amount of cash disbursements per book in July?

Aljon Co. had the following bank reconciliation on June 30: Balance per bank statement, June 30 3,000,000 Deposit in transit 400,000 Total 3,400,000 Outstanding checks (900,000) Balance per book, June 30 2,500,000 The bank statement for the month of July showed the following: Deposits, including P200,000 note collected for Aljon 9,000,000 Disbursements, including P140,000 NSF customer check And P10,000 service charge All reconciling items on June 30 cleared through the bank in July. The outstanding checks totaled P600,000 and the deposit in transit amounte P1,000,000 on July 31. 7,000,000 1. What is adjusted cash in bank on July 31? 2. What is the cash balance per book on July 31? 3. What is the amount of cash receipts per book in July? 4. What is the amount of cash disbursements per book in July?

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 7.3BE

Related questions

Question

Answer #4 only.

Transcribed Image Text:PROBLEM #7

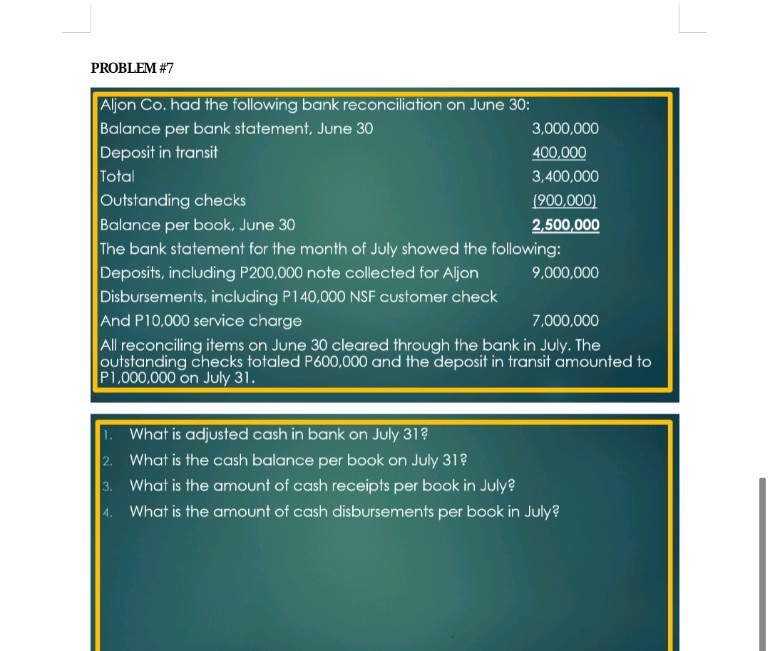

Aljon Co. had the following bank reconciliation on June 30:

Balance per bank statement, June 30

Deposit in transit

Total

Outstanding checks

Balance per book, June 30

The bank statement for the month of July showed the following:

Deposits, including P200,000 note collected for Aljon

Disbursements, including P140,000 NSF customer check

And P10,000 service charge

All reconciling items on June 30 cleared through the bank in July. The

outstanding checks totaled P600,000 and the deposit in transit amounted to

P1,000,000 on July 31.

3,000,000

400,000

3,400,000

(900,000)

2,500,000

9,000,000

7,000,000

1. What is adjusted cash in bank on July 31?

2. What is the cash balance per book on July 31?

3.

What is the amount of cash receipts per book in July?

4. What is the amount of cash disbursements per book in July?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,