All else the same, which of the following management decisions would help alleviate the problem of a buildup of excess cash? O Increase credit terms to customer; i.e. allow them more time to pay O Borrow short term to increase the size of the Interest Tax Shield O Reduce credit terms to customers: i.e. make them pay sooner O Reduce the dividend payout ratio to create higher levels of retained eamings

All else the same, which of the following management decisions would help alleviate the problem of a buildup of excess cash? O Increase credit terms to customer; i.e. allow them more time to pay O Borrow short term to increase the size of the Interest Tax Shield O Reduce credit terms to customers: i.e. make them pay sooner O Reduce the dividend payout ratio to create higher levels of retained eamings

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter9: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 6Q

Related questions

Question

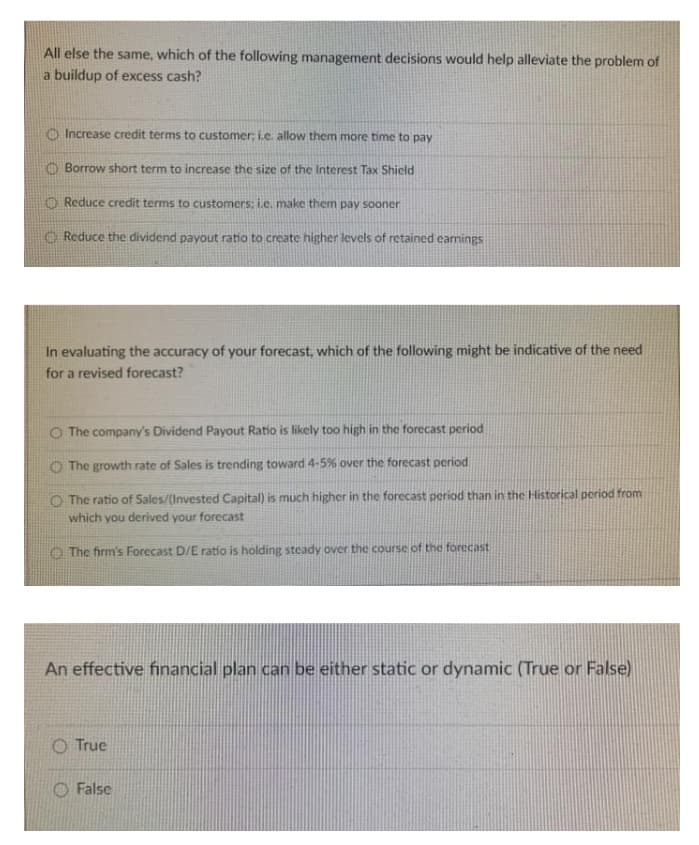

Transcribed Image Text:All else the same, which of the following management decisions would help alleviate the problem of

a buildup of excess cash?

O Increase credit terms to customer; i.e. allow them more time to pay

Borrow short term to increase the size of the Interest Tax Shield

O Reduce credit terms to customers: i.c. make them pay sooner

O Reduce the dividend payout ratio to crcate higher levels of retained earnings

In evaluating the accuracy of your forecast, which of the following might be indicative of the need

for a revised forecast?

O The company's Dividend Payout Ratio is likely too high in the forecast period

O The growth rate of Sales is trending toward 4-5% over the forecast period

O The ratio of Sales/(Invested Capital) is much higher in the forecast period than in the Historical period from

which you derived your forecast

O The firm's Forecast D/E ratio is holding steady over the course of the forecast

An effective financial plan can be either static or dynamic (True or False)

O True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College