Alma, Tina and Carla are partners

Chapter21: Partnerships

Section: Chapter Questions

Problem 11BCRQ

Related questions

Question

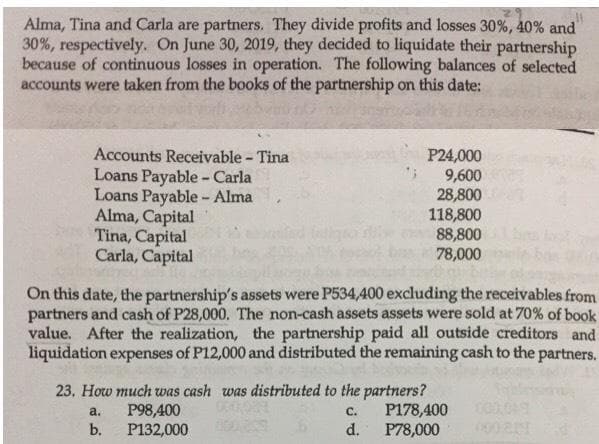

Transcribed Image Text:Alma, Tina and Carla are partners. They divide profits and losses 30%, 40% and

30%, respectively. On June 30, 2019, they decided to liquidate their partnership

because of continuous losses in operation. The following balances of selected

accounts were taken from the books of the partnership on this date:

Accounts Receivable - Tina

Loans Payable - Carla

Loans Payable - Alma

Alma, Capital

Tina, Capital

Carla, Capital

P24,000

9,600

28,800

118,800

88,800

78,000

On this date, the partnership's assets were P534,400 excluding the receivables from

partners and cash of P28,000. The non-cash assets assets were sold at 70% of book

value. After the realization, the partnership paid all outside creditors and

liquidation expenses of P12,000 and distributed the remaining cash to the partners.

23. How much was cash was distributed to the partners?

a.

C.

b.

d.

P98,400

P132,000

P178,400

P78,000

000,049

000 214

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College