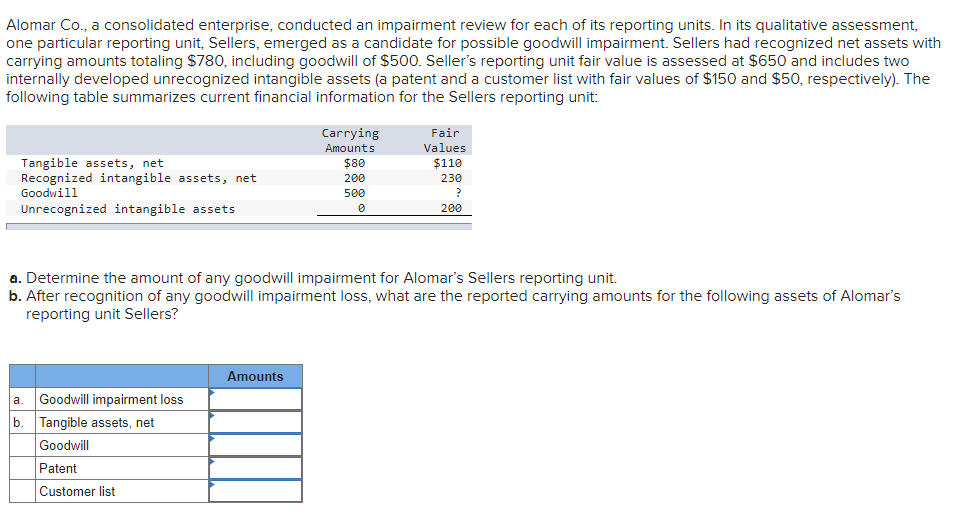

Alomar Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment, one particular reporting unit, Sellers, emerged as a candidate for possible goodwill impairment. Sellers had recognized net assets with carrying amounts totaling $780, including goodwill of $500. Seller's reporting unit fair value is assessed at $650 and includes two internally developed unrecognized intangible assets (a patent and a customer list with fair values of $150 and $50, respectively). The following table summarizes current financial information for the Sellers reporting unit: Tangible assets, net Recognized intangible assets, net Goodwill Unrecognized intangible assets a. Goodwill impairment loss b. Tangible assets, net Goodwill Patent Customer list Carrying Amounts Amounts $80 200 500 0 a. Determine the amount of any goodwill impairment for Alomar's Sellers reporting unit. b. After recognition of any goodwill impairment loss, what are the reported carrying amounts for the following assets of Alomar's reporting unit Sellers? Fair Values $110 230 ? 200

Alomar Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment, one particular reporting unit, Sellers, emerged as a candidate for possible goodwill impairment. Sellers had recognized net assets with carrying amounts totaling $780, including goodwill of $500. Seller's reporting unit fair value is assessed at $650 and includes two internally developed unrecognized intangible assets (a patent and a customer list with fair values of $150 and $50, respectively). The following table summarizes current financial information for the Sellers reporting unit: Tangible assets, net Recognized intangible assets, net Goodwill Unrecognized intangible assets a. Goodwill impairment loss b. Tangible assets, net Goodwill Patent Customer list Carrying Amounts Amounts $80 200 500 0 a. Determine the amount of any goodwill impairment for Alomar's Sellers reporting unit. b. After recognition of any goodwill impairment loss, what are the reported carrying amounts for the following assets of Alomar's reporting unit Sellers? Fair Values $110 230 ? 200

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:Alomar Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment,

one particular reporting unit, Sellers, emerged as a candidate for possible goodwill impairment. Sellers had recognized net assets with

carrying amounts totaling $780, including goodwill of $500. Seller's reporting unit fair value is assessed at $650 and includes two

internally developed unrecognized intangible assets (a patent and a customer list with fair values of $150 and $50, respectively). The

following table summarizes current financial information for the Sellers reporting unit:

Tangible assets, net

Recognized intangible assets, net

Goodwill

Unrecognized intangible assets

a. Goodwill impairment loss

b. Tangible assets, net

Goodwill

Patent

Customer list

Carrying

Amounts

$80

200

500

a. Determine the amount of any goodwill impairment for Alomar's Sellers reporting unit.

b. After recognition of any goodwill impairment loss, what are the reported carrying amounts for the following assets of Alomar's

reporting unit Sellers?

Amounts

Fair

Values

$110

230

?

200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning