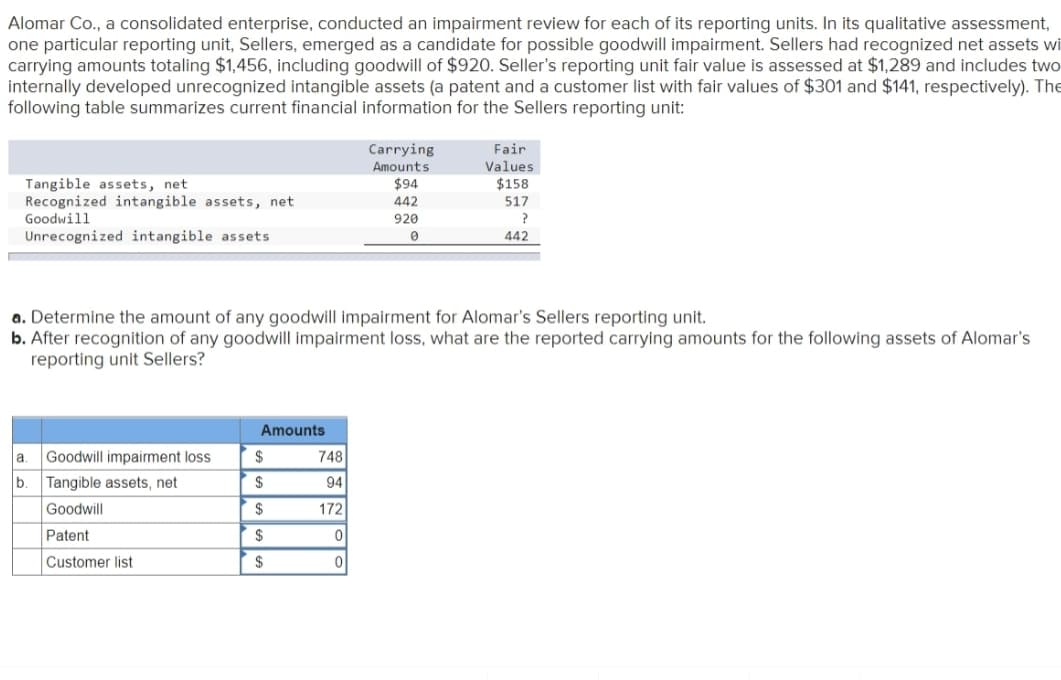

Alomar Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment, one particular reporting unit, Sellers, emerged as a candidate for possible goodwill impairment. Sellers had recognized net assets wi carrying amounts totaling $1,456, including goodwill of $920. Seller's reporting unit fair value is assessed at $1,289 and includes two nternally developed unrecognized intangible assets (a patent and a customer list with fair values of $301 and $141, respectively). The following table summarizes current financial information for the Sellers reporting unit: Carrying Fair Values $158 Amounts Tangible assets, net Recognized intangible assets, net Goodwill Unrecognized intangible assets $94 442 517 920 442

Alomar Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment, one particular reporting unit, Sellers, emerged as a candidate for possible goodwill impairment. Sellers had recognized net assets wi carrying amounts totaling $1,456, including goodwill of $920. Seller's reporting unit fair value is assessed at $1,289 and includes two nternally developed unrecognized intangible assets (a patent and a customer list with fair values of $301 and $141, respectively). The following table summarizes current financial information for the Sellers reporting unit: Carrying Fair Values $158 Amounts Tangible assets, net Recognized intangible assets, net Goodwill Unrecognized intangible assets $94 442 517 920 442

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter16: Advanced Topics Concerning Complex Auditing Judgments

Section: Chapter Questions

Problem 65RSCQ

Related questions

Question

Transcribed Image Text:Alomar Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment,

one particular reporting unit, Sellers, emerged as a candidate for possible goodwill impairment. Sellers had recognized net assets wi

carrying amounts totaling $1,456, including goodwill of $920. Seller's reporting unit fair value is assessed at $1,289 and includes two

internally developed unrecognized intangible assets (a patent and a customer list with fair values of $301 and $141, respectively). The

following table summarizes current financial information for the Sellers reporting unit:

Carrying

Fair

Amounts

Values

$94

$158

Tangible assets, net

Recognized intangible assets, net

Goodwill

Unrecognized intangible assets

442

517

920

442

a. Determine the amount of any goodwill impairment for Alomar's Sellers reporting unit.

b. After recognition of any goodwill impairment loss, what are the reported carrying amounts for the following assets of Alomar's

reporting unit Sellers?

Amounts

a.

Goodwill impairment loss

$

748

b.

Tangible assets, net

$

94

Goodwill

$

172

Patent

$

Customer list

$

Expert Solution

Step 1

An impairment loss is recognized when the carrying value or the book value of the asset is more than the recoverable amount of an asset. In other words, when the recoverable amount (fair value) of an asset reduces below the carrying value of an asset, the difference in the amount is determined as an impairment loss.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning