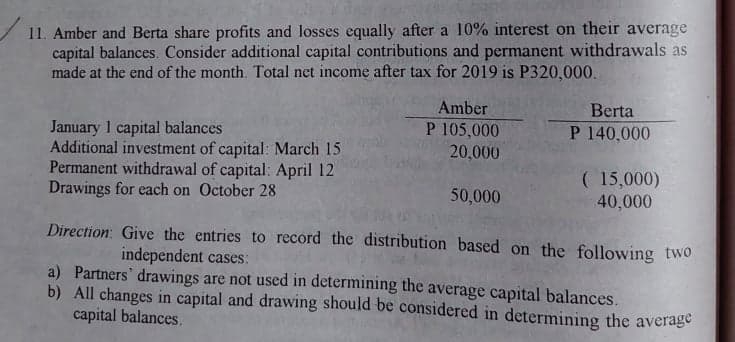

Amber and Berta share profits and losses equally after a 10% interest on their average capital balances. Consider additional capital contributions and permanent withdrawals as made at the end of the month. Total net income after tax for 2019 is P320,000. (see attached image, kindly answer it based on your knowledge, thank you! please answer both a and b, I need it in my assignment. Godbless! Thank you so much again! :)) Direction: Give the entries to record the distribution based on the following two independent cases: a) Partners' drawings are not used in determining the average capital balances. b) All changes in capital and drawing should be considered in determining the average capital balances.

11. Amber and Berta share

(see attached image, kindly answer it based on your knowledge, thank you! please answer both a and b, I need it in my assignment. Godbless! Thank you so much again! :))

Direction: Give the entries to record the distribution based on the following two independent cases:

a) Partners' drawings are not used in determining the average capital balances.

b) All changes in capital and drawing should be considered in determining the average capital balances.

Step by step

Solved in 2 steps with 3 images