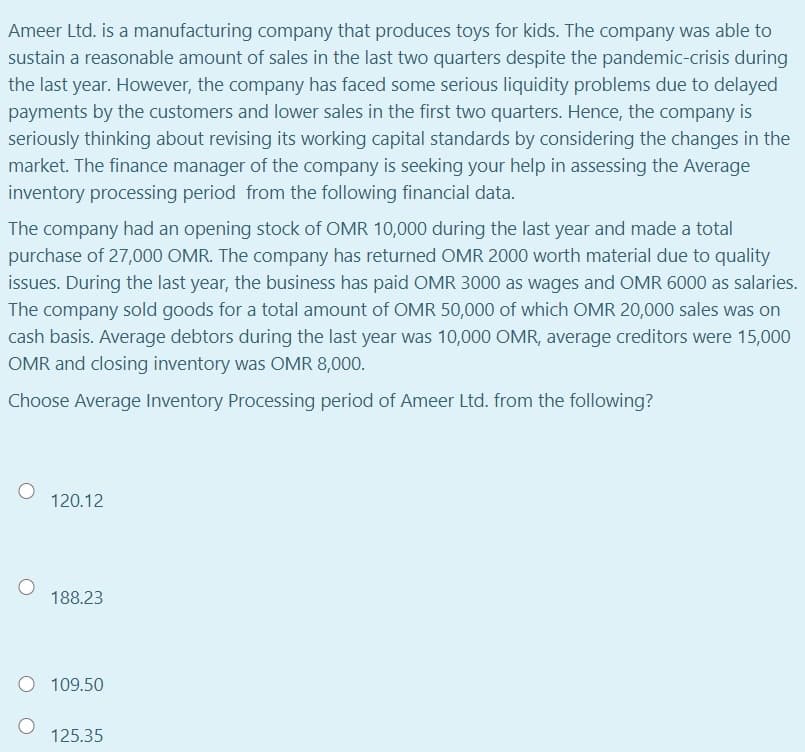

Ameer Ltd. is a manufacturing company that produces toys for kids. The company was able to sustain a reasonable amount of sales in the last two quarters despite the pandemic-crisis during the last year. However, the company has faced some serious liquidity problems due to delayed payments by the customers and lower sales in the first two quarters. Hence, the company is seriously thinking about revising its working capital standards by considering the changes in the market. The finance manager of the company is seeking your help in assessing the Average inventory processing period from the following financial data. The company had an opening stock of OMR 10,000 during the last year and made a total purchase of 27,000 OMR. The company has returned OMR 2000 worth material due to quality issues. During the last year, the business has paid OMR 3000 as wages and OMR 6000 as salaries. The company sold goods for a total amount of OMR 50,000 of which OMR 20,000 sales was on cash basis. Average debtors during the last year was 10,000 OMR, average creditors were 15,000 OMR and closing inventory was OMR 8,000. Choose Average Inventory Processing period of Ameer Ltd. from the following? 120.12 188.23 109.50 125.35

Cost of Debt, Cost of Preferred Stock

This article deals with the estimation of the value of capital and its components. we'll find out how to estimate the value of debt, the value of preferred shares , and therefore the cost of common shares . we will also determine the way to compute the load of every cost of the capital component then they're going to estimate the general cost of capital. The cost of capital refers to the return rate that an organization gives to its investors. If an organization doesn’t provide enough return, economic process will decrease the costs of their stock and bonds to revive the balance. A firm’s long-run and short-run financial decisions are linked to every other by the assistance of the firm’s cost of capital.

Cost of Common Stock

Common stock is a type of security/instrument issued to Equity shareholders of the Company. These are commonly known as equity shares in India. It is also called ‘Common equity

Step by step

Solved in 3 steps with 2 images